Executive Summary: Policy & Culture Research Trends in the Construction Industry

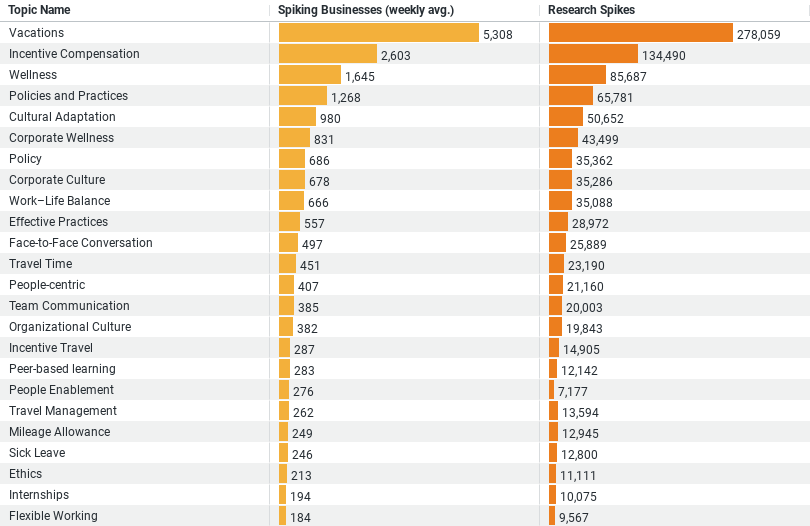

– A collective research effort represented by 278,059 research spikes across the top five topics, indicating a high level of engagement and interest in these areas within the industry.

– Vacations emerge as the top interest, which could be attributed to a growing emphasis on balancing work and life.

– A significant gap between the top two topics (Vacations and Incentive Compensation) and the rest, suggesting these areas might be of critical strategic importance to businesses in this sector.

– Wellness, Policies and Practices, and Cultural Adaptation also receive substantial attention, reflecting a broader concern for creating supportive, inclusive, and adaptable work environments.

– The weekly average of spiking businesses ranges from 5,308 for Vacations to 980 for Cultural Adaptation, highlighting varied but substantial interest levels across different focus areas.

This analysis underscores the construction industry’s commitment to addressing key policy and cultural issues, with a notable emphasis on employee well-being, compensation, and workplace adaptability.

A Growing Focus on Vacations for Work-life Balance

Topping the list of researched topics is Vacations, with a staggering 278,059 research spikes and a weekly average of 5,308 spiking businesses. This overwhelming interest suggests a seismic shift in how the construction industry views work-life balance. The data implies a growing acknowledgment of the importance of rest, recuperation, and time away from the workplace. Businesses seem increasingly invested in understanding how vacation policies can be structured to benefit both employee well-being and the bottom line—recognizing that a rested workforce is a more productive and satisfied one.

Incentive Compensation: Motivating the Workforce

The second most prominent area of research, Incentive Compensation, with 134,490 research spikes and 2,602.65 weekly spiking businesses, indicates a strategic focus on remuneration structures. This keen interest reflects an industry in search of the most effective ways to motivate employees, retain talent, and drive performance. By exploring incentive compensation, construction businesses are looking beyond traditional salary models to more dynamic systems that reward achievement, innovation, and commitment.

Wellness: A Holistic Approach

With 85,687 research spikes, Wellness ranks third, highlighting a holistic concern for the physical and mental health of the workforce. This topic’s prominence underscores an industry-wide recognition of the critical link between employee health and organizational success. Construction companies are increasingly researching programs and initiatives that promote wellness, from mental health support to physical fitness, signaling a shift towards more supportive and nurturing work environments.

Policies and Practices: The Framework for Success

The research interest in Policies and Practices, evidenced by 65,781 research spikes, reflects a broader contemplation of the foundational rules and norms that govern workplace culture. This encompasses a wide array of concerns, from diversity and inclusion policies to ethical standards and operational practices. The construction industry’s focus here indicates a drive towards creating more equitable, transparent, and efficient workplaces that align with modern values and expectations.

Cultural Adaptation: Embracing Change

Lastly, Cultural Adaptation, with 50,652 research spikes, shows an industry in transition, keen on understanding and integrating into the rapidly changing social and cultural milieu. This interest points towards a proactive approach to embracing diversity, understanding global markets, and fostering an environment of inclusivity and respect. For construction businesses, adapting to cultural shifts is not just about surviving but thriving in a globalized world.

Implications and the Way Forward

The data reveals an industry at a pivotal moment, actively engaging with complex issues that go beyond the physicality of construction to the heart of how businesses operate, how they treat their employees, and how they contribute to society. The emphasis on vacations, incentive compensation, wellness, policies and practices, and cultural adaptation speaks to a broader industry trend towards human-centric business models.

This shift is not just about adhering to new regulations or societal expectations but about a genuine commitment to creating better workplaces, improving employee satisfaction, and, ultimately, enhancing productivity and profitability. The construction industry’s research into policy and culture is a testament to its resilience and adaptability—qualities that have always been at its core, now applied to the evolving challenges of the modern workplace.

In conclusion, the construction sector’s focus on policy and culture issues is a clear indicator of its readiness to build not just structures but also communities, relationships, and, importantly, a better future for its workforce. By investing in research and embracing change, the industry is laying the foundations for a more inclusive, supportive, and dynamic work environment, proving that even the oldest industries can learn new tricks.

Company Sample Data

The dataset categorizes companies into five size ranges based on the number of employees: Micro, Small, Medium-Small, Medium, and Medium-Large. For each category, it tracks two main metrics: the weekly average of spiking businesses and their percentage of the total observed behavior. This setup offers a clear picture of which company sizes are most actively researching policy and culture-related topics.

Insights and Trends

– Micro (1 – 9 Employees): With 1,536.33 spiking businesses weekly, micro companies constitute 12.06% of the total. Their active research might be driven by a need to establish solid foundational policies and cultural practices as they grow.

– Small (10 – 49 Employees): This category shows the highest engagement, with 4,183.90 spiking businesses, making up 32.84% of the total. Small businesses are likely at a stage where refining policies and culture can significantly impact employee satisfaction and retention, indicating a strategic investment in their workforce’s well-being and productivity.

– Medium-Small (50 – 199 Employees): With 3,892.54 spiking businesses weekly, medium-small companies account for 30.55% of the total. This high level of engagement suggests that companies of this size are keen on scaling their operations while maintaining a positive and productive work environment, necessitating research into effective policies and cultural adaptations.

– Medium (200 – 499 Employees): These companies have 1,505.85 spiking businesses weekly, contributing to 11.82% of the total. The trend here could be attributed to medium-sized companies seeking to solidify their organizational culture and operational efficiencies as they prepare for larger scale operations.

– Medium-Large (500 – 999 Employees): With 678.67 spiking businesses and 5.33% of the total, medium-large companies are the least active in this dataset. This could be because such organizations have already established their core policies and cultural norms and are focusing more on operational excellence and market expansion rather than internal research.

Why This is a Trend

The distribution of research activity across company sizes reflects various stages of organizational development and priorities. Smaller companies (micro and small) are likely in the formative stages of crafting their identity, policies, and cultural foundations, necessitating a greater proportion of research in these areas. As companies grow (medium-small to medium-large), the focus may shift towards refining existing policies and scaling up operations, with less need for intensive research compared to their earlier stages.

The high engagement of small and medium-small businesses highlights a critical phase where companies recognize the importance of establishing strong, scalable policies and cultural practices to sustain growth and employee satisfaction. Conversely, the tapering off in the medium and medium-large categories suggests a transition towards operational and strategic focus areas beyond internal policy and culture research.

This trend underscores the evolving priorities of businesses as they grow, reflecting the balance between nurturing a positive internal culture and achieving external operational goals.