Executive Summary: Operating System Research Trends in the Construction Industry

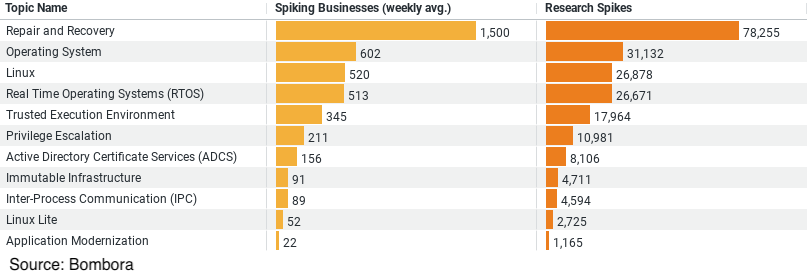

– Top Researched Topics: The data highlights the top five topics in the realm of operating systems that are garnering attention within the construction industry. These topics are ranked based on the number of businesses researching them weekly and the instances of research spikes.

– Leading Topic: “Repair and Recovery” emerges as the leading subject with an average weekly interest from approximately 1,500 businesses and the highest research spikes at 78,255.

– Strong Interest in Core Operating Systems: The core topic “Operating System” shows substantial engagement, with about 602 businesses focusing on it weekly and accumulating 31,132 research spikes.

– Specialized Operating Systems: Topics like “Linux” and “Real Time Operating Systems (RTOS)” demonstrate significant industry focus, indicating a robust interest in both open-source and specialized operating systems. Linux attracts around 520 businesses weekly, whereas RTOS engages about 513.

– Security Focus: “Trusted Execution Environment” appears as a niche but important area, reflecting an industry interest in secure operating system features, with around 345 businesses researching it weekly.

Exploring Operating System Trends in the Construction Industry

In an era where technology intertwines intricately with every sector, the construction industry stands out not just for its cranes and concrete but also for its increasing reliance on sophisticated operating systems. Recent data provides a fascinating glimpse into how construction businesses are channeling their research efforts towards operating systems, highlighting their priorities and technological orientations.

Diverse Research Interests Reflect Sector Needs

The construction sector’s foray into operating systems isn’t limited to basic software needs; instead, it spans a variety of specialized topics. Leading the research trends is “Repair and Recovery,” a crucial aspect that resonates deeply with the industry’s need for robust systems ensuring continuity and efficiency. With an impressive weekly average of 1,500 businesses focusing on this area, coupled with over 78,255 research spikes, it’s clear that maintaining operational integrity through reliable recovery solutions is a top priority.

Not far behind, the general theme of “Operating Systems” attracts significant attention, with around 602 businesses investigating this area each week, accumulating a total of 31,132 research spikes. This broad interest likely encompasses various facets from installation and maintenance to updates and security, underlining the critical role these systems play in daily operations.

Specialized Operating Systems: From Linux to RTOS

The industry’s interest also extends into more specialized operating systems such as Linux and Real-Time Operating Systems (RTOS). Each of these topics has its unique appeal within the construction sector. Linux, known for its flexibility and security, draws around 520 businesses weekly. This open-source model supports customizable solutions that can be tailored to specific construction needs, from managing heavy machinery to data handling.

RTOS, with a weekly interest close to that of Linux, involves around 513 businesses. Its application in construction is particularly pertinent where operations require immediate processing and real-time task management—such as in automated and remote-controlled environments. The consistent research into RTOS highlights the growing trend towards automation and precise timing in construction processes.

Security in Focus: Trusted Execution Environment

Another intriguing area of focus is the “Trusted Execution Environment” which secures around 345 businesses’ attention each week. This interest points to an increasing awareness and necessity for cybersecurity within the industry. As construction firms integrate more technology into their operations, securing these systems against threats becomes imperative. Research into trusted environments indicates a proactive approach to safeguard sensitive data and operational integrity.

Implications and Future Directions

What do these trends imply for the construction industry’s future? First, the high level of engagement with diverse operating systems underscores a shift towards more technologically integrated construction processes. The focus on repair and recovery, along with real-time operations, suggests a move towards not only adopting technology but also ensuring its resilience and efficiency.

Moreover, the emphasis on security through Trusted Execution Environments signals a mature approach to cybersecurity, reflecting the industry’s recognition of the growing threats in a digitally connected world. As construction firms continue to innovate, the integration of secure, robust operating systems will likely play a critical role in shaping competitive edges.

Conclusion

The construction industry’s research into operating systems paints a picture of a sector actively seeking to harness technology’s power. By focusing on both general and specialized operating systems, the industry is laying a foundation for more sophisticated, secure, and efficient operations. As this trend continues, we can anticipate construction processes that are not only technologically advanced but also more reliable and secure, driving the industry towards a future where technology and construction are seamlessly integrated.

Company Sample Data: Intent by Company Size

Data Overview

– Company Size: The data is segmented into five categories based on company size: Micro (1-9 employees), Small (10-49 employees), Medium-Small (50-199 employees), Medium (200-499 employees), and Medium-Large (500-999 employees).

– Spiking Businesses (weekly avg.): This column shows the average number of businesses per week, within each size category, that have shown a spike in interest or activity related to the topic.

– Percent of Total: Represents each size category’s share of the total engagement measured.

Analysis and Insights:

1. Engagement Patterns by Size:

– Micro and Small Businesses: Micro-sized businesses, despite their smaller scale, show notable engagement with 263 weekly spikes on average, accounting for about 8.7% of total engagement. Small businesses show a more significant level of activity with 743 weekly spikes and make up about 24.5% of total engagement. This might reflect the agility of smaller businesses to adopt or investigate new trends rapidly.

2. Peak Interest in Medium-Small Companies:

– The highest level of engagement comes from medium-small businesses (50-199 employees) with an average of 826 weekly spikes, representing approximately 27.2% of the total. This suggests that businesses within this size range are possibly at an ideal scale to invest resources in exploring and implementing new trends or technologies without the constraints of smaller business sizes or the inertia often found in larger organizations.

3. Decline in Larger Size Categories:

– As company size increases, there seems to be a decrease in the relative engagement with the trend. Medium businesses show a decline to 438 weekly spikes, and medium-large businesses further decrease to 255 spikes. This could be due to larger organizations having established systems and processes that might slow down the adoption of new technologies or trends.

Why This Trend?

– Flexibility vs. Structure: Smaller companies often have more flexibility to pivot and experiment with new technologies or strategies, which might explain the higher engagement rates seen in micro to medium-small businesses. As companies grow, the complexity of changing direction increases, possibly leading to reduced agility in adopting new trends.

– Resource Allocation: Medium-small companies, typically having more resources than smaller businesses but less bureaucratic than larger ones, may find it easier to allocate resources towards exploring new trends or technologies, which is reflected in their highest engagement rates.

Conclusion

The trend in the data suggests that while all company sizes show some degree of interest in the market trend or topic, medium-small businesses are most actively engaged. This could indicate a sweet spot in company size where the balance between resources, flexibility, and the ability to innovate or adopt new trends is optimal. For stakeholders and marketers, understanding these dynamics can help tailor approaches to different business sizes effectively.