Executive Summary: Business Services Research Trends in the Construction Industry

Dominant Topics:

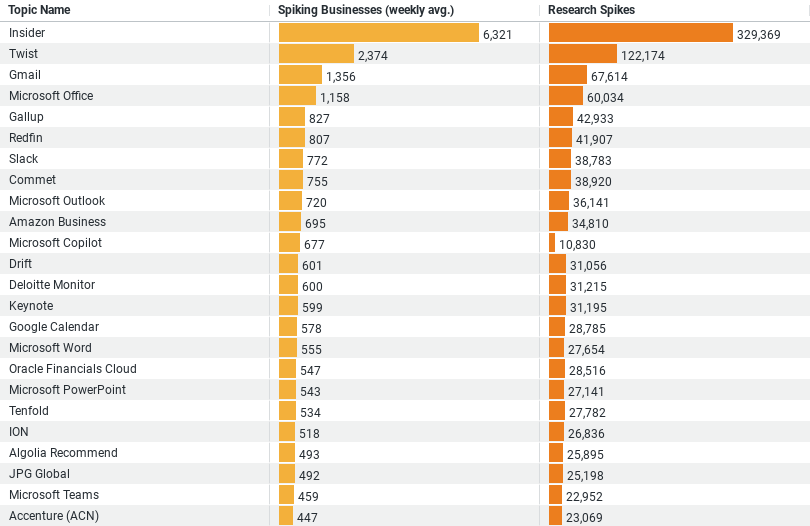

– Insider shows the highest engagement with an average of 6,320 businesses researching it weekly and a total of 329,369 research spikes.

– Twist and Gmail follow with significant weekly engagements and total research spikes, highlighting their importance in business services within the industry.

Technological Emphasis:

– The presence of topics like Gmail and Microsoft Office underscores a strong reliance on communication and productivity tools, essential for operational efficiency.

Research Activity:

– The data suggests a vibrant landscape of research within the construction industry, with businesses actively seeking insights into various Business Services topics to presumably enhance their operations and strategic decisions.

Potential Further Analysis:

– Trend Analysis: If time-series data is available, analyzing the trends over time could provide insights into the changing priorities or emerging interests in the industry.

– Correlation Study: Studying the correlation between the number of spiking businesses and research spikes could help identify which topics are gaining traction or are of high strategic importance.

– Topic Clustering: Clustering topics based on research intensity and business engagement might reveal underlying patterns or categories of service that are particularly relevant to the construction industry.

Exploring Business Services: Key Research Trends in the Construction Industry

In an age dominated by rapid technological advancement and increasing competition, the construction industry’s keen interest in the topic of Business Services is both intriguing and revealing. A recent analysis of data involving 500 research entries provides a panoramic view of how construction businesses are actively engaging with various business service topics. This post delves into the core findings from this data, illuminating the patterns and priorities that are shaping the industry’s approach to business services.

Understanding the Research Landscape

The dataset reveals a dynamic exploration of Business Services, with topics ranging from technology tools to strategic business practices. It records two primary metrics: the average weekly number of businesses spiking in research (indicating a surge in interest) and the total instances of research spikes. These metrics provide a dual perspective on both the intensity and the breadth of research within the industry.

High-Engagement Topics

Among the most researched topics, “Insider” emerges as the clear leader, attracting an average of over 6,320 businesses per week. This massive interest suggests that Insider strategies or insider knowledge about the industry could be pivotal in shaping business decisions and competitive strategies in construction. Following closely are topics like “Twist” and “Gmail,” each reflecting significant weekly engagement and total research activities. While “Twist” might relate to innovative or disruptive business strategies, the inclusion of “Gmail” highlights an emphasis on leveraging established communication tools to enhance operational efficiency.

Technological Integration

The prominence of topics such as “Microsoft Office” points to a widespread reliance on technology for daily operations and communication within the industry. This reliance underscores the integration of digital tools in business processes, reflecting a broader trend towards digital transformation. The construction industry, traditionally seen as more manual and less tech-intensive, appears to be bridging this gap by adopting and researching state-of-the-art business services and tools.

Research Intensity and Industry Needs

The intensity of research activities—illustrated by the total number of research spikes—signals a robust quest for knowledge and best practices among construction businesses. This intensive research behavior underlines the industry’s need to stay ahead of the curve, particularly in areas critical to enhancing efficiency, productivity, and strategic planning. By deeply engaging in business services research, construction companies are not just looking to adapt; they are aiming to lead and redefine standards.

Strategic Implications

The strategic implications of these insights are profound. For businesses in the construction sector, staying informed and adaptable to the rapidly changing landscape of business services can be a key differentiator. The data suggests that companies are not only seeking to optimize their existing processes but are also exploring new ways to gain competitive advantages through innovative business practices and technologies.

Conclusion

As the construction industry continues to evolve, its engagement with diverse business services will likely play a crucial role in shaping its future. The data provides a valuable snapshot of current trends and interests, offering stakeholders critical insights into where the industry is heading. For industry leaders and analysts, understanding these trends is essential to strategize and capitalize on emerging opportunities. In conclusion, the ongoing research in business services within the construction industry highlights a proactive approach towards embracing innovation, enhancing efficiency, and ultimately driving sustained growth.

Company Sample Data: Analysis by Company Size

1. Company Size: Describes the size of the company based on the number of employees. The categories range from micro-sized companies (1-9 employees) to medium-large companies (500-999 employees).

2. Spiking Businesses (weekly avg.): Shows the average weekly number of businesses within each size category that have shown a significant spike in research activities.

3. Percent of Total: Represents the percentage of total research activities attributed to each company size category.

Data Overview:

– Micro Companies (1 – 9 Employees): Despite being the smallest category, these companies are still actively engaged, making up about 13% of the total research activities.

– Small Companies (10 – 49 Employees): This category shows the highest level of engagement, with an average of 6,339 weekly spiking businesses, accounting for approximately 34% of total research.

– Medium-Small Companies (50 – 199 Employees): These companies also show substantial activity, contributing 29.3% to the total, with an average of 5,469 weekly spikes.

– Medium Companies (200 – 499 Employees): Engagement drops significantly in this category, accounting for about 10.9% of the total.

– Medium-Large Companies (500 – 999 Employees): The smallest share of research activities at 4.9%, indicating a lower relative engagement in this category.

Trend Analysis Based on Company Sizes:

The data suggests a prominent trend where smaller to medium-small companies (ranging from 10 to 199 employees) are the most active in researching business services. This could be attributed to several factors:

– Agility and Growth Potential: Smaller companies are often more agile and may be seeking business services to facilitate rapid growth and scalability. They might be exploring opportunities to optimize operations, reduce costs, or enhance productivity through services and technologies that are discussed in these research spikes.

– Resource Constraints: Unlike larger enterprises, smaller companies might not have extensive in-house capabilities, leading them to seek external business services and solutions more frequently.

– Innovation and Competition: Small to medium-sized enterprises (SMEs) need to stay competitive with larger corporations, which could be driving the high volume of research as they look for innovative strategies and tools.

This data underscores the critical role that business services play in enabling companies, especially in the smaller to medium size brackets, to enhance their competitive edge and operational efficiency. It highlights a significant trend where the intensity of research correlates with company size, peaking within the small to medium-small categories, which could reflect their dynamic and evolving business needs.