Executive Summary: CRM Research Trends in the Construction Industry

The construction industry is witnessing a significant shift towards a customer-centric approach, underscored by an increasing focus on Customer Relationship Management (CRM). A detailed analysis of recent market research reveals key insights and trends regarding the industry’s research interests in CRM. This executive summary encapsulates the essence of these findings, highlighting the strategic areas of interest and their implications for the construction sector.

Key Research Trends

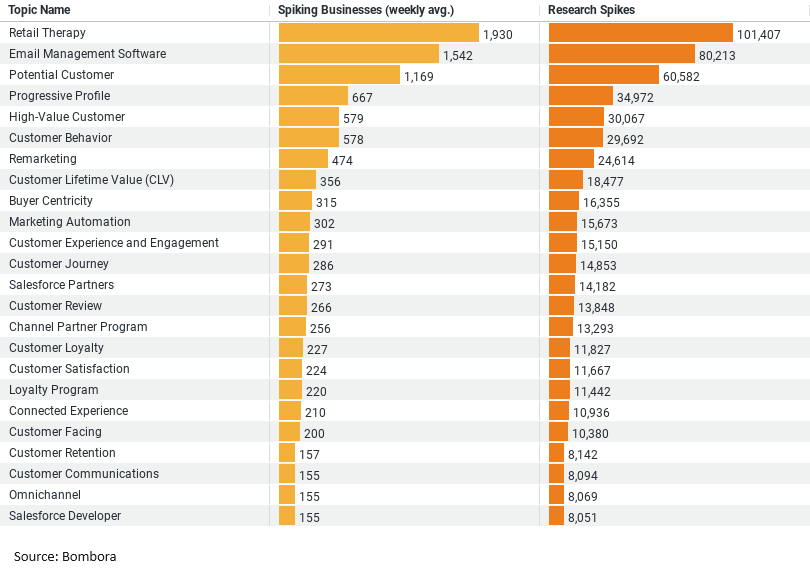

Retail Therapy: Dominating the research landscape, Retail Therapy has emerged as the most explored topic, with an average of 1,929.79 weekly research spikes, culminating in 101,407 instances over the past year. This trend signifies a growing interest in leveraging retail-inspired strategies within CRM frameworks to enhance customer engagement and loyalty.

Email Management Software: With 1,542.40 weekly spikes and a yearly total of 80,213, the industry’s focus on Email Management Software illustrates a commitment to improving communication efficacy. This underscores the importance placed on optimizing customer communication channels to ensure timely and personalized interactions.

Potential Customer Engagement: Marked by 1,169.23 weekly spikes and a total of 60,582 over the year, the industry’s prioritization of identifying and engaging potential customers indicates a strategic emphasis on lead generation and customer acquisition as foundational components of CRM strategies.

Progressive Profiling: The interest in Progressive Profiling, evidenced by 667.40 weekly spikes and 34,972 annually, reflects an inclination towards developing in-depth customer profiles. This approach aims at tailoring interactions and services more effectively to meet customer needs and preferences, enhancing the overall CRM efficacy.

High-Value Customers: Research focusing on High-Value Customers, with an average of 579.10 weekly spikes and a yearly total of 30,067, highlights a strategic move towards prioritizing relationships with key clients. This focus aims at optimizing resource allocation and enhancing satisfaction and loyalty among the most profitable customer segments.

Implications for the Construction Industry

The construction industry’s intensified research into CRM-related topics signals a transformative shift towards more sophisticated and integrated customer relationship strategies. The emphasis on Retail Therapy and Email Management Software indicates a drive towards adopting innovative approaches to customer engagement and communication. Meanwhile, the focus on Potential Customer Engagement, Progressive Profiling, and High-Value Customers showcases a strategic alignment towards understanding and catering to customer needs and preferences in a more nuanced and effective manner.

These trends not only reflect the industry’s acknowledgment of the critical role of CRM in achieving business growth and customer satisfaction but also underscore a broader move towards leveraging technology and data analytics to refine and personalize customer interactions. As the construction sector continues to navigate a competitive and dynamic market landscape, the integration of CRM practices will undoubtedly serve as a key differentiator, enabling businesses to build stronger, more enduring relationships with their clients.

In conclusion, the construction industry’s research and interest in CRM underscore a pivotal shift towards enhanced customer relationship management. By focusing on areas such as Retail Therapy, Email Management Software, and customer engagement strategies, the industry is poised to leverage CRM as a powerful tool for driving growth, improving customer satisfaction, and securing a competitive advantage in the marketplace.

The Construction Industry’s Growing Focus on CRM: Insights and Trends

In the ever-evolving landscape of the construction industry, the importance of Customer Relationship Management (CRM) has never been more pronounced. As companies strive to forge stronger connections with their clients, the integration of CRM practices has become a cornerstone for success. A recent analysis of market research data sheds light on how construction businesses are increasingly focusing on CRM to enhance their customer engagement, streamline communications, and drive growth. This post delves into the key insights and trends from this data, offering a glimpse into the industry’s strategic approach to CRM.

Embracing Retail Therapy in CRM

The concept of “Retail Therapy” tops the list of CRM-related topics researched by the construction industry, with an astonishing weekly average of 1,929.79 research spikes, cumulating to 101,407 over the past year. This trend signifies a shift towards adopting retail strategies within construction CRM efforts. Businesses are exploring how the retail experience can be leveraged to improve client satisfaction and loyalty. By integrating retail concepts, construction companies are looking to create more personalized and engaging customer experiences, potentially transforming the traditional B2B interactions into more consumer-centric engagements.

Optimizing Communications through Email Management Software

The second most researched area, “Email Management Software,” with 1,542.40 weekly research spikes and a total of 80,213 over the last 12 months, highlights the industry’s commitment to enhancing communication channels. Efficient communication is the backbone of successful CRM, and the construction sector is no exception. By investing in advanced email management solutions, businesses aim to streamline their outreach and follow-up processes, ensuring timely and effective interactions with clients. This focus on optimizing email communication underscores the industry’s understanding of the critical role that timely, personalized communication plays in building and maintaining customer relationships.

Prioritizing Potential Customer Engagement

The industry’s interest in “Potential Customer” research, marked by 1,169.23 weekly spikes and a total of 60,582 over the year, reveals a strategic emphasis on lead generation and customer acquisition. Identifying and engaging potential customers is a pivotal aspect of CRM strategies, as it lays the foundation for future business growth and expansion. Construction companies are keen on employing sophisticated CRM tools and techniques to capture and nurture leads, demonstrating a proactive approach to expanding their client base and securing new projects.

Progressive Profiling for Personalized CRM

Research into “Progressive Profile” topics, with 667.40 weekly spikes and 34,972 annually, indicates a growing interest in developing comprehensive customer profiles. This approach allows businesses to gradually collect and analyze data on their clients, leading to more tailored and relevant interactions. Progressive profiling in CRM enables construction companies to understand their clients’ needs, preferences, and behaviors better, allowing for more personalized service offerings and communications. This trend reflects the industry’s move towards more customer-centric strategies, where understanding the client’s journey and touchpoints can significantly enhance the CRM effectiveness.

Focusing on High-Value Customers

Lastly, the research on “High-Value Customer” topics, averaging 579.10 weekly spikes and totaling 30,067 over the past year, highlights the industry’s strategy to identify and prioritize its most lucrative clients. By focusing on high-value customers, construction businesses can allocate their resources more efficiently, ensuring that those who contribute most significantly to the bottom line receive the attention and service they deserve. This approach not only optimizes CRM efforts but also enhances customer satisfaction and loyalty among key clients.

Conclusion

The construction industry’s increasing research and interest in CRM topics underscore a strategic shift towards more sophisticated, customer-centric approaches. By exploring areas such as Retail Therapy, Email Management Software, Potential Customer engagement, Progressive Profiling, and focusing on High-Value Customers, businesses are positioning themselves to build stronger, more profitable relationships with their clients. As the industry continues to evolve, the integration of CRM practices will undoubtedly play a critical role in shaping the future of construction business strategies, driving growth, and enhancing customer experiences.

Company Sample Data

The company sample dataset offers a compelling snapshot of market research engagement across companies of varying sizes, categorized by the number of employees. This data provides an insightful overview of how businesses from different segments actively seek market insights to inform their strategies, showcasing a range of activity that reflects their priorities and capacities for research.

Key Trends and Insights:

Predominant Activity in Medium-Small Businesses: Companies with 50 to 199 employees (Medium-Small) are the most engaged in market research, with an average of 2,157.87 weekly spikes. This segment represents the highest level of activity, accounting for nearly 30% of the total market research interest. It suggests that medium-small businesses are particularly keen on leveraging market insights to navigate their competitive landscapes and inform their growth strategies.

Strong Engagement Across Small and Medium Businesses: Small companies (10 – 49 Employees) and medium companies (200 – 499 Employees) also show significant research activity, with 26.57% and 14.83% of the total, respectively. This demonstrates a robust commitment to understanding market dynamics and applying insights to business operations, highlighting the importance of market research in these company sizes’ strategic planning.

Micro and Medium-Large Companies: Micro (1 – 9 Employees) and Medium-Large (500 – 999 Employees) companies, while less active than their counterparts, still demonstrate notable market research engagement. With 8.76% and 7.24% of the total activity, respectively, these segments indicate that regardless of size, businesses are inclined to invest in market research to some extent, underlining its value across the spectrum of company sizes.

Diverse Research Engagement: The dataset illuminates the diversity in how companies of different sizes approach market research. While all segments show some level of engagement, the intensity and focus of this activity vary, likely reflecting differences in resources, strategic priorities, and the specific challenges and opportunities faced by companies at different stages of growth.

In summary, the dataset reveals that medium-small businesses are the most active in seeking market insights, with small and medium businesses also displaying considerable engagement. This trend underscores the critical role of market research in business development and strategic planning across the board. Despite varying levels of activity, the data highlights a universal recognition of the importance of market insights, suggesting that businesses of all sizes are committed to understanding and responding to their evolving landscapes.