Executive Summary: Customer Service Research Trends in the Construction Industry

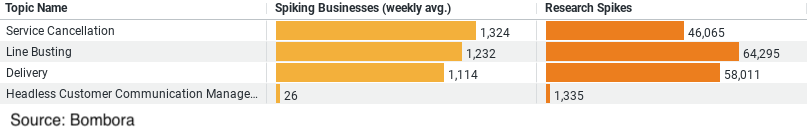

– Service Cancellation: Attracts the highest average weekly interest from businesses (1,324 businesses), with 46,065 research spikes, indicating a priority in managing service expectations and cancellation processes.

– Line Busting: Leads in research spikes (64,295), with 1,232 businesses showing interest on average per week. This trend points to a significant focus on improving service efficiency and customer throughput.

– Delivery: Shows strong interest with 58,011 research spikes and an average weekly interest of 1,114 businesses. This data underscores the importance of reliability and speed in the delivery processes within the industry.

– Headless Customer Communication Management: Although it has the smallest footprint with 1,335 research spikes and about 26 businesses showing interest weekly, it suggests an emerging interest in innovative communication technologies that could streamline customer interactions.

Construction Industry Focus: Customer Service Trends and Insights

In today’s competitive market, the construction industry is rapidly evolving, not only in terms of technological advancements and project management techniques but also in the realm of customer service. A detailed analysis of current industry data reveals a nuanced understanding of how construction companies are focusing on and researching customer service topics. This post dives into the specific areas attracting attention and how businesses are strategically navigating customer service challenges.

Elevating the Customer Experience with Service Cancellation Insights

One of the most critical aspects that construction businesses are scrutinizing is service cancellation. Data indicates a substantial weekly interest from approximately 1,324 businesses, accompanied by 46,065 research spikes. This trend suggests that companies are proactively seeking ways to manage service cancellations more effectively. By understanding the underlying reasons behind cancellations, businesses can implement strategies to reduce their occurrence, such as improving communication, offering flexible solutions, and enhancing overall customer satisfaction. This not only helps in retaining clients but also in building a more resilient service model.

Line Busting: Streamlining Operations to Enhance Client Satisfaction

Line busting stands out with the highest number of research spikes, totaling 64,295, with an average of 1,232 businesses per week delving into this area. The construction industry often faces challenges related to wait times and service delays, especially during peak operational hours. By researching line busting strategies, companies are exploring efficient ways to manage queues and reduce waiting times, thereby improving the client experience. Such strategies are crucial in large projects where timely service delivery can significantly impact overall project timelines and client trust.

The Role of Delivery in Construction Customer Service

With 58,011 research spikes and an average weekly interest from 1,114 businesses, the focus on delivery within the construction industry highlights its critical role in customer service. Timely and reliable delivery of services and materials is a cornerstone of successful construction projects. Businesses are investing in research to optimize logistics, incorporate real-time tracking systems, and ensure that delivery processes are as efficient as possible. This not only boosts operational efficiency but also enhances client satisfaction by minimizing delays and ensuring that project milestones are met as planned.

Innovating Communication with Headless Customer Communication Management

Although it has the least research spikes (1,335) and interests from businesses (average 26 weekly), Headless Customer Communication Management (HCCM) represents a growing area of interest. HCCM refers to managing communication without a traditional front-end interface, using APIs to interact directly with other systems and manage workflows. For the construction industry, this could mean more streamlined, flexible, and scalable communication solutions that can adapt to various project needs without requiring extensive interface adjustments. This emerging interest suggests that the industry is beginning to recognize the potential of advanced communication technologies in enhancing customer interaction and service delivery.

Conclusion

The data-driven insights into how construction companies are researching customer service reveal a strategic emphasis on enhancing the client experience and operational efficiencies. From managing service cancellations to innovating communication methods, the industry is actively seeking solutions that not only meet but exceed client expectations. As these trends continue to develop, the construction industry is set to become more responsive, client-focused, and efficient in its operations. This commitment to excellent customer service will undoubtedly play a crucial role in shaping the future success of construction businesses globally. By investing in and prioritizing customer service research, the industry is not just solving immediate challenges but also paving the way for long-term growth and client loyalty.

Company Sample Data Overview

1. Company Size: This categorizes companies into different groups based on the number of employees. The categories listed are Micro (1 – 9 employees), Small (10 – 49 employees), Medium-Small (50 – 199 employees), Medium (200 – 499 employees), and Medium-Large (500 – 999 employees).

2. Spiking Businesses (weekly avg.): Represents the average number of businesses within each size category that show a notable spike in research or interest in the topic per week.

3. Percent of Total: Indicates the proportion of the total interest that each company size category represents.

Data Summary and Trends

Here’s a breakdown of the data by company size, focusing on how much interest each segment contributes:

– Micro (1 – 9 Employees): Shows an average of 243.6 businesses spiking weekly, contributing 8.65% to the total interest. This suggests that even the smallest companies are actively engaged in researching business topics or services, though their overall impact is relatively modest.

– Small (10 – 49 Employees): With an average of 680.6 businesses spiking weekly, this segment contributes 24.16% to the total. Small businesses are significantly more active compared to micro enterprises, indicating a higher level of engagement or need for specific insights and services.

– Medium-Small (50 – 199 Employees): This is the most active group with 849.1 businesses spiking weekly, making up 30.14% of the total interest. This high level of activity could reflect the transitional challenges and opportunities these businesses face as they scale up.

– Medium (200 – 499 Employees): This segment shows 452.9 spiking businesses weekly, accounting for 16.08% of the total. The medium-sized companies, being more established, possibly have more resources to dedicate to research and development.

– Medium-Large (500 – 999 Employees): Smaller than medium in terms of activity, with 234.3 weekly spikes and 8.32% of the total. This suggests that while these companies are large, their specific needs might be well-established, resulting in less frequent spikes in new research.

Insights and Trends

The data suggests a clear trend: as companies grow from micro to medium-small, there is an increase in the frequency and percentage of research spikes, peaking with medium-small businesses. This may be due to these companies reaching a critical size where the complexities of operations and competitive pressures drive more aggressive research and development efforts.

Conversely, as companies continue to grow beyond 200 employees, there appears to be a decrease in the proportion of total research activity, possibly indicating a stabilization in their operational practices or a shift towards internal development strategies rather than external research.

This trend underlines the dynamic nature of business needs as companies evolve, emphasizing that the intensity of research and exploration is heavily influenced by company size and the specific challenges and opportunities this brings.