Executive Summary: Recruitment, Hiring & Onboarding Research Trends in the Construction Industry

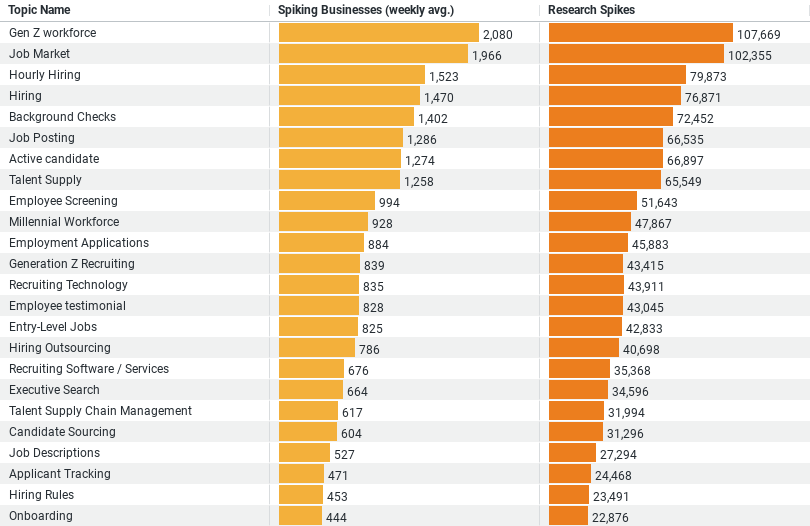

– Gen Z Workforce: Dominates the interest with 107,669 research spikes and an average of 2,080 businesses researching weekly.

– Job Market: Shows substantial interest with 102,355 research spikes and 1,965 businesses focusing on it weekly.

– Hourly Hiring: Attracts considerable attention with 79,873 research spikes and 1,523 businesses exploring it each week.

– Hiring: Maintains strong relevance with 76,871 research spikes and 1,470 businesses analyzing it weekly.

– Background Checks: Essential for recruitment integrity, capturing 72,452 research spikes and 1,401 businesses focusing on it weekly.

Adapting to Change: How the Construction Industry Focuses on Recruitment, Hiring, and Onboarding

In today’s dynamic work environment, the construction industry is increasingly focusing on innovative strategies to attract and manage talent. Recent data reveals significant research and interest in topics crucial to recruitment, hiring, and onboarding processes, particularly as these areas evolve to meet new market demands and workforce dynamics.

Understanding the Gen Z Workforce

The most notable trend from the data is the industry’s concentrated focus on the Gen Z workforce. With a whopping 107,669 research spikes and an average of 2,080 businesses analyzing this topic weekly, it’s clear that the construction sector is keen on understanding and integrating this new generation into their ranks. Gen Z, known for its unique work preferences and technological inclination, requires different engagement strategies compared to previous generations. Construction companies are exploring ways to appeal to this demographic’s values, such as sustainability, technology integration, and flexible working conditions, which are significantly different from the traditional norms of the industry.

Keeping Pace with the Job Market

The job market itself is another area of intense scrutiny. Data shows 102,355 research spikes and 1,965 businesses delving into this topic on a weekly basis. This indicates a robust interest in understanding current market trends, including the availability of skilled labor, wage expectations, and employment rates. For the construction industry, which often experiences fluctuations in project volume and workforce demand, staying informed about the job market helps in strategic planning and competitive positioning.

The Importance of Hourly Hiring

Hourly hiring is a critical component in the construction industry, evidenced by 79,873 research spikes and 1,523 businesses focusing on it each week. Many construction jobs are project-based with a need for hourly workers; thus, optimizing the recruitment and management of such employees is vital. Companies are likely exploring efficient hiring practices, retention strategies, and regulatory compliance related to hourly employment to ensure a steady flow of capable labor that can be scaled up or down according to project demands.

Refining General Hiring Practices

General hiring practices are under continuous examination, with the data indicating 76,871 research spikes and about 1,470 businesses researching this weekly. This persistent interest suggests that construction companies are working to enhance their hiring processes. Streamlining how they recruit not only improves efficiency but also helps in attracting and retaining the best talent. This includes leveraging technology for recruitment processes, improving interview techniques, and developing better criteria for candidate selection.

Ensuring Integrity Through Background Checks

Lastly, the topic of background checks shows significant activity with 72,452 research spikes and 1,401 businesses focusing on it weekly. In an industry where safety and reliability are paramount, thorough background checks are crucial. Companies are likely investing in advanced methods and technologies to conduct comprehensive checks to maintain a secure and trustworthy workforce.

Conclusion

The construction industry’s focus on these topics highlights a proactive approach towards adapting to new workforce dynamics and optimizing recruitment strategies. As companies continue to navigate through the complexities of hiring and onboarding in a changing market landscape, the insights derived from such data-driven research will be crucial in shaping resilient and forward-thinking workforce management strategies. By aligning their recruitment practices with the expectations and realities of the modern labor market, construction businesses are not just filling gaps—they are building the foundation for future growth and sustainability.

Company Sample Data: Trends by Company Size

The dataset categorizes companies into five distinct sizes:

1. Micro (1 – 9 Employees)

2. Small (10 – 49 Employees)

3. Medium-Small (50 – 199 Employees)

4. Medium (200 – 499 Employees)

5. Medium-Large (500 – 999 Employees)

For each category, two key metrics are tracked:

– Spiking Businesses (weekly avg.): The average number of businesses in each size category that show a peak in a specific activity each week.

– Percent of Total: The percentage that each company size category represents in the total number of spiking businesses.

Analysis of Trends by Company Size

1. Micro Companies (1 – 9 Employees):

– Weekly Average: 1,229.7

– Percent of Total: 10.04%

– Trend: Micro companies, despite their smaller size, are actively engaging in business activities that spike interest. Their agility allows them to adapt quickly, though they contribute a smaller portion to the total activity volume.

2. Small Companies (10 – 49 Employees):

– Weekly Average: 3,517.6

– Percent of Total: 28.73%

– Trend: Small companies show significant engagement, likely due to their capacity to specialize and focus on niche areas, resulting in a higher activity spike relative to their size.

3. Medium-Small Companies (50 – 199 Employees):

– Weekly Average: 3,986.6

– Percent of Total: 32.56%

– Trend: This group leads in activity spikes, possibly because they have sufficient resources to engage broadly in market activities while still maintaining flexibility and innovation like smaller companies.

4. Medium Companies (200 – 499 Employees):

– Weekly Average: 1,694.6

– Percent of Total: 13.84%

– Trend: Medium-sized companies, though larger, may face more bureaucratic challenges than smaller firms, which might slow their ability to peak in specific activities quickly.

5. Medium-Large Companies (500 – 999 Employees):

– Weekly Average: 765.4

– Percent of Total: 6.25%

– Trend: As companies grow larger, the proportion of total spikes decreases, suggesting that larger organizations may engage in more consistent, but less peak-oriented activities due to established processes and stability.

Conclusion

The data reveals a trend where smaller to medium-sized companies are more likely to show spikes in specific business activities compared to larger firms. This could be due to their ability to be more nimble, innovative, and reactive to market changes and opportunities. Conversely, larger firms, while engaging less in spiking activities, may be focusing on sustained and stable growth strategies. The insights drawn from this data are essential for understanding how company size influences business behavior and market engagement.