Executive Summary: Controls & Standards Research Trends in the Construction Industry

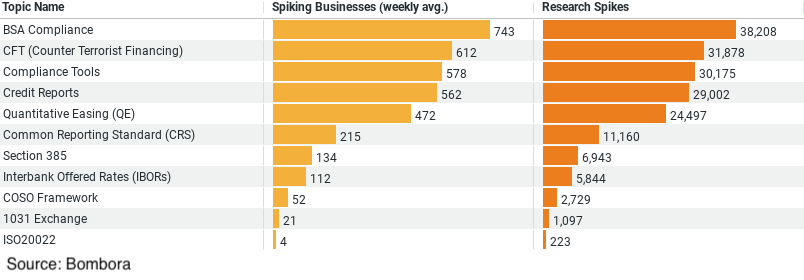

– Total Topics Analyzed: The dataset comprises several topics related to Controls & Standards, with data on weekly spikes and total research spikes for each topic.

– Highest Weekly Engagement: The topic of BSA Compliance has the highest weekly business engagement with an average of 743 businesses showing a spike in interest.

– Highest Total Research Spikes: BSA Compliance also leads in total research spikes, accumulating 38,208 instances where significant research activity was noted.

– Range of Business Engagement: Weekly business engagement across the top five topics ranges from 472 to 743 businesses.

– Range of Research Spikes: The number of research spikes across these topics varies from 24,497 to 38,208, indicating varying levels of depth and focus in research activities.

Research Trends in Construction: A Deep Dive into Controls & Standards

In the dynamic world of construction, staying updated with industry standards and control measures is not just a requirement but a necessity for sustainability and growth. The construction industry, often seen as a backbone of economic development, has shown a profound interest in various topics related to Controls & Standards. A recent analysis of the industry’s research activities provides fascinating insights into where businesses are directing their focus to navigate the complex terrain of regulatory compliance and operational excellence.

BSA Compliance Takes the Lead

At the forefront of this research is BSA Compliance, which tops the charts with an average of 743 businesses actively seeking information on this topic each week. The Bank Secrecy Act (BSA), designed to combat money laundering and other illegal financial activities, is evidently a major concern for construction companies. The high number of research spikes, totaling 38,208, underscores the critical role of BSA Compliance in ensuring that companies adhere to legal standards and maintain clean financial operations.

Fighting Financial Crimes

Following closely, the interest in Counter Terrorist Financing (CFT) highlights the industry’s commitment to understanding and mitigating risks associated with financial crimes. With around 612 businesses per week diving into this area, it’s clear that construction entities are keen on bolstering their defenses against the financing of terrorism. This proactive approach is crucial in safeguarding not only the financial health of the businesses but also contributing to global security measures.

Tooling Up with Compliance Tools

The focus on Compliance Tools with approximately 578 businesses researching this weekly speaks volumes about the industry’s drive towards efficiency and precision in compliance management. These tools are instrumental in helping companies navigate the often complex compliance landscape, simplifying processes, and ensuring that businesses can focus on their core operations without the constant fear of non-compliance penalties.

Credit Where Credit’s Due

Research on Credit Reports, engaging around 562 businesses weekly, reflects the sector’s vigilance in maintaining robust financial health. These reports are essential for assessing the financial reliability of partners and clients, thus reducing risk and fostering trust within the industry ecosystem.

Economic Insights through Quantitative Easing (QE)

Lastly, the interest in Quantitative Easing (QE), with about 472 businesses per week looking into it, might seem out of place in a construction-focused discussion. However, its impact on the industry is undeniable. QE measures, typically implemented by central banks, can significantly affect borrowing costs, influencing everything from project financing to capital expenditure decisions. Understanding QE helps construction businesses forecast and strategize around potential economic fluctuations.

Conclusion: Building on Knowledge

The detailed dive into these topics reveals a sector that is not just reactive but increasingly proactive in its approach to dealing with a fast-evolving regulatory and economic landscape. Construction companies are not only keen on keeping up with current standards but are also leveraging advanced tools to anticipate future challenges.

This commitment to research and understanding underlines a broader trend towards knowledge-driven management in the construction industry. By staying informed and prepared, these companies are building more than just structures; they are constructing a resilient future that stands firm against the challenges of compliance and financial uncertainties. The construction sector’s focused research into Controls & Standards is a testament to its dedication to excellence, integrity, and sustained growth.

Company Sample Data

1. Company Size – Describes the size of the company categorized by the number of employees.

2. Spiking Businesses (weekly avg.) – The average number of businesses in each size category showing a spike in interest or engagement in specific topics per week.

3. Percent of Total – The percentage representation of each company size category relative to total businesses showing interest.

From the initial data:

– Micro (1 – 9 Employees): Shows an average weekly spike in 210 businesses, contributing to about 8.25% of the total observed spikes.

– Small (10 – 49 Employees): Larger engagement with around 566 businesses spiking weekly, accounting for approximately 22.19% of the total.

– Medium-Small (50 – 199 Employees): The highest engagement, with 677 businesses per week, representing 26.55% of the total.

– Medium (200 – 499 Employees): Shows a lower engagement than medium-small, with 380 businesses contributing to about 14.92% of the total.

– Medium-Large (500 – 999 Employees): Shows engagement from 230 businesses weekly, making up about 9.03% of the total.

Analysis of Trends by Company Size

The trend indicates that the medium-small companies (50 – 199 employees) are the most active in researching or showing interest in specific topics, which suggests a potentially higher need for innovation and adaptation as these companies are possibly in a growth phase, seeking resources to expand or improve their operations effectively.

Small companies (10 – 49 employees) follow closely, which could indicate these businesses are reaching a stage where strategic decisions and changes are necessary for scaling up. Micro companies, despite their smaller size, still show significant activity, likely due to the agility and flexibility they have to adapt quickly to new trends or market demands.

The decreasing trend in larger companies (200 – 999 employees) might be attributed to the more established processes and lesser flexibility in adopting new practices rapidly compared to smaller companies. However, their engagement levels still represent a considerable focus on keeping updated with industry trends and adapting as needed, albeit at a possibly slower pace due to larger organizational structures.

This pattern suggests that as companies grow, their focus on certain trends or industry changes might become more selective and strategically driven, with each size category showcasing unique behavior in their approach to industry insights and changes.