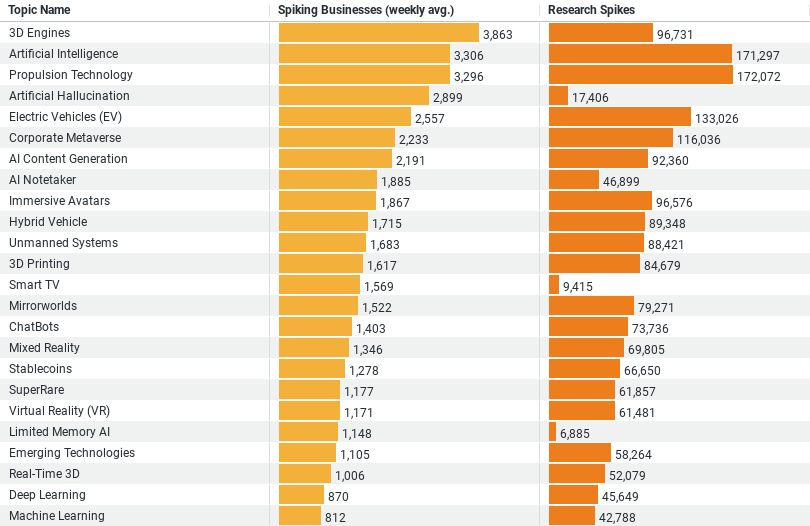

(Data visualized in the chart captures buying and research signals for the past 365 days)

Executive Summary: Emerging Tech Research Trends in the Construction Industry

– The dataset lists the top 5 topics related to Emerging Technologies in the construction industry.

– Artificial Intelligence and Propulsion Technology have the highest research interest, with 171,297 and 172,072 research spikes, respectively, indicating significant exploration into these areas.

– 3D Engines show the highest weekly average of spiking businesses at 3,862.8, highlighting its prominence in current industry interest.

– Electric Vehicles (EV) and Artificial Hallucination are also notable but with lesser engagement compared to the top three technologies, suggesting nascent but growing interest areas.

– The dataset reveals a broad spectrum of technological interests, from design and simulation to automation and sustainability, showcasing the construction industry’s proactive approach towards embracing and researching emerging technologies.

Embracing the Future: The Construction Industry’s Dive into Emerging Technologies

The construction industry, traditionally seen as a bastion of physical labor and brick-and-mortar methodologies, is now at the forefront of technological evolution. A recent analysis of how this sector is researching trends in Emerging Technologies reveals a fascinating pivot towards innovation, sustainability, and efficiency. This blog post delves into the latest data, uncovering the top technologies that are capturing the industry’s attention and shaping the future of construction.

The Digital Blueprint: Top Technologies Reshaping Construction

Our exploration begins with an insightful dataset that lists various topics of interest within Emerging Technologies, alongside metrics such as “Spiking Businesses (weekly avg.)” and “Research Spikes.” The data, a mirror to the industry’s aspirations, highlights several key technologies that are currently under the spotlight:

1. 3D Engines: Leading the charge with the highest weekly average of spiking businesses at 3,862.8, 3D Engines are revolutionizing the way construction projects are visualized, planned, and executed. This technology enables precise simulations, intricate designs, and immersive experiences that enhance decision-making and project outcomes.

2. Artificial Intelligence (AI): With 171,297 research spikes, AI stands as a colossus in the realm of Emerging Technologies within the construction sector. From predictive analytics and machine learning algorithms to robotics and automation, AI is not just an auxiliary tool but a fundamental shift in how projects are managed, executed, and optimized for efficiency and safety.

3. Propulsion Technology: Closely following AI, Propulsion Technology, with 172,072 research spikes, is igniting interest for its potential to innovate transportation and machinery used in construction. The implications are vast, from reducing carbon footprints to enabling more agile and efficient movement of materials and equipment.

4. Artificial Hallucination: Although a nascent area with 17,406 research spikes, this technology is emerging as a game-changer for project visualization and stakeholder engagement. By creating highly realistic simulations, stakeholders can better understand and experience project outcomes before physical construction begins, paving the way for more informed decision-making and creativity in design.

5. Electric Vehicles (EV): With 133,026 research spikes, the interest in EVs underscores the industry’s commitment to sustainability and innovation. Electric vehicles promise to transform the logistics of construction sites, reduce emissions, and potentially lower operational costs, aligning with global efforts to combat climate change.

Insights from the Data: A Technological Renaissance in Construction

The data tells a story of an industry in transformation, eagerly exploring the frontiers of technology to address both perennial and emerging challenges. Here are some key insights drawn from the analysis:

– A Broad Spectrum of Interests: The construction industry is not limiting its focus to traditional areas of technological improvement. Instead, it’s casting a wide net, exploring everything from AI and 3D visualization to sustainable transportation and beyond.

– Investment in Efficiency and Sustainability: The high research spikes in AI, Propulsion Technology, and EVs signal a strong drive towards not just operational efficiency but also environmental sustainability. It’s clear that the industry is seeking ways to reduce its carbon footprint while enhancing productivity and safety.

– Engagement with Cutting-Edge Technologies: The interest in emerging areas like Artificial Hallucination indicates a willingness to engage with cutting-edge technologies that can transform the stakeholder experience and project outcomes.

Conclusion

The construction industry’s engagement with Emerging Technologies is more than a trend; it’s a testament to its resilience, adaptability, and forward-thinking ethos. By harnessing the power of technologies such as 3D Engines, AI, and EVs, the sector is setting the stage for a future where construction projects are safer, more efficient, and sustainable.

As we look towards the horizon, it’s evident that the construction industry’s journey into the digital age is not just about adopting new tools but reimagining the very fabric of how we build our world. With each research spike and business interest, we’re witnessing the blueprint of tomorrow being redrawn, promising a future where technology and construction go hand in hand in building the landscapes of the future.

Company Sample Data

This contains data that appears to detail the engagement of companies of varying sizes with Emerging Technologies, focusing on their research intensity and market interest. Here’s a breakdown of the dataset based on the initial examination:

– Company Size: This column categorizes companies into various size brackets based on the number of employees. The classifications range from Micro (1 – 9 Employees) to Medium-Large (500 – 999 Employees), covering a broad spectrum of company sizes.

– Spiking Businesses (weekly avg.): This metric provides the weekly average number of businesses within each size category that have shown a significant increase in activities or interest related to Emerging Technologies. It offers insights into which company sizes are most actively exploring or investing in these technologies.

– Percent of Total: This column indicates the proportion of companies within each size category that contribute to the total activity or interest in Emerging Technologies. It helps in understanding the relative engagement level of different company sizes.

– Micro to Medium-Small Companies Show High Engagement: The data indicates that smaller companies, specifically in the Micro (1 – 9 Employees) and Small to Medium-Small (10 – 199 Employees) categories, exhibit a high level of engagement with Emerging Technologies, as seen in their weekly average of spiking businesses. This suggests that smaller enterprises are keenly interested in leveraging emerging technologies, possibly to gain competitive advantages or innovate in their offerings.

– Distribution of Interest Across Company Sizes: While Micro and Small companies lead in terms of engagement, there is notable interest across all sizes, including Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees). However, the intensity of engagement decreases as company size increases, possibly due to larger organizations having more established processes and slower adoption rates.

– Small Companies Contribute Significantly to Total Engagement: Small companies (10 – 49 Employees) account for the largest percent of total engagement, underscoring the role of small enterprises in driving innovation and exploration within the realm of Emerging Technologies.

This dataset provides a valuable perspective on how companies of different sizes are approaching Emerging Technologies, highlighting the dynamic nature of technological adoption and interest across the business spectrum. It suggests a vibrant ecosystem where smaller companies are particularly active, potentially shaping future trends and applications of these technologies in their respective industries.