Executive Summary: Data Management Research Trends in the Construction Industry

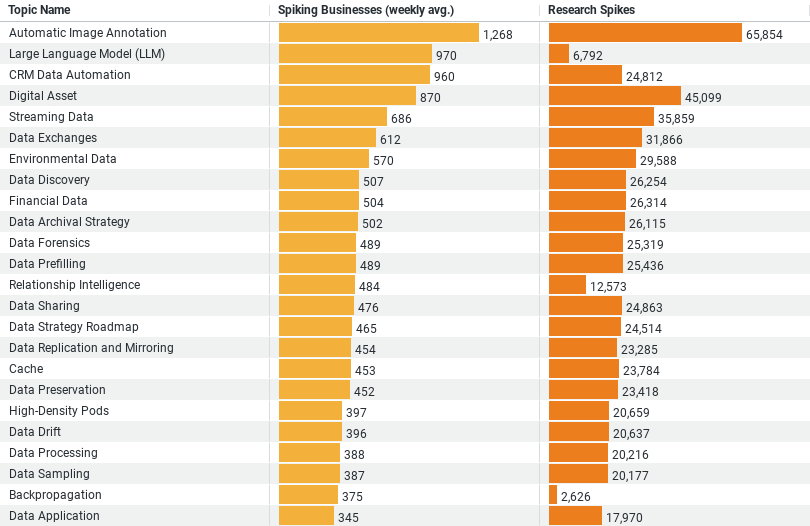

1. Automatic Image Annotation is the most researched topic, with a weekly average of approximately 1,268 spiking businesses and the highest number of research spikes, totaling 65,854. This suggests a significant interest in leveraging automated processes to tag digital images, likely for better data organization and accessibility in construction projects.

2. Large Language Model (LLM) follows with 970 businesses showing interest on a weekly average and 6,792 research spikes. This indicates a growing exploration of AI-driven text analysis and generation technologies for various applications, such as document analysis, automated reporting, or customer service enhancements.

3. CRM Data Automation is also a key area of focus, with around 960 businesses researching it weekly and 24,812 spikes in research. This highlights the industry’s move towards automating customer relationship management data processes for efficiency and improved customer engagement.

4. Digital Asset management is another significant area, with 870 businesses engaging in research weekly and 45,099 research spikes. This trend underscores the importance of managing digital files and content effectively, especially for large-scale projects that generate vast amounts of data.

5. Streaming Data has attracted attention from approximately 686 businesses weekly, with 35,859 research spikes. The interest in streaming data implies a need for real-time data processing capabilities, possibly for monitoring construction sites, real-time decision-making, or integrating IoT devices.

These insights reflect a strong industry focus on leveraging technology for data management, aiming to enhance operational efficiencies, improve decision-making processes, and foster innovation in construction projects.

Automatic Image Annotation Leads the Charge

At the forefront of this digital transformation is the interest in automatic image annotation. With a staggering weekly average of 1,268 businesses diving into this topic and a total of 65,854 research spikes, it’s clear that the construction industry sees immense value in leveraging AI to tag digital images automatically. This technology has the potential to revolutionize how project documentation, site surveys, and compliance records are managed. By automating the tagging process, businesses can significantly reduce the time and effort required to organize and retrieve digital assets, enhancing productivity and reducing the margin for error.

Large Language Models (LLM) Gain Ground

Following closely is the exploration of Large Language Models (LLMs), with 970 businesses researching this topic weekly and accumulating 6,792 spikes in interest. LLMs, powered by advanced artificial intelligence, offer the construction industry innovative ways to process and generate text. This can range from analyzing project reports and generating automated responses to inquiries, to creating more accurate and up-to-date documentation. The potential for LLMs to streamline communication and documentation processes in construction is immense, signaling a move towards more integrated and intelligent project management systems.

CRM Data Automation: A Key Focus

Customer relationship management (CRM) data automation also stands out as a key area of research, with around 960 businesses delving into it on a weekly basis and witnessing 24,812 spikes in research activity. In an industry where relationships with clients, suppliers, and partners are paramount, CRM data automation can provide a competitive edge. Automating data entry and analysis processes not only improves accuracy and efficiency but also enables construction firms to offer personalized services, anticipate client needs, and strengthen relationships.

Digital Asset Management: Essential for Efficiency

The importance of managing digital files and content effectively is underscored by the interest in digital asset management, with 870 businesses engaging in research weekly and 45,099 research spikes noted. As construction projects generate vast amounts of data, from architectural designs to compliance documentation, efficient management of these digital assets is essential. Effective digital asset management solutions ensure that the right information is accessible at the right time, facilitating smoother project execution and collaboration.

Streaming Data: The New Frontier

Lastly, the construction industry’s interest in streaming data, with approximately 686 businesses researching it weekly and 35,859 research spikes, highlights the sector’s move towards real-time data processing. This interest likely stems from the potential of streaming data to enhance site monitoring, support real-time decision-making, and integrate Internet of Things (IoT) devices for smarter project management. The ability to process and analyze data as it’s generated can significantly improve operational efficiency, safety, and project outcomes.

Conclusion

As these trends indicate, the construction industry is rapidly transforming through the integration of digital technologies in data management. By embracing automatic image annotation, LLMs, CRM data automation, digital asset management, and streaming data, the sector is not only enhancing efficiency and productivity but also paving the way for innovative project management approaches. As research and interest in these areas continue to grow, the construction industry is set to become more agile, transparent, and technologically advanced, ultimately leading to improved project delivery and client satisfaction.

Company Sample Data on Data Management Research Trends in the Construction Industry

Here’s a detailed breakdown of what the data reveals and why it’s indicative of broader trends across different company sizes:

1. Micro (1 – 9 Employees): With an average of 820 spiking businesses weekly, micro-sized companies represent a significant portion of the interest, accounting for approximately 9.73% of the total. This high level of engagement from the smallest of businesses suggests a robust entrepreneurial spirit and a keen interest in leveraging new trends or technologies to compete effectively in their markets.

2. Small (10 – 49 Employees): Small businesses show even greater activity, with 2,196 spiking businesses on average each week, making up 26.04% of the total. Additionally, this demonstrates that small enterprises are not only interested in keeping pace with emerging trends but are possibly seeking ways to scale their operations or enhance their competitive edge.

3. Medium-Small (50 – 199 Employees): This category leads in terms of activity, with 2,405 businesses engaging weekly, accounting for 28.52% of the total. The data underscores medium-small companies’ capacity and readiness to invest in new technologies or methodologies, likely driven by the need to optimize operations and foster growth in a competitive landscape.

4. Medium (200 – 499 Employees): Medium-sized companies, with 1,224 spiking businesses weekly, contribute to 14.51% of the total interest. This level of engagement reflects a strategic approach to innovation, where such businesses may have more resources to dedicate to researching and implementing new trends, aiming for efficiency and market leadership.

5. Medium-Large (500 – 999 Employees): With 643 spiking businesses weekly, making up 7.63% of the total, medium-large companies show a targeted interest in new trends. This suggests that while these organizations are sufficiently large to be considered established, they remain keen on exploring new technologies or practices to refine their operations and enhance their market position.

Why This Trend Matters

The data reveals a clear trend: businesses across all sizes are actively engaging with new trends or technologies, albeit with varying degrees of intensity. In addition, this widespread interest across the spectrum suggests a broader movement within the business world towards innovation and digital transformation. Companies, regardless of their size, recognize the importance of staying abreast of developments that can drive efficiency, growth, and competitive advantage.

For micro and small businesses, the engagement likely reflects a necessity to adopt cost-effective solutions that can level the playing field against larger competitors. Moreover, medium-sized enterprises, on the other hand, demonstrate a capacity and willingness to invest more substantially in new trends, leveraging their size and resources for strategic growth.

In essence, the data not only showcases the proactive stance businesses are taking towards innovation but also highlights the dynamic nature of the contemporary business landscape. Companies are increasingly leaning into the digital era, seeking tools, technologies, and practices that can propel them forward, regardless of their operational scale. This underscores a broader trend towards agility, innovation, and strategic growth across the business ecosystem.