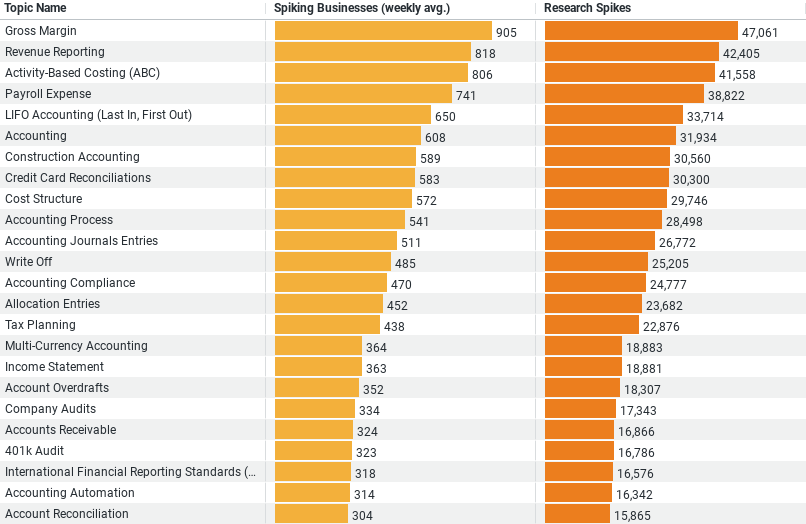

(Data visualized in the chart captures buying and research signals for the past 365 days)

The dataset provides a focused look at the construction industry’s research interests in Accounting:

Here’s a data-focused summary highlighting the key trends in the construction industry’s research into accounting topics:

– Gross Margin emerges as the most researched topic, with an impressive weekly average of 905 businesses exploring it, culminating in a total of 47,061 research spikes. This indicates a strong industry focus on understanding and optimizing profit margins.

– Revenue Reporting attracts significant attention, with 818 businesses per week delving into it, resulting in 42,405 research spikes. This highlights the importance placed on accurate income reporting and financial transparency.

– Activity-Based Costing (ABC) is closely followed, with 805 businesses weekly engaged in research, leading to 41,558 spikes. The interest in ABC points towards a need for precise cost allocation to enhance project profitability analysis.

– Payroll Expense is a key concern, with 741 businesses weekly investigating this area, which translates to 38,822 research spikes. This underscores the critical nature of labor cost management in the industry.

– LIFO Accounting (Last In, First Out) is researched by an average of 650 businesses weekly, with a total of 33,714 research spikes. The focus on LIFO suggests an interest in strategic inventory cost management amid fluctuating material prices.

The Keystone of Profitability: Gross Margin

Topping the chart with 905 businesses researching weekly and a staggering 47,061 research spikes, Gross Margin isn’t just a topic of interest—it’s the epicenter of financial scrutiny in the construction sector. This figure underscores a universal truth: understanding and optimizing gross margin is pivotal. In the construction landscape, where project costs can fluctuate and timelines extend, maintaining a healthy gross margin is akin to navigating through a storm with a reliable compass. Firms are digging into the nuances of cost of goods sold (COGS) versus revenue to ensure that their pricing strategies not only cover costs but also secure profitability.

The Framework of Transparency: Revenue Reporting

With 818 businesses engaging in weekly research and 42,405 spikes, Revenue Reporting emerges as a critical pillar of financial management. The emphasis on revenue reporting reflects a growing demand for accuracy and transparency in financial statements. This trend is likely driven by the need to comply with evolving accounting standards and the recognition that accurate revenue recognition practices are fundamental to earning stakeholder trust and securing investments. Construction firms are seeking to refine their reporting mechanisms to ensure that every dollar earned from their multifaceted projects is accounted for and reported correctly.

The Scaffolding of Cost Efficiency: Activity-Based Costing (ABC)

Activity-Based Costing (ABC) garners attention with 805 businesses researching weekly, resulting in 41,558 research spikes. ABC’s popularity signals a shift towards more granular financial management practices. By attributing costs to specific activities or projects, construction firms aim to uncover the true cost of their operations. This insight is invaluable in an industry characterized by complex projects with varying scopes, timelines, and resource requirements. Understanding the real cost of activities enables firms to price their services more accurately, improve budgeting, and enhance profitability on a project-by-project basis.

The Foundation of Workforce Management: Payroll Expense

The research into Payroll Expense, with 741 businesses exploring weekly and 38,822 spikes, highlights the industry’s focus on one of its most significant expenses: labor. Efficient payroll management is crucial in construction, where the workforce is often large, diverse, and spread across multiple sites. Firms are looking for strategies to optimize labor costs, improve workforce productivity, and ensure compliance with labor laws and regulations. This interest points towards an industry striving to balance the scales of labor-intensive operations and financial health.

The Inventory Strategy: LIFO Accounting

Lastly, LIFO Accounting (Last In, First Out) attracts an average of 650 businesses weekly, with a total of 33,714 research spikes. This interest suggests a strategic approach to managing inventory costs amidst fluctuating material prices. By focusing on LIFO, firms are exploring ways to mitigate the impact of price volatility on their cost of goods sold, thereby protecting their margins. This accounting method’s scrutiny is particularly relevant in times of economic uncertainty, where cost management becomes even more critical to financial sustainability.

Conclusion

The construction industry’s focused research into these accounting topics reveals a sector committed to financial excellence. By prioritizing gross margin optimization, revenue reporting accuracy, cost efficiency through ABC, effective payroll management, and strategic inventory accounting, construction firms are not just building structures; they’re constructing a robust financial foundation for sustainable growth. This data-driven approach to financial management underscores the industry’s resilience and adaptability, positioning it to navigate the complexities of the modern economic landscape with confidence and precision.

Population Sample For The Above Article

1. Company Size: This column categorizes companies into different size brackets based on the number of employees. The size categories listed are:

– Micro (1 – 9 Employees)

– Small (10 – 49 Employees)

– Medium-Small (50 – 199 Employees)

– Medium (200 – 499 Employees)

– Medium-Large (500 – 999 Employees)

2. Spiking Businesses (weekly avg.): This column shows the average weekly number of businesses within each size category that are researching the specified topics. The data indicates the level of active interest or intent to explore these topics within each company size segment.

3. Percent of Total: This column represents the percentage share of each company size category in the total research activity. It provides insight into which company size segments are most actively engaged in researching the topics.

From the data, it’s evident that there’s a diverse range of interests across different company sizes. Medium-Small companies (50 – 199 Employees) lead in research intensity with 2,473.79 businesses on average researching weekly, constituting 30.25% of the total activity. Small companies (10 – 49 Employees) follow with 2,128.23 businesses, making up 26.03% of the total. This distribution suggests a higher engagement in the specified topics among companies that are not too small yet not among the largest, indicating a potential focus on growth and operational optimization.