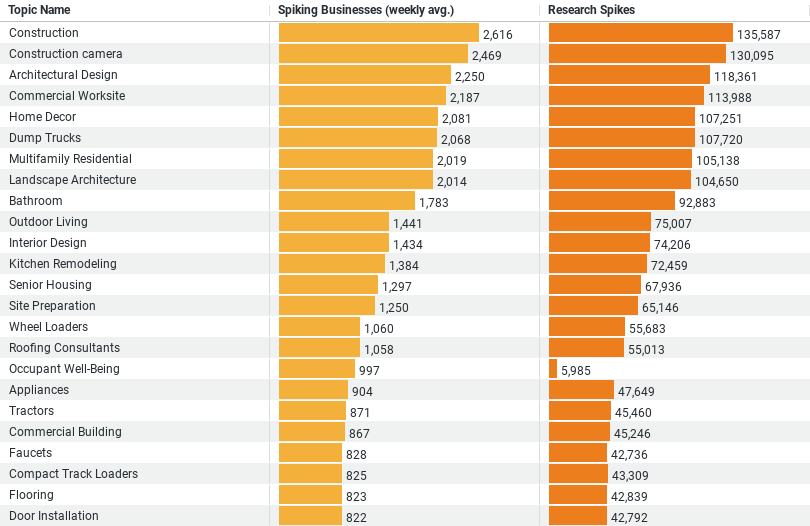

(Data visualized in the chart captures buying and research signals for the past 365 days)

Executive Summary: Construction Research Trends in the Construction Industry

The data highlights the top trends and insights within the construction industry, focusing on how businesses are researching “Construction” and related topics. Here’s a summary of the top trends from the data:

1. Construction: This topic stands at the forefront of the industry’s research, with an average of 2,615.62 businesses spiking in their research weekly, and a total of 135,587 research spikes observed.

2. Construction Camera: Following closely, this technology is also a hot topic with 2,469.04 weekly average business research spikes, accumulating to 130,095 spikes. This indicates a high interest in surveillance and monitoring technologies within construction sites.

3. Architectural Design: With 2,250.02 businesses on average researching this weekly, totaling 118,361 spikes, architectural design is a significant area of focus. This suggests a strong demand for innovative and sustainable design practices in the industry.

4. Commercial Worksite: This topic, which garnered 2,187.23 weekly average business research spikes and a total of 113,988 spikes, indicates a keen interest in commercial construction projects and their management.

5. Home Decor: Though slightly tangential, the interest in home decor, with 2,081.23 businesses researching it weekly (totaling 107,251 spikes), suggests a broader interest within the construction industry towards interior design and aesthetics, possibly driven by end-consumer demand.

These insights reveal that the construction industry is not only focused on traditional construction topics but is also keenly interested in technology (such as construction cameras), design (architectural and interior), and commercial project management. This reflects a dynamic industry that is adapting to modern technologies and consumer demands while maintaining a strong foundation in its core activities.

Technological Integration

– Construction Cameras: With 2,469 weekly research spikes on average, the data underscores a significant trend towards the integration of technology in construction projects. This interest points towards an industry-wide push for enhancing security, monitoring progress, and improving documentation through advanced surveillance technologies. The close gap between general construction and construction camera research spikes (135,587 vs. 130,095) highlights the critical role of tech solutions in modern construction practices.

Design and Aesthetics

– Architectural Design: The focus on architectural design, with an average of 2,250 businesses researching this topic weekly, signifies an evolving industry perspective that places a premium on innovative design and sustainability. The substantial number of research spikes (118,361) reflects a strong demand for architectural excellence, blending aesthetics with functionality in construction projects.

Commercial Projects Focus

– Commercial Worksite: The data reveals a concentrated interest in commercial construction, with 2,187 average weekly research spikes. This interest (113,988 total spikes) indicates a robust market activity in the commercial sector, emphasizing the importance of efficient worksite management, project delivery, and scalability in commercial construction endeavors.

Expanding Industry Scope

– Home Decor: An intriguing aspect of the dataset is the substantial interest in home decor, with 2,081 weekly research spikes on average. While not directly related to construction, this trend (107,251 total spikes) suggests an expanding scope of the construction industry into interior design and decoration, possibly driven by market demand for comprehensive construction-to-interior solutions.

Implications for the Construction Industry

The data not only illustrates the primary areas of interest and research within the construction industry but also highlights the sector’s dynamic response to technological advancements, market demands, and sustainability considerations. The emphasis on construction cameras and architectural design points towards a future where technology and innovation play pivotal roles in shaping construction practices. Additionally, the focus on commercial worksites and the extended interest in home decor indicate a broadening of the industry’s scope, catering to a wider range of client needs from foundational construction to the final touches of interior aesthetics.

Conclusion

This comprehensive analysis reveals a construction industry at the cusp of significant transformation, driven by technology, innovation, and a deepening understanding of consumer expectations. These trends not only reflect current industry priorities but also suggest areas of potential growth and development in the future.

Company Sample Data

This contains data on companies within the construction industry, focusing on their size and corresponding research activity related to the industry. Here’s a brief overview of its structure and the information it conveys:

– Company Size: This column categorizes companies based on the number of employees. The categories range from “Micro (1 – 9 Employees)” to “Medium-Large (500 – 999 Employees)”, providing a spectrum of company sizes within the construction industry.

– Spiking Businesses (weekly avg.): This column shows the average weekly number of businesses within each size category that have shown a spike in research activity related to construction. This metric offers insights into the level of active interest and research engagement among companies of different sizes.

– Percent of Total: Represents the percentage of total research activity attributable to companies within each size category. This gives an idea of how much each segment contributes to the overall research activity in the construction industry.

Key Observations

– Small companies (10 – 49 Employees) and medium-small companies (50 – 199 Employees) are the most active in research related to construction, with significant weekly spikes (7,073.19 and 6,425.17 on average, respectively).

– These two categories also contribute the most to the total percentage of research activity, with small companies accounting for approximately 34.74% and medium-small companies for about 31.56%.

– Micro companies, despite being the smallest, still show considerable activity, indicating a vibrant interest in construction research across all levels of business sizes.

This data suggests a diverse engagement across different company sizes in the construction sector, with a notably higher level of activity among small to medium-sized businesses. This could reflect the dynamic nature of the construction industry, where businesses of various sizes actively seek out new information, technologies, and methodologies.