Executive Summary: Certification Research Trends in the Construction Industry

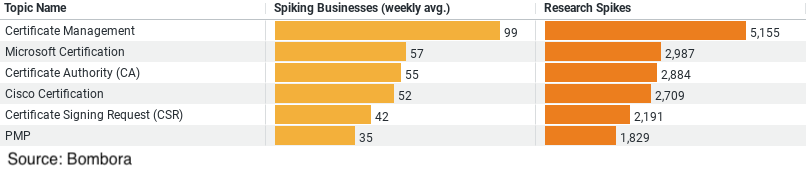

1. Certificate Management is the leading topic with the highest weekly average of spiking businesses, at approximately 99 businesses showing interest weekly. This topic also has the highest number of research spikes, totaling 5155. This suggests that managing certifications is a critical concern for businesses in the construction industry, indicating a high demand for efficient certificate management systems or services.

2. Microsoft Certification comes in second, with an average of about 57 businesses per week showing interest and a total of 2987 research spikes. This interest may reflect the construction industry’s need for professionals skilled in Microsoft technologies, which are often fundamental to project management, data analysis, and office administration within the sector.

3. Certificate Authority (CA) and Cisco Certification are also significant areas of interest, with weekly spiking businesses averages of approximately 55 and 52, respectively. The research spikes for these topics are 2884 and 2709. The focus on Certificate Authority (CA) indicates concerns with digital security and trust, while interest in Cisco Certification suggests a demand for network and IT infrastructure expertise within the construction industry.

4. Certificate Signing Request (CSR) is another key topic, with a weekly average of about 42 businesses showing interest and a total of 2191 research spikes. This trend highlights the importance of securing digital communications and transactions, as CSRs are used to obtain certificates that enable encrypted data exchange.

The Rising Tide of Certificate Management

At the forefront of the construction industry’s interest is Certificate Management. With an average of 99 businesses per week delving into this topic, it’s clear that managing certifications is more than a bureaucratic necessity; it’s a strategic endeavor. This interest is underscored by an impressive 5,155 research spikes, indicating a robust demand for solutions that streamline the management of certificates. In an industry where safety and compliance are paramount, effective certificate management ensures that businesses stay ahead of regulatory changes and maintain the highest standards of operational integrity.

The Digital Edge: Microsoft and Cisco Certifications

The digital transformation of the construction industry is in full swing, as evidenced by the significant interest in Microsoft and Cisco Certifications. With weekly averages of 57 and 52 businesses exploring these topics, respectively, it’s evident that construction firms are keen on harnessing technology to enhance their operations. Microsoft’s suite of productivity tools and Cisco’s networking solutions are critical for project management, data analysis, and secure communication—skills that empower companies to complete projects efficiently and competitively.

Security and Trust: The Role of Certificate Authority (CA)

Another key area of focus is the Certificate Authority (CA), with 55 businesses per week investigating this topic. This trend highlights the industry’s increasing concern with digital security and the integrity of online transactions. In an era where cyber threats loom large, establishing trust through verified digital certificates is crucial for protecting sensitive project data and ensuring secure communications with partners and stakeholders.

Certificate Signing Request (CSR): Securing Digital Communications

The interest in Certificate Signing Request (CSR), with a weekly average of 42 businesses exploring this topic, further emphasizes the construction industry’s commitment to digital security. CSRs are pivotal in obtaining digital certificates that encrypt data exchange, safeguarding information from unauthorized access. This proactive approach to cybersecurity underscores the sector’s recognition of the importance of secure digital infrastructures.

The Influence of Company Size on Certification Trends

A closer look at how companies of different sizes engage with the topic of certifications reveals a bell curve of interest. Micro and small companies show a growing interest, underscoring the foundational role of certifications in establishing credibility and operational excellence. The peak of this curve occurs in the medium-small business category, suggesting that at this stage, companies view certifications as critical leverage for growth and competitive differentiation. Interestingly, as companies grow larger, there’s a slight dip in interest, possibly indicating a shift in focus towards leveraging existing certifications and exploring other avenues for expansion and innovation.

Conclusion

The construction industry’s increasing focus on certifications reflects a broader trend towards excellence, safety, and digital transformation. As businesses of all sizes navigate the complexities of the modern construction landscape, certifications emerge as vital tools for building trust, enhancing operational efficiency, and staying competitive. The insights gleaned from current research patterns not only highlight the areas of highest interest but also suggest a strategic roadmap for companies aiming to excel in this ever-evolving industry. In essence, certifications are not just badges of honor; they are the building blocks of a resilient, innovative, and successful construction business.

Company Sample Data on Researching Certification in the Construction Industry

– Micro Companies (1 – 9 Employees) have an average weekly spike of approximately 18 businesses, accounting for about 7% of the total engagement. This indicates that even though these companies are small in size, there is a noticeable level of interest in staying updated or obtaining certifications, highlighting the importance of certifications even at the early stages of business.

– Small Companies (10 – 49 Employees) show a more significant engagement, with around 39 businesses spiking weekly, which is about 15% of the total. This jump suggests that as companies grow, the need or interest in certifications or staying abreast of industry trends becomes more pronounced, possibly due to the need to compete more effectively in the market.

– Medium-Small Companies (50 – 199 Employees) demonstrate the highest level of engagement among all categories, with an average of approximately 42 businesses showing interest weekly, accounting for almost 16% of the total. This could indicate that at this size, companies are at a critical growth stage where certifications and up-to-date industry knowledge can play a pivotal role in scaling the business, entering new markets, or securing large contracts.

– Medium Companies (200 – 499 Employees) have a decrease in weekly spikes to about 27 businesses, making up around 10% of the total. This decrease might suggest that as companies grow larger, they may have established more of the necessary certifications and industry knowledge, or they might be focusing on different areas for growth and expansion.

– Medium-Large Companies (500 – 999 Employees) show a further decrease in engagement, with approximately 23 businesses spiking weekly, representing around 9% of the total. This trend might reflect a plateau in the need for new certifications as companies reach a certain size, possibly due to having a more established presence in their industry or having developed in-house training programs.

The trend observed across different company sizes suggests a bell curve of interest in certifications and industry research, peaking with Medium-Small companies. The initial increase from Micro to Medium-Small companies indicates growing importance of industry trends and certifications with increasing company size, up to a certain point. Beyond this, the trend reverses for Medium and Medium-Large companies, potentially due to the reasons mentioned earlier.

This data implies that certifications and industry knowledge are critical for growth and competitive advantage, especially for smaller to medium-sized companies. For larger companies, while certifications remain important, the focus might shift towards leveraging existing certifications, focusing on innovation, or expanding market presence.