Executive Summary: Campaigns Research Trends in the Construction Industry

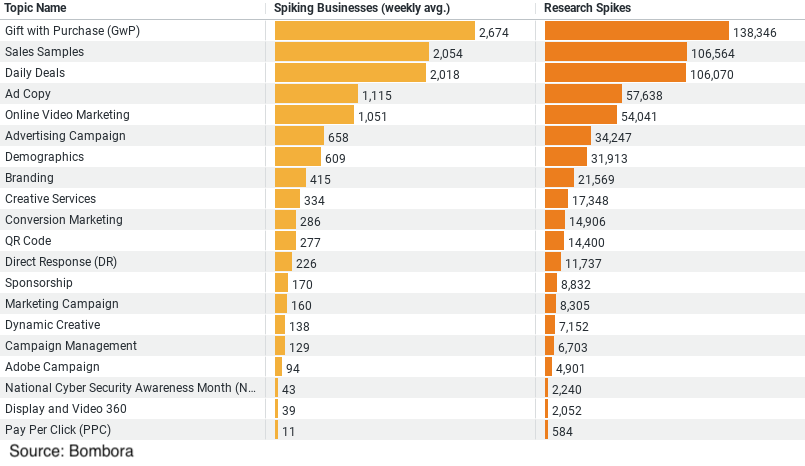

– Gift with Purchase (GwP) emerges as the most engaging topic with the highest weekly average of spiking businesses (approximately 2674) and the greatest number of research spikes (138,346). This indicates its prominence as a successful promotional tool, attracting significant attention and activity.

– Sales Samples and Daily Deals are also notably popular, each drawing over 2000 businesses weekly and achieving over 100,000 research spikes. These topics are crucial for stimulating sales and enhancing visibility in the short term.

– Lesser but still substantial engagement is seen in Ad Copy and Online Video Marketing, with both attracting over 1000 businesses weekly. These areas are vital for effective communication and marketing, underscoring the importance of content quality in campaigns.

– The focus on promotional strategies such as gifts, samples, and deals, alongside content-driven tactics like advertising copy and video marketing, suggests a balanced approach to driving business outcomes and maintaining customer engagement.

Exploring Campaign Strategies: Insights from the Construction Industry

The construction industry is vast and diverse, involving countless companies and professionals dedicated to everything from residential to commercial building projects. As with any industry, marketing and promotional strategies are crucial to attracting new customers and retaining existing ones. A recent analysis of campaign-related topics within the industry offers intriguing insights into how businesses engage with different marketing techniques and their growing interest in banking solutions.

Promotional Campaigns Lead the Way

One of the most prominent findings from the data is the popularity of promotional campaigns, particularly those involving “Gift with Purchase (GwP).” This strategy tops the chart with an average of 2674 businesses engaging weekly, alongside a staggering 138,346 research spikes indicating its effectiveness and popularity. The appeal of receiving something extra with a purchase seems to resonate strongly within the construction sector, perhaps because it offers tangible added value to large-scale transactions typical in this industry.

Following closely are “Sales Samples” and “Daily Deals,” each drawing significant attention with over 2000 businesses engaging weekly and research spikes surpassing 100,000. These strategies are particularly effective in the construction industry as they provide immediate incentives for customers to make a decision, be it through sampling new materials or capitalizing on time-sensitive discounts. These tactics not only enhance visibility but also drive sales by creating a sense of urgency.

Content Is Becoming A Priority

Despite the effectiveness of direct promotional strategies, the importance of quality content cannot be understated. “Ad Copy” and “Online Video Marketing” have also shown considerable engagement, with over 1000 businesses investing in these areas weekly. In a field where projects can often be complex and highly technical, effective ad copy and engaging video content can be crucial in simplifying messages and conveying the value of services and products in an accessible way. These tools are not just about selling but about educating potential clients on the specifics and benefits of construction solutions.

Banking Interests

Interestingly, there is a growing intersection between the construction industry and banking, particularly in how campaign strategies are formulated around financial solutions. As construction projects often require significant investment, both from businesses and their clients, the role of financing options becomes critical. Campaigns that effectively communicate the availability and benefits of supportive banking services can attract businesses looking for robust financing solutions to fund their projects.

Financial institutions that tailor their services to the needs of the construction industry, offering everything from loans to lines of credit, are increasingly highlighted in industry research. This synergy suggests that construction companies are not only interested in traditional marketing campaigns but are also keenly aware of the importance of financial partnerships that can facilitate larger and more ambitious projects.

Strategic Applications and Future Trends

The data clearly indicates that construction companies are strategically using promotional campaigns to achieve immediate business outcomes like increased sales and enhanced customer engagement. At the same time, they are investing in content creation to build long-term relationships and educate their market.

As we look to the future, these trends suggest a few developments. First, the integration of comprehensive financial solutions into campaign strategies will likely grow as companies seek to make their offers more attractive and financially feasible for clients. Second, as digital platforms continue to evolve, so too will the methods by which these companies engage with their audiences, particularly through online marketing channels.

In conclusion, the construction industry’s approach to research and campaign strategies reveals a dynamic and multifaceted engagement with marketing techniques. Companies that continue to innovate in their promotional offerings while maintaining a strong focus on financial solutions and quality content are well-positioned to thrive in this competitive industry.

Company Sample Data

Data Overview

– Company Size: This categorizes companies into different groups based on the number of employees, ranging from micro-sized businesses with 1-9 employees to medium-large companies with 500-999 employees.

– Spiking Businesses (weekly avg.): Indicates the average number of businesses in each size category that show a significant increase in activity or interest in a particular area weekly.

– Percent of Total: Represents the proportion of businesses in each size category relative to the total number considered in the dataset.

Insights from the Data

1. Micro Businesses (1 – 9 Employees):

– These businesses show a weekly average of 869 spiking businesses, which accounts for about 10.1% of the total. This high activity level in proportion to their size might reflect a dynamic sector where small entities frequently explore new opportunities or need to pivot their strategies regularly.

2. Small Businesses (10 – 49 Employees):

– With 2451 spiking businesses weekly and making up approximately 28.5% of the total, small businesses are significantly active. This suggests that businesses in this size range are possibly at a developmental stage where they are scaling operations and are highly responsive to market changes.

3. Medium-Small Businesses (50 – 199 Employees):

– This category tops the activity with 2707 spiking businesses weekly, comprising 31.5% of the total. Medium-small businesses likely have enough resources to engage robustly in market activities, yet are still agile enough to react quickly to industry trends.

4. Medium Businesses (200 – 499 Employees):

– Medium-sized companies show a notable drop in relative activity with 1164 spiking businesses weekly, about 13.6% of the total. This may indicate a stabilization phase where companies have established market positions and might focus more on deepening existing engagements rather than expanding them.

5. Medium-Large Businesses (500 – 999 Employees):

– These businesses have the least activity with only 548 spiking businesses, or 6.4% of the total. The smaller proportion of spiking businesses could reflect a more consolidated approach to market engagements, where larger companies may prioritize sustained, long-term strategies over frequent changes.

Trend Analysis and Implications

The trend in the data suggests that smaller to medium-sized companies exhibit higher proportions of spiking activities, likely driven by their need to be more adaptive and responsive in a competitive marketplace. As companies grow larger, the proportion of spiking businesses decreases, possibly indicating a shift towards more stable, long-term strategies as they consolidate their market presence.

This pattern can inform strategic decisions across industries, suggesting that smaller companies might benefit from leveraging nimbleness and flexibility to capture opportunities, while larger entities may need to balance stability with innovation to maintain competitive advantage.