Executive Summary: Staff Departure Research Trends in the Construction Industry

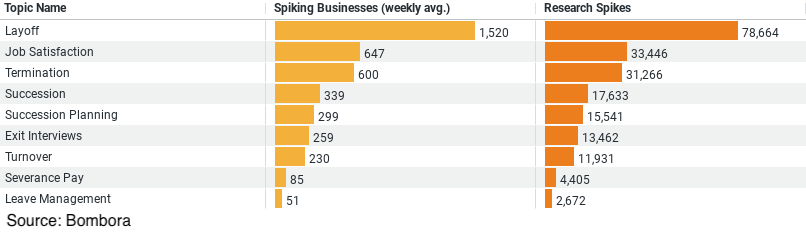

1. Layoff: This is the most researched topic, with a weekly average of approximately 1519 businesses showing interest. The total research spikes count is 78,664, indicating high concern or interest in layoffs within the industry. This trend was seen in mid-2023 and early 2024.

2. Job Satisfaction: This topic ranks second, with around 647 businesses researching it weekly on average. The total research spikes amount to 33,446, suggesting a significant focus on understanding and improving job satisfaction among staff.

3. Termination: The third most researched topic, with an average of 600 businesses per week exploring this area. It has a total of 31,266 research spikes, highlighting concerns or processes related to ending employment.

4. Succession: Coming in fourth, with an average of 339 businesses researching it weekly. The total research spikes are 17,633, indicating interest in planning for or managing the transition of roles within the industry.

5. Succession Planning: Closely related to the topic of succession, this topic sees about 299 businesses researching it weekly, with a total of 15,541 research spikes. This underscores the importance placed on preparing for future leadership and key position changes within companies.

These insights indicate a strong focus within the construction industry on managing staff departure, including layoffs, terminations, and succession planning. Additionally, there’s a significant interest in understanding and enhancing job satisfaction, which could be seen as a strategy to possibly reduce turnover and improve retention.

Layoff Concerns at the Forefront

At the heart of the industry’s research efforts is the topic of layoffs. Data reveals that an average of 1,519 businesses per week are actively seeking information related to layoffs, accumulating a total of 78,664 research spikes. This intense focus suggests an acute awareness within the sector of the potential for workforce reduction, driven by factors such as economic downturns, project completions, or operational efficiencies. The construction industry’s keen interest in layoffs reflects a broader concern for stability and continuity amidst uncertain market conditions.

The Importance of Job Satisfaction

Following closely is the industry’s exploration of job satisfaction, with around 647 businesses weekly delving into this area, leading to 33,446 research spikes. This significant attention to job satisfaction underscores a strategic pivot towards understanding what keeps employees engaged and committed to their roles. In an industry characterized by high physical demands, tight deadlines, and often precarious working conditions, fostering a positive work environment is crucial for retaining talent and minimizing voluntary exits.

Termination Procedures and Policies

Termination procedures also command considerable attention, with 600 businesses per week researching this topic, amounting to 31,266 spikes in interest. This focus highlights the industry’s need to navigate the complexities of employment termination, whether due to performance issues, contract ends, or layoffs. By seeking out best practices and legal guidelines, companies aim to ensure that termination processes are handled ethically and professionally, minimizing the impact on both the organization and its departing members.

Succession and Future Planning

The topics of succession and succession planning also emerge as areas of keen interest, with weekly research averages of 339 and 299 businesses, respectively, and total research spikes of 17,633 and 15,541. These insights reflect a proactive approach within the construction industry towards leadership continuity and the strategic preparation for role transitions. Succession planning is essential in safeguarding the industry’s future, ensuring that projects do not suffer due to sudden departures and that knowledge is effectively passed down.

Industry Implications and Strategies

The data paints a comprehensive picture of the construction industry’s proactive stance towards managing staff departure. By prioritizing research into layoffs, job satisfaction, termination, and succession planning, the sector demonstrates a multifaceted strategy aimed at mitigating the impacts of workforce changes. This approach is not just about managing exits but also about creating an environment that fosters long-term employee engagement and prepares the organization for future challenges.

To effectively address the concerns highlighted by the data, construction companies may consider several strategies. First, enhancing job satisfaction through meaningful work, career development opportunities, and a supportive work environment can help reduce voluntary turnover. Secondly, establishing clear, fair, and consistent policies for layoffs and terminations can mitigate the negative impacts of these difficult decisions. Finally, investing in succession planning ensures the industry remains resilient, capable of navigating leadership changes without disrupting ongoing projects or long-term goals.

Conclusion

As the construction industry continues to evolve, understanding and managing staff departure remains a paramount concern. The data-driven insights into how businesses research and address this topic offer a roadmap for fostering a stable, engaged, and future-ready workforce. By focusing on the key areas of layoffs, job satisfaction, termination procedures, and succession planning, the construction sector can build a foundation for sustained growth and success, even in the face of inevitable workforce changes.

Company Sample Data

Micro (1 – 9 Employees): This category shows an average of 253.4 businesses spiking weekly, which constitutes approximately 8.5% of the total. Despite the smallest size, the active engagement of micro-enterprises suggests a dynamic interest in specific topics, likely driven by the need to find niche opportunities and strategies tailored to their agile nature.

Small (10 – 49 Employees): Small businesses, with an average of 695.6 weekly spikes, represent about 23.4% of the total. This significant proportion indicates that small enterprises are highly active in researching or pursuing specific trends, possibly reflecting their efforts to expand or solidify their market position.

Medium-Small (50 – 199 Employees): With the highest weekly average of 824.7 businesses and making up 27.7% of the total, medium-small companies show the most considerable engagement. This could be attributed to their potential for rapid growth and expansion, necessitating a keen interest in market trends, innovations, and strategic planning to leverage opportunities.

Medium (200 – 499 Employees): This segment sees 460.1 businesses spiking on average each week, accounting for 15.5% of the total. The involvement level of medium-sized companies indicates a balanced approach to exploring new areas, possibly focusing on scaling their operations and entering new markets.

Medium-Large (500 – 999 Employees): With 263.8 weekly spikes and 8.9% of the total, medium-large companies have a notable but lesser engagement compared to smaller entities. This trend might reflect a shift towards more in-depth, strategic research as companies grow, focusing on long-term objectives and efficiency improvements.

Trend Analysis and Implications

The data illustrates a clear trend: as companies grow in size, their proportion of total engagement in specific research areas first increases, peaking with medium-small companies, before gradually declining as companies become larger. This trend could indicate that the urgency and intensity of exploring new opportunities or strategic focuses are most pronounced in companies at the cusp of moving from small to medium size. Such companies are likely at a critical growth phase, where the right strategies and knowledge can catapult them to the next level, hence the heightened research activity.

Conversely, the reduced relative engagement in larger companies suggests a transition towards more focused, possibly internalized research efforts. As companies grow, they may develop dedicated teams for research and strategic development, reducing the need for external spikes in interest. Additionally, larger organizations might focus on consolidating their market position, optimizing operations, and exploring strategic acquisitions, which involve different types of research and strategic planning activities.

Conclusion

The analysis of company sample data by size highlights the dynamic nature of business engagement with market trends, strategic planning, and research activities. The peak of engagement among medium-small companies underscores the critical growth phase where targeted research and strategic initiatives are crucial. Meanwhile, the evolution of research engagement patterns reflects the shifting priorities and resources as companies grow. Understanding these trends can offer valuable insights for service providers, market analysts, and the companies themselves as they navigate their growth trajectories and strategic planning processes.