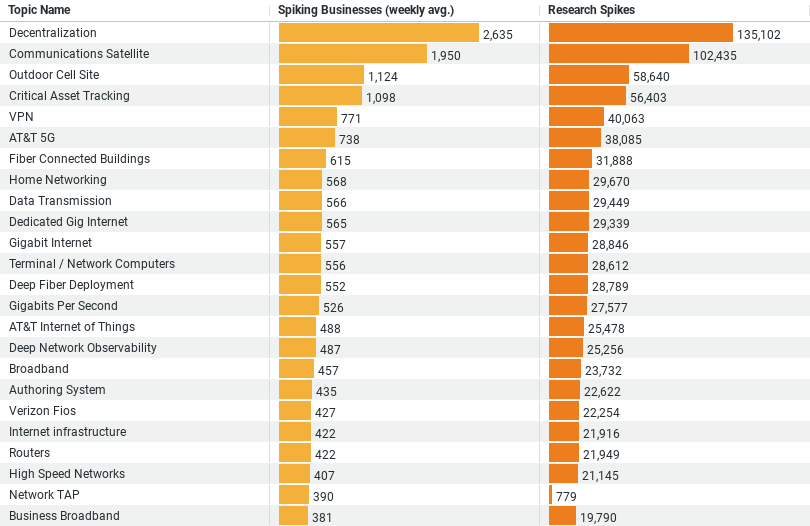

Executive Summary: Networking Research Trends in the Construction Industry

– Decentralization emerges as the leading topic with a weekly average of 2,635 businesses spiking their research, resulting in a total of 135,102 research spikes. This indicates a significant interest in distributed networking systems.

– Communications Satellite follows, with 1,950 businesses engaged weekly and a total of 102,435 research spikes, highlighting its importance for improving communications in remote areas.

– Outdoor Cell Site has attracted interest from 1,124 businesses weekly, totaling 58,640 research spikes, suggesting an emphasis on enhancing network coverage outdoors.

– Critical Asset Tracking is researched by approximately 1,098 businesses weekly, with a total of 56,403 research spikes, reflecting a focus on tracking and managing resources efficiently.

– VPN (Virtual Private Network) shows a weekly engagement of 771 businesses and 40,063 research spikes, pointing to a priority on securing remote network access.

Networking Innovations in Construction: Key Trends and Insights

The construction industry is not often seen on the cutting edge of digital innovation, but recent data reveals a growing focus on networking technologies that are set to revolutionize this sector. From decentralization to virtual private networks, businesses in construction are increasingly leveraging advanced networking solutions to enhance efficiency, security, and connectivity.

Decentralization Leads the Way

At the forefront of this trend is the concept of decentralization, which has seen the highest level of interest among construction companies. With a weekly average of 2,635 businesses diving deep into research and accumulating a staggering 135,102 research spikes, the interest in decentralization is unmatched. This move towards decentralized networks indicates a shift towards more resilient and scalable networking solutions. By distributing data across multiple nodes, companies can achieve a more robust system that minimizes central points of failure, enhancing the overall reliability of construction project management.

Enhancing Remote Communication with Satellite Technology

Communications satellite technology is the second most researched topic, with 1,950 businesses engaging weekly and generating 102,435 research spikes. This keen interest underlines the industry’s effort to improve communication capabilities, particularly in remote or inaccessible construction sites where traditional communication networks fail to reach. Satellite communications offer a reliable alternative, ensuring that teams stay connected, data flows seamlessly, and operations continue without interruption, regardless of location.

Outdoor Cell Site Expansion

The research into outdoor cell sites, with 1,124 businesses actively engaged each week and a total of 58,640 research spikes, suggests a strategic focus on expanding network coverage in outdoor environments. Construction sites often extend beyond the urban grid into less accessible areas where standard cellular coverage is not guaranteed. By investing in outdoor cell site technologies, construction companies can ensure constant connectivity, facilitating real-time data exchange and decision-making.

Critical Asset Tracking

Asset management is crucial in construction, a fact underscored by the 1,098 businesses researching critical asset tracking weekly (56,403 research spikes). This technology enables the tracking and management of crucial resources and equipment, ensuring they are used efficiently and are always available when needed. The ability to track assets not only reduces the risk of theft or loss but also contributes to streamlined operations and reduced downtime.

VPN for Secure Remote Access

The research into Virtual Private Networks (VPN) reveals that 771 businesses per week (totaling 40,063 research spikes) are exploring ways to secure their network connections. As remote work scenarios become more common and data security becomes a critical concern, VPNs are proving essential. They provide secure and reliable access to the network resources necessary for remote teams to collaborate effectively and access critical data securely from any location.

Implications for the Construction Industry

The data illustrates a clear trend: the construction industry is increasingly dependent on sophisticated networking technologies. This shift is driven by the need to overcome the unique challenges posed by construction work, including site remoteness, the need for real-time data exchange, and high security for sensitive information.

For construction companies, staying abreast of these networking trends is not just about technology adoption; it’s about transforming operational capabilities and securing competitive advantages. As the industry embraces these innovations, it can expect not only to see enhancements in operational efficiency but also improvements in project management and execution.

In conclusion, the move towards more advanced networking solutions in the construction industry highlights a broader trend towards digital transformation in traditionally less digitized sectors. As construction firms continue to explore and invest in these technologies, they pave the way for more connected, efficient, and secure construction practices. The future of construction lies in its ability to integrate these networking technologies into everyday operations, driving the industry forward into a new era of digital competence.

Company Sample Data: Networking Intent by Company Size

Data Overview

– Company Size Categories: The data categorizes companies into five groups based on the number of employees: Micro (1-9 employees), Small (10-49 employees), Medium-Small (50-199 employees), Medium (200-499 employees), and Medium-Large (500-999 employees).

– Spiking Businesses (weekly avg.): This metric shows the average number of businesses in each size category that are actively researching networking solutions each week.

– Percent of Total: This represents the proportion of total business engagement in networking research for each company size.

Trends and Insights

1. Small to Medium-Small Businesses Lead in Engagement:

– Companies in the Small (10-49 employees) and Medium-Small (50-199 employees) categories show the highest engagement, with weekly averages of 3,597 and 3,766 businesses respectively. This suggests that businesses within these size ranges are actively seeking to improve or expand their networking capabilities.

– They collectively account for nearly 60% of the total engagement in networking research, highlighting a significant trend towards technology adoption in this segment.

2. Micro Businesses Show Notable Interest:

– Despite their size, Micro businesses (1-9 employees) are also significantly engaged, with a weekly average of 1,323 businesses exploring networking technologies. This accounts for over 10% of the total engagement.

– This indicates that even the smallest companies recognize the importance of robust networking solutions, possibly driven by needs for efficiency and competitive advantage in a digital-first market.

3. Larger Companies Have Lower Relative Engagement:

– Medium (200-499 employees) and Medium-Large (500-999 employees) companies show lower engagement relative to their smaller counterparts, with 1,664 and 793 businesses respectively.

– This may reflect a scenario where larger companies already have established networking infrastructures and therefore exhibit less frequent spikes in research as they are possibly upgrading or maintaining rather than building new infrastructures.

Why This Is a Trend?

The trend towards increased networking technology research among smaller to medium-sized businesses could be attributed to several factors:

– Scalability and Flexibility Needs: Smaller companies, which are often in growth phases, may find that scalable and flexible networking solutions are critical as they expand operations or adapt to market changes.

– Cost Efficiency: Networking technologies can offer cost-efficient solutions that are crucial for smaller businesses operating with tighter budgets.

– Competitive Pressure: In an increasingly connected and digital marketplace, businesses of all sizes must leverage technology to stay competitive. Smaller businesses particularly need to optimize their operations and reach through digital means to compete with larger entities.