Executive Summary: Expansion Research Trends in the Construction Industry

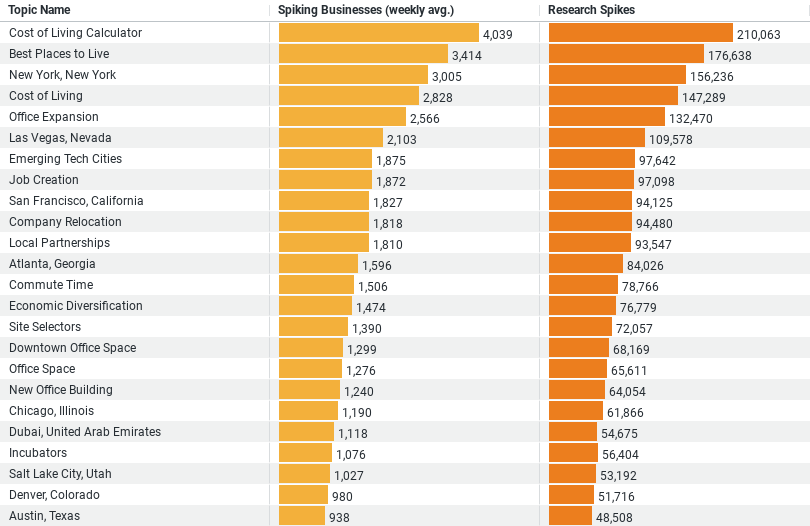

– Dataset Size: The dataset covers 54 unique topics related to construction and expansion.

– Metrics Analyzed: Weekly average business interest and total research spikes.

1. Top Research Focus:

– Cost of Living Calculator leads with the highest average weekly business interest (approx. 4039 businesses) and the highest research spike (210,063 instances).

– Best Places to Live, New York, New York, Cost of Living, and Office Expansion are also key topics with significant interest and activity.

2. Variability and Interest:

– There is considerable variability in interest among the topics, indicating diverse focal areas within the industry.

– Both average business interest and research spikes show high standard deviations, reflecting the fluctuation in the popularity of different topics.

Trending Topics

– Economic and location-based considerations dominate the research trends, with a substantial focus on understanding the economic aspects of living and operating businesses in various locales.

– Office Expansion specifically stands out as a significant construction-related topic, reflecting ongoing interest in commercial real estate development.

Insights into Construction Industry Expansion: A Data-Driven Approach

The construction industry is inherently dynamic, evolving continuously as it responds to various economic, social, and technological changes. With a specific focus on expansion, businesses within this sector are increasingly turning to data to guide their strategic decisions. A recent analysis of the industry’s research patterns offers enlightening insights into where businesses are channeling their focus and resources, particularly regarding expansion strategies.

Analyzing the Trends

Our dataset comprises 54 distinct topics that capture the breadth of interests across the industry, with metrics such as weekly average business interest and total research spikes painting a vivid picture of current priorities. A deeper look into these figures reveals not only the areas of highest interest but also the considerable variability in how different topics captivate industry stakeholders.

The top trending topic, the “Cost of Living Calculator,” averages about 4,039 businesses showing interest weekly, with a staggering 210,063 research activity spikes. This high level of engagement suggests a keen industry focus on understanding how varying cost of living indices affect both project viability and location attractiveness. This tool appears indispensable for businesses looking to expand, as it helps predict future financial commitments in different geographical areas.

Similarly, topics like “Best Places to Live” and “New York, New York” garner significant attention, indicating a strong interest in geographic factors. These topics, which attract thousands of businesses weekly, highlight a strategic emphasis on location as a crucial element in expansion decisions. Companies are not only looking for viable places to expand but are also considering the quality of life and economic conditions of these locations, which directly influence construction demands.

The Economic Focus

The broad interest in the general “Cost of Living” topic, with over 2,828 businesses engaged weekly, underlines the economic underpinnings central to the industry’s expansion strategies. Economic considerations shape every aspect of construction, from material costs to labor markets, and understanding these dynamics is crucial for successful expansion.

Moreover, the “Office Expansion” topic, specifically, sheds light on the industry’s response to changing business landscapes. With an average of 2,566 businesses interested per week and significant research spikes, it’s clear that there’s a robust interest in developing commercial properties. This trend likely mirrors the evolving needs of businesses that are adapting to hybrid work models or expanding their physical footprints due to growth.

Implications for Future Construction Projects

These insights have profound implications for the construction industry. For one, the heavy investment in understanding economic conditions suggests that businesses are taking a more calculated approach to expansion. They are not merely reacting to opportunities but are proactively analyzing potential risks and returns based on thorough economic assessments.

Additionally, the focus on location-based research highlights the importance of regional market dynamics in shaping construction strategies. Companies are likely using these insights to pinpoint emerging markets or regions ripe for development, guided by detailed analyses of demographic and economic data.

Conclusion

The construction industry’s focused research on expansion-related topics reflects a sophisticated use of data to inform strategic decisions. By prioritizing economic and geographic insights, businesses are not only enhancing their competitive edge but are also better positioned to capitalize on emerging opportunities in a highly variable market.

This data-driven approach is likely to continue shaping the industry’s expansion strategies, with a growing reliance on analytical tools to navigate future challenges and opportunities. As the industry evolves, so too will its use of data, with businesses increasingly turning to detailed research to drive successful expansion and sustainable growth in the ever-changing construction landscape.

Company Sample Data

1. Company Size: Companies are segmented into five categories based on the number of employees:

– Micro (1 – 9 Employees)

– Small (10 – 49 Employees)

– Medium-Small (50 – 199 Employees)

– Medium (200 – 499 Employees)

– Medium-Large (500 – 999 Employees)

2. Spiking Businesses (weekly avg.): This column provides the average weekly count of businesses in each size category showing a spike in activity or interest in particular areas.

3. Percent of Total: This shows the proportion of total activity that each company size category represents.

Insights and Trend Analysis

The data indicates a significant variance in activity across different company sizes, which can reflect broader trends in the business landscape:

1. High Engagement Among Smaller Companies:

– Small companies (10 – 49 Employees) and Medium-Small companies (50 – 199 Employees) show the highest levels of activity, with weekly averages of 7,706 and 6,942 businesses spiking respectively. This suggests that smaller to mid-sized companies are highly active in exploring new opportunities or adjusting strategies, possibly due to their need to remain competitive and agile in a dynamic market.

2. Micro Companies Showing Considerable Activity:

– Despite their small size, Micro companies (1 – 9 Employees) show a notable level of engagement (2,820 weekly spikes), accounting for about 12.7% of total activity. This high percentage could be due to the entrepreneurial nature of such companies, which often requires them to be more reactive to market changes and opportunities.

3. Decreased Activity in Larger Companies:

– As companies grow larger, the activity level in terms of spiking interest decreases (Medium companies show 2,407 spikes, and Medium-Large companies 974 spikes). This trend might indicate that larger organizations are possibly more stable in their operations and may have established routines or less need for frequent strategic shifts compared to smaller companies.

4. Proportional Representation:

– The percentages of total activity align with the trends in spikes; smaller companies make up a larger fraction of the total activity compared to their larger counterparts, reinforcing the idea that they are more actively seeking opportunities or facing challenges requiring frequent attention.

These trends suggest that company size significantly influences business behavior, particularly in terms of responsiveness and engagement with new opportunities or challenges. Smaller companies tend to be more dynamic, possibly due to their need to quickly adapt to retain competitive edges, while larger companies might engage less frequently, potentially due to established processes and less pressure to adapt swiftly.

This data can be very useful for understanding market dynamics and could be particularly valuable for service providers or policymakers looking to tailor their offerings or interventions to different segments of the business population.