Executive Summary: Trends in researching about Contracts in the Construction Industry

– The dataset contains information on various topics related to contracts.

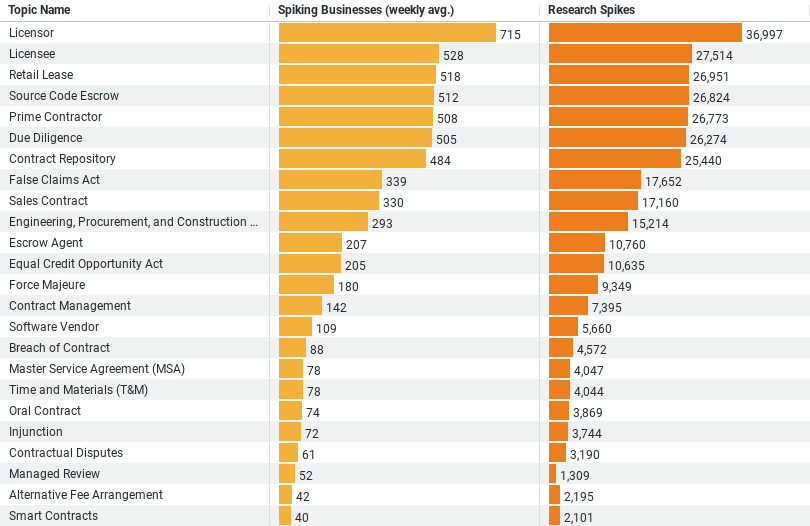

– Columns include “Topic Name”, “Spiking Businesses (weekly avg.)”, and “Research Spikes”.

– A few topic examples from the dataset are:

– **Licensor**: Shows significant interest with a weekly average of 715 spiking businesses and 36,997 research spikes.

– **Licensee**: Another highly relevant topic with 528 spiking businesses on average weekly and 27,514 research spikes.

– **Retail Lease**: Indicates a weekly average of 518 spiking businesses and 26,951 research spikes.

– **Source Code Escrow** and **Prime Contractor**: Both topics also show high activity with over 500 spiking businesses weekly and more than 26,000 research spikes.

This summary indicates the dataset focuses on tracking the interest and activity level in various contract-related topics among businesses, measured through spikes in business activities and research interest.

In the fast-paced world of the construction industry, understanding the trends and interests in contract topics is not just beneficial—it’s crucial. As businesses and professionals navigate the complexities of agreements, leases, and licenses, a clear picture emerges from the data, revealing where the industry’s interests lie. This post aims to dissect and highlight the insights drawn from recent data, shedding light on how the construction sector researches and prioritizes its interests in contracts.

The Landscape of Interest

The construction industry is a behemoth, characterized by multifaceted projects and a plethora of stakeholders, each with their vested interests and obligations. Within this intricate web of interactions, contracts serve as the backbone, ensuring clarity, compliance, and coordination among parties. A recent analysis of contract-related topics has uncovered fascinating trends, offering a glimpse into the industry’s collective mind.

The data, distilled from a comprehensive dataset titled “TopTopics_Contracts.xlsx”, showcases the most researched contract topics within the industry. With columns like “Topic Name”, “Spiking Businesses (weekly avg.)”, and “Research Spikes”, the dataset provides a robust framework for understanding where businesses are focusing their attention.

Key Insights from the Data

A deeper dive into the data reveals several key topics that have captured the industry’s interest:

– Licensor and Licensee: These topics top the chart, indicating a significant weekly average of 715 and 528 spiking businesses, respectively. The high volume of research spikes, with Licensor at 36,997 and Licensee at 27,514, underscores the critical importance of licensing in the construction sector. Licensing agreements, pivotal for ensuring that all parties have the necessary permissions for materials, technologies, and designs, are evidently a focal point for many businesses.

– Retail Lease: With 517 spiking businesses weekly and 26,951 research spikes, the Retail Lease topic highlights the sector’s interest in understanding the nuances of leasing retail spaces. This is particularly relevant for construction companies involved in commercial projects, where leasing agreements directly impact project planning, execution, and profitability.

– Source Code Escrow and Prime Contractor: These topics, with over 500 spiking businesses weekly and more than 26,000 research spikes, reflect the industry’s keen interest in protecting intellectual property and ensuring project leadership. Source Code Escrow agreements are vital for safeguarding software and technology used in modern construction projects. Meanwhile, understanding the role and responsibilities of the Prime Contractor is essential for managing complex projects, coordinating subcontractors, and ensuring compliance.

Implications for the Construction Industry

The insights gleaned from the data have profound implications for the construction industry. Firstly, they underscore the critical role of contracts in managing risk, protecting assets, and ensuring project success. As businesses research these topics extensively, it’s clear that there is a concerted effort to strengthen contractual foundations across projects.

Secondly, the data reflects the industry’s adaptation to modern challenges. With significant interest in licensing and intellectual property protection, construction companies are increasingly recognizing the importance of technology and innovation in their projects. This shift towards embracing digital tools and solutions marks a pivotal evolution in the industry’s approach to project management and execution.

Lastly, the focus on Prime Contractors and Retail Leases signals the industry’s attention to leadership and commercial viability. By understanding the intricacies of these contracts, companies aim to optimize project outcomes, enhance efficiency, and drive profitability.

Conclusion

The construction industry’s research and interests in contracts reflect a deep understanding of the sector’s challenges and opportunities. As businesses continue to delve into these critical topics, they arm themselves with the knowledge and tools necessary to thrive in an ever-changing environment. The data not only highlights the current state of affairs but also serves as a beacon, guiding the industry towards a more informed, efficient, and successful future.

Company Sample Data

This dataset categorizes businesses into eight distinct size brackets, ranging from “Micro” companies with 1-9 employees to “XXLarge” companies with 10,000+ employees. It provides insights into two key metrics:

1. Spiking Businesses (weekly avg.): This column quantifies the average weekly number of businesses experiencing a significant uptick in activities or interest in the context of the dataset’s focus area. This metric is crucial for identifying trends and levels of engagement across different company sizes.

2. Percent of Total: This column represents the percentage each category of business size contributes to the total number of spiking businesses. It offers a proportional analysis of engagement, allowing for an understanding of which segments of the business population are most active or interested in the specific topics of study.

Overview of Findings:

– Micro (1 – 9 Employees): Representing the smallest businesses, this segment accounts for 7.3% of the total, with 285 businesses spiking weekly on average.

– Small (10 – 49 Employees): A larger slice at 22.6%, indicating that small businesses are significantly engaged, with 886 businesses showing weekly spikes.

– Medium-Small (50 – 199 Employees): The most active category, with 1,066 businesses spiking weekly, constituting 27.1% of the total.

– Medium (200 – 499 Employees): These businesses represent 15.8% of the total activity, with 620 businesses experiencing weekly spikes.

– Medium-Large (500 – 999 Employees): With 354 businesses spiking, this group accounts for 9.0% of the total.

– Large (1,000 – 4,999 Employees): This category shows a substantial level of activity (11.4%) with 446 businesses spiking weekly.

– XLarge (5,000 – 10,000 Employees) and XXLarge (10,000+ Employees): Though these represent the largest companies, they contribute less to the total spikes (2.9% and 4.0%, respectively), suggesting that while significant, the sheer size of a company does not necessarily correlate with the highest level of engagement or activity in the dataset’s focus area.

Implications:

The data indicates that the level of engagement with the dataset’s specific topics varies significantly across company sizes. Medium-small businesses appear to be the most active or interested, suggesting that companies within this size range may have the resources and flexibility to engage more dynamically with the topics in question. In contrast, the largest companies, despite their extensive resources, show a lower percentage of activity, which could be due to a variety of factors including but not limited to corporate structure, focus areas, and operational priorities.

This dataset provides valuable insights into how different sizes of companies engage with specific business or contractual topics, potentially informing targeted strategies for outreach, service offerings, or content development aimed at these businesses.