Executive Summary: Taxation Research Trends in the Construction Industry

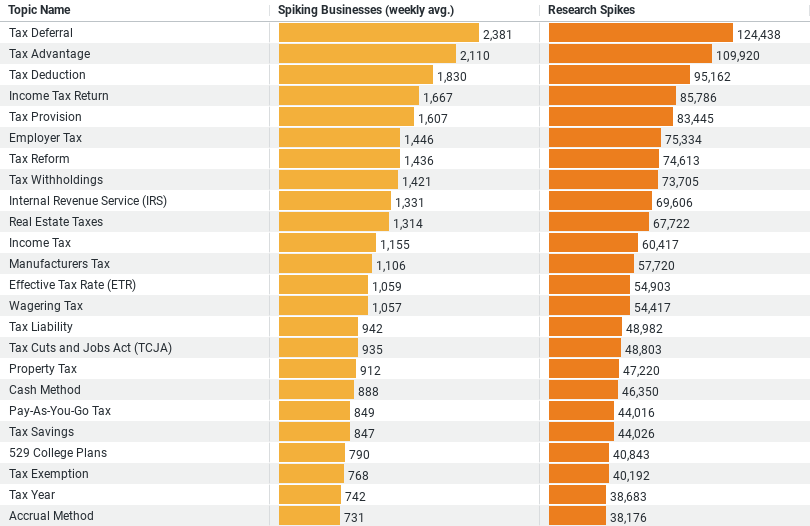

1. Top Researched Topics: The most actively researched topics are “Tax Deferral”, “Tax Advantage”, and “Tax Deduction”, indicating a strong focus on strategies that either postpone tax liabilities or minimize taxable income to optimize financial outcomes.

2. Business Engagement:

– Tax Deferral: Leads with the highest weekly average of spiking businesses at approximately 2381, with a total of 124,438 research spikes.

– Tax Advantage: Follows closely with about 2110 businesses engaged weekly, totaling 109,920 spikes.

– Tax Deduction: Shows significant interest with around 1830 businesses per week and 95,162 total spikes.

3. Research Intensity: The data illustrates that topics with direct financial implications like tax deductions and deferrals command the most attention, suggesting that these are areas where businesses anticipate significant impact on their financial planning and compliance strategies.

4. Visual Trends: The visual analysis underscores that the highest spikes in research are not just numerically significant but also show consistent interest over time, affirming their ongoing relevance in the industry’s fiscal management practices.

Industry Insight: How the Construction Sector Tackles Taxation Research

In the dynamic landscape of the construction industry, understanding taxation is not just about compliance—it’s a strategic endeavor crucial for financial success. Recent data provides a fascinating glimpse into how companies of various sizes within this sector approach their tax-related research. This blog post delves into the insights from this data, highlighting trends and pinpointing where the interests of construction businesses lie in terms of taxation strategies.

Prioritizing Tax Deferral

Among the hottest topics, ‘Tax Deferral’ stands out as the most researched area. This is particularly significant in the construction industry, where the timing of income and expenses can be unpredictable due to the project-based nature of the work. Tax deferral strategies enable businesses to manage their cash flow more effectively by delaying tax payments to a more favorable financial period. This approach not only helps in smoothing out financial fluctuations but also aids in better capital management—critical for the heavy upfront investments required in construction projects.

Leveraging Tax Advantages

Close on the heels of tax deferral is the intense focus on ‘Tax Advantage’. This includes exploring tax credits and deductions that are specifically beneficial to the construction industry. For example, investments in energy-efficient materials and technologies can yield significant tax breaks, aligning financial benefits with sustainable practices. The high level of engagement in this topic underscores an industry-wide push toward maximizing financial gains through every available tax benefit, showcasing a proactive rather than reactive approach to tax planning.

Exploring Tax Deductions

The research into ‘Tax Deduction’ remains robust, reflecting a broad interest in reducing taxable income. Construction companies, big and small, dive deep into understanding which costs can be legitimately deducted to lower their tax burden. This ranges from straightforward deductions for equipment and supplies to more nuanced areas like depreciation and labor costs. The depth of research in this area highlights the industry’s diligence in ensuring every dollar is accounted for, minimizing tax liabilities where possible.

Visual Trends in Research Activity

The data visualization further illuminates these trends. Companies engaged in ‘Tax Deferral’, ‘Tax Advantage’, and ‘Tax Deduction’ not only dominate the research activity by volume but also show a consistent pattern over time. This indicates a sustained strategic focus, rather than sporadic interest, which could be attributed to the ongoing changes and complexities in tax legislation affecting the construction sector.

Implications for the Industry

For stakeholders in the construction industry, understanding these research trends is crucial. It helps in tailoring support services, from consultancy to software solutions, ensuring that they meet the nuanced needs of businesses across the spectrum of company sizes. Additionally, this insight can guide policy advocates and educational bodies in designing initiatives that address the specific pain points of the industry regarding taxation.

Conclusion

As the construction industry continues to evolve, so does the complexity of managing its finances. Taxation, a significant component of financial management, remains a key area of focus. The insights from the recent data not only highlight the priority topics but also reflect the strategic nature of tax-related research in the construction sector. By staying informed and proactive, businesses within this industry can leverage tax strategies to fortify their financial footing and support sustained growth.

Company Sample Data Overview

1. Company Size: Categories ranging from micro to large enterprises, specifically:

– Micro (1 – 9 Employees)

– Small (10 – 49 Employees)

– Medium-Small (50 – 199 Employees)

– Medium (200 – 499 Employees)

– Medium-Large (500 – 999 Employees)

– Large (1000+ Employees)

2. Spiking Businesses (weekly avg.): The average number of businesses in each size category that are actively researching specific topics weekly.

3. Percent of Total: The proportion of total research activity accounted for by each company size category.

Insights and Trends Based on Company Sizes

The data highlights several interesting trends:

– Higher Engagement in Smaller Companies: Smaller companies, particularly those in the ‘Small (10 – 49 Employees)’ and ‘Medium-Small (50 – 199 Employees)’ categories, show significantly higher research activity. This could be attributed to the agile nature of smaller businesses, which often need to stay very informed and adaptive due to their limited resources and higher vulnerability to market changes.

– Decrease in Research Activity as Company Size Increases: There is a noticeable decrease in research intensity as company size increases, with the smallest companies (micro-sized) and the largest companies showing the least relative activity. This trend might reflect the established processes and resources available in larger firms that possibly rely more on in-house expertise or established strategies, reducing the need for external research.

– Medium-Small Businesses Lead in Research Intensity: Medium-small businesses (50 – 199 Employees) not only have a high weekly average of spiking businesses but also contribute a significant percentage to the total research activity, suggesting that companies of this size are particularly proactive in exploring new business strategies or technologies.

Implications

This pattern of research activity can indicate a few key implications:

– Responsiveness and Adaptation: Smaller and medium-sized companies might be more responsive to market trends and regulatory changes, driving them to engage more actively in research.

– Resource Allocation: Larger companies may allocate their resources differently, perhaps focusing on internal research teams or established strategies that do not show up in this kind of external research tracking.

– Strategic Planning: The data may inform strategic planning for service providers and B2B companies by highlighting which company sizes are more likely to be seeking new information and may be more receptive to new solutions or partnerships.

Understanding these trends can help tailor products, services, and communications to better meet the needs of companies based on their size and corresponding behaviors. This dataset offers a valuable lens through which to view and analyze business intent and activity across different scales of operation.