Executive Summary: Search Marketing Research Trends in the Construction Industry

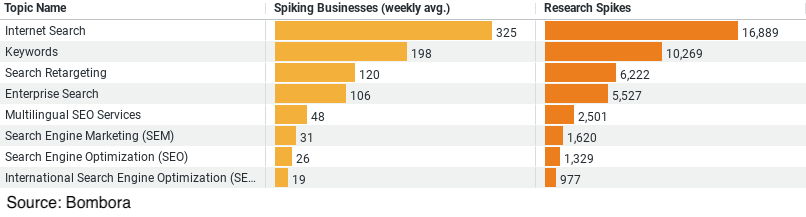

1. Internet Search: This topic is the most researched, with an average of approximately 325 businesses spiking weekly. It has the highest number of research spikes, totaling 16,889. This suggests that the construction industry places significant emphasis on general online search strategies, indicating a broad interest in improving online visibility and search-related activities.

2. Keywords: Coming in second, this topic sees about 198 businesses on average researching it weekly, with 10,269 research spikes. This highlights the importance placed on keyword optimization and strategy, suggesting that construction businesses are keen on targeting specific search terms to attract relevant traffic.

3. Search Retargeting: This topic is researched by around 120 businesses weekly on average, with 6,222 research spikes. It suggests an interest in targeting users who have previously interacted with their online content or services, indicating a strategy focused on re-engaging past visitors to improve conversion rates.

4. Enterprise Search: With an average of 106 businesses researching this weekly and 5,527 research spikes, there’s a notable interest in improving internal search capabilities within large organizations. This could reflect an effort to enhance operational efficiencies and data retrieval within enterprise-level construction businesses.

5. Multilingual SEO Services: This topic, researched by an average of 48 businesses weekly with 2,501 research spikes, indicates a focus on reaching non-English speaking markets or multilingual audiences. It suggests that construction businesses are looking to expand their reach and cater to a broader, more diverse audience.

The Dominance of Internet Search

The cornerstone of Search Marketing, Internet Search, emerges as the most extensively researched topic within the construction sector. With an impressive weekly average of approximately 325 businesses delving into this area, it’s clear that mastering online search mechanisms is deemed crucial. The sheer volume of research spikes, peaking at 16,889, underscores the industry’s collective endeavor to harness the full potential of Internet Search. This intense focus reflects a broader strategy to enhance online visibility and effectively navigate the vast digital landscape.

Strategic Keyword Optimization

The importance of keywords in crafting a successful Search Marketing strategy is well-acknowledged, as evidenced by the significant attention it receives. Around 198 construction businesses, on average, dedicate their research efforts to keywords weekly, with a total of 10,269 research spikes recorded. This trend indicates a meticulous approach to keyword selection and optimization, aiming to capture the essence of consumer searches. By targeting specific search terms, construction companies aspire to attract more relevant traffic, thereby increasing the chances of converting leads into clients.

Leveraging Search Retargeting

With 119 businesses on average exploring Search Retargeting each week, and a total of 6,222 research spikes, the construction industry is keenly aware of the benefits of re-engaging with past website visitors. This strategy is instrumental in reminding potential clients of their interest in construction services or products, enhancing the likelihood of converting previous interactions into sales. The data reflects a strategic investment in fostering repeat engagements, a testament to the industry’s understanding of the customer journey and the importance of maintaining visibility in a competitive market.

Enterprise Search: Streamlining Operations

The construction industry’s interest in Enterprise Search, with 106 businesses researching it weekly and a total of 5,527 research spikes, reveals an internal focus aimed at enhancing operational efficiency. By improving the ability to retrieve and manage internal information, construction businesses are looking to streamline processes and bolster productivity. This internal optimization is crucial for large organizations where the swift retrieval of data can significantly impact decision-making and project management.

Expanding Horizons with Multilingual SEO Services

Lastly, the industry’s exploration of Multilingual SEO Services, researched by an average of 48 businesses weekly, with 2,501 research spikes, signifies a forward-thinking approach to globalization. This strategy is about transcending linguistic barriers to tap into non-English speaking markets or cater to multilingual audiences. By doing so, construction businesses are not just expanding their reach but are also showcasing their adaptability and commitment to inclusivity, catering to a broader, more diverse clientele.

In Summary

The construction industry’s engagement with Search Marketing reveals a multifaceted approach to digital strategy. From mastering the nuances of Internet Search to the strategic use of keywords, retargeting efforts, and the pursuit of operational excellence through Enterprise Search, the data illustrates a sector in motion, keen on leveraging digital tools for growth. Moreover, the exploration of Multilingual SEO Services highlights an outward-looking perspective, ready to embrace the challenges and opportunities of a global market.

As the construction industry continues to navigate the complexities of the digital landscape, these insights not only shed light on current priorities but also hint at the future directions of marketing strategies within the sector. The emphasis on research and development in Search Marketing is a clear indicator of the industry’s commitment to innovation, efficiency, and global outreach, paving the way for sustained growth and competitiveness in the years to come.

Company Sample Data

The data is segmented by company size, ranging from micro (1 – 9 employees) to medium-large (500 – 999 employees), showcasing the intensity of search marketing interest across different scales of operation:

1. Micro Enterprises (1 – 9 Employees): With an average of approximately 52 businesses spiking weekly, micro enterprises represent the smallest segment in terms of absolute numbers, accounting for about 7.25% of the total. This relatively lower engagement could be attributed to limited resources and the focus of micro enterprises on immediate operational needs over strategic marketing investments.

2. Small Businesses (10 – 49 Employees): Small businesses show a higher level of engagement, with around 128 companies spiking weekly, making up nearly 17.8% of the total. This increase suggests that businesses in this category are more likely to invest in search marketing as a means to expand their visibility and reach, possibly due to having slightly more resources and recognizing the need for strategic online presence.

3. Medium-Small Businesses (50 – 199 Employees): This category exhibits the highest level of interest, with approximately 143 businesses spiking weekly, constituting almost 19.8% of the total. Medium-small businesses are likely at a stage where they recognize the critical importance of search marketing for scaling up operations and competing more effectively in broader markets.

4. Medium Businesses (200 – 499 Employees): Here, the interest slightly declines to about 100 businesses spiking weekly, accounting for 13.9% of the total. While still significant, this drop might indicate that businesses of this size have established marketing strategies and are possibly focusing on refining rather than expanding their search marketing efforts.

5. Medium-Large Businesses (500 – 999 Employees): With approximately 76 businesses spiking weekly, this segment represents 10.6% of the total. The tapering interest could reflect a transition to more diversified marketing strategies beyond search marketing, as businesses of this size might rely on a broader mix of marketing channels and have established market positions.

Why This Is a Trend

The data reveals a clear trend: as companies grow from micro to medium-small, their engagement with search marketing significantly increases. This uptrend likely results from the growing recognition of the importance of digital presence and search visibility as essential drivers of business growth and customer acquisition. However, as companies further increase in size, reaching the medium and medium-large categories, the relative interest in search marketing slightly decreases, possibly due to the diversification of marketing strategies and the evolution of their marketing needs.

This trend underscores the evolving nature of marketing priorities as businesses expand. Smaller companies focus intensely on search marketing to establish and grow their digital footprint, while larger organizations, having potentially achieved a level of visibility, may allocate resources to a wider range of marketing activities, reflecting their broader strategic objectives and market presence.

These insights are invaluable for understanding how different sizes of companies prioritize and invest in search marketing, highlighting the strategic importance of search marketing across the business growth spectrum.