Executive Summary: Funding & Loans Research Trends in the Construction Industry

– Total Research Topics Analyzed: 5 topics.

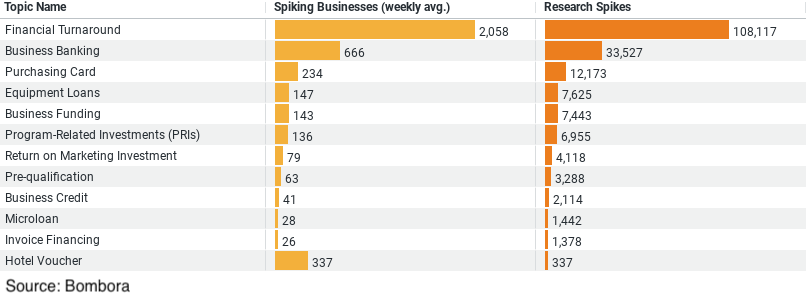

– Highest Weekly Average of Spiking Businesses: Financial Turnaround, with an average of 2057 businesses per week.

– Maximum Research Spikes in a Single Topic: Financial Turnaround, with 108,117 spikes.

– Topic with the Least Weekly Spiking Businesses: Business Funding, with an average of 143 businesses.

– Total Research Spikes Across All Topics: 164,385 spikes.

Construction Industry Insights: Trends in Funding & Loans Research

The construction industry is a dynamic field that requires substantial financial agility and acumen. As businesses navigate through phases of growth, downturns, and recovery, understanding their research behaviors concerning funding and loans is crucial. This post delves into recent data that highlights how companies within the construction sector are actively seeking information related to financial solutions, pointing out the intensity and focus of their interests.

1. Prioritizing Financial Turnaround

One of the most striking findings from the latest data is the heavy focus on financial turnaround strategies. On average, over 2,000 construction businesses per week have been exploring this topic, with a total of 108,117 research spikes noted. This suggests that a significant portion of the industry is possibly looking to recover from recent financial setbacks or aiming to restructure their financial strategies to withstand future economic shocks. The high volume of research indicates that businesses are likely exploring innovative financial restructuring strategies, securing new funding sources, and optimizing operational efficiencies to enhance profitability.

2. Banking Solutions for Businesses

Research into business banking solutions also shows considerable activity, with an average of 665 businesses per week delving into this area, culminating in 33,527 research spikes. This trend underscores the importance of robust banking services tailored to the needs of construction firms. Topics likely explored under this category include better account management, favorable loan terms, and financial services that can support large transactions often required in construction projects.

3. The Role of Purchasing Cards

Purchasing cards appear to be a focal point for around 234 businesses weekly, accumulating 12,173 research spikes. In the construction industry, where purchases range from small tools to large pieces of machinery, having an efficient purchasing card program can streamline procurement processes. These cards can offer simplified vendor payments, potential cashback rewards, and detailed transaction tracking, which aids in financial oversight and budget management.

4. Seeking Equipment Loans

Equipment is the backbone of any construction operation, and securing financing for such capital-intensive purchases is critical. The data shows that each week, about 147 businesses research equipment loans, with a total of 7,625 spikes in interest. This indicates a steady demand for financial products that can assist companies in either purchasing new equipment or leasing machinery, thus maintaining the flow of operations without the burden of upfront costs.

5. Finding Business Funding

Lastly, the topic of business funding garners attention from approximately 143 businesses weekly, with research spikes totaling 7,443. This reflects ongoing concerns about obtaining sufficient capital to fund projects and operations. Construction firms may be exploring various funding avenues, from traditional bank loans and lines of credit to newer options like crowdfunding and venture capital, depending on the scale and nature of their projects.

Conclusion

The data offers a comprehensive look at the current research trends within the construction industry regarding funding and loans. It is evident that businesses are not only seeking ways to secure financial backing but are also looking to optimize their financial operations and ensure sustainability and growth. Understanding these trends can help financial service providers tailor their offerings to meet the specific needs of the construction sector. Additionally, construction companies can leverage this information to benchmark their research and financial strategies against broader industry trends, ensuring they remain competitive and well-prepared to face financial challenges ahead.

In essence, the construction industry’s focused research into funding and loans reveals a proactive approach towards financial management and resilience-building. It’s an industry well aware of the critical role that strategic financial planning plays in its success and longevity.

Company Sample Data Analysis

1. Data Overview:

– Company Size Categories: The dataset categorizes companies based on the number of employees, ranging from micro-sized firms with 1-9 employees to medium-large firms with 500-999 employees.

– Spiking Businesses (weekly avg.): This metric reflects the average number of businesses in each size category that show a significant increase in activity or interest in a specific area per week.

– Percent of Total: Indicates the proportion of total spiking businesses represented by each company size category.

2. Analysis of Trends by Company Size:

Micro (1 – 9 Employees):

– Weekly Average Spikes: 319.17

– Percentage of Total: 10.37%

– Trend Analysis: Micro businesses, despite their small size, are actively engaging in researching or initiating business activities. This level of activity suggests a dynamic segment, potentially exploring niche markets or specialized services.

Small (10 – 49 Employees):

– Weekly Average Spikes: 846.92

– Percentage of Total: 27.53%

– Trend Analysis: Small businesses show a higher level of activity compared to micro businesses, indicating robust interest in expanding their operations or enhancing their capabilities. This could be due to their need to scale operations or diversify their services.

Medium-Small (50 – 199 Employees):

– Weekly Average Spikes: 885.12

– Percentage of Total: 28.77%

– Trend Analysis: This category has the highest percentage of total spiking businesses, which highlights their critical role in the business ecosystem. Firms of this size may be engaging in strategic investments, exploring new markets, or implementing technological advancements.

Medium (200 – 499 Employees):

– Weekly Average Spikes: 408.88

– Percentage of Total: 13.29%

– Trend Analysis: Medium-sized companies have a significant but lesser activity level compared to smaller firms, possibly due to more established operations and slower movement towards new trends or technologies.

Medium-Large (500 – 999 Employees):

– Weekly Average Spikes:215.48

– Percentage of Total: 7.00%

– Trend Analysis: As companies grow larger, the percentage of total spiking businesses tends to decrease. This could be due to these companies having more established practices and being less agile in adopting new trends compared to smaller entities.

3. Implications of Trends:

The data indicates that smaller companies (especially those in the medium-small category) are the most active in terms of spiking business activities. This might suggest a higher degree of flexibility, responsiveness to market changes, or urgent needs to adapt to competitive pressures. In contrast, larger companies show less relative activity, possibly due to their size and established nature which may inhibit rapid shifts in focus or strategy.