Executive Summary: Urban Planning Research Trends in the Construction Industry

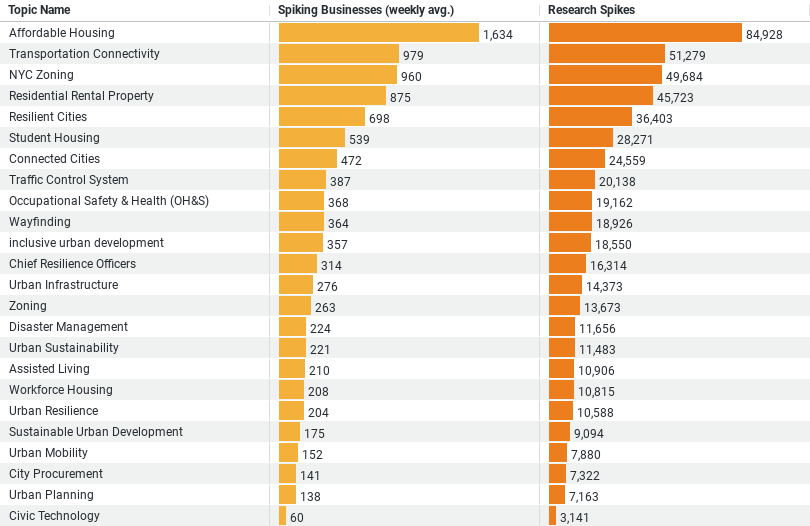

1. Affordable Housing is the top trending topic, with an average weekly spike of approximately 1,634 businesses engaging in research. It also has the highest number of research spikes, totaling 84,928. This indicates a significant interest in developing or learning about affordable housing solutions within urban planning, reflecting the industry’s response to the pressing need for affordable living spaces in urban areas.

2. Transportation Connectivity ranks second, showing an average weekly engagement of around 979 businesses and a total of 51,279 research spikes. This suggests a strong emphasis on integrating transportation solutions that enhance connectivity within cities, highlighting the importance of accessible and efficient transportation networks in urban planning.

3. NYC Zoning is the third most researched topic, with an average weekly engagement of 960 businesses and a total of 49,684 research spikes. It shows the specific interest of New York City in how zoning laws and regulations impact urban development in one of the world’s most iconic cities, potentially discovering ways it can maximize the space for the current population.

4. Residential Rental Property is another key area of interest, with an average weekly engagement of 875 businesses and 45,723 research spikes. This points to a focus on the rental market within urban centers, possibly exploring ways to improve the viability and sustainability of residential rental properties in response to urban population dynamics.

5. Resilient Cities rounds out the top five topics, with an average weekly engagement of around 698 businesses and 36,403 research spikes. This reflects an increasing awareness and concern for creating cities that are resilient to environmental, social, and economic challenges, underscoring the importance of sustainability and adaptability in urban planning.

These trends underscore the construction industry’s active exploration of critical aspects of urban planning, including housing affordability, transportation, regulatory environments, residential properties, and city resilience. The data indicates a broad and deep interest in addressing the complex challenges of urban development, with an eye toward sustainable, inclusive, and efficient solutions.

Affordable Housing: A Leading Concern

At the forefront of the construction industry’s research interests is the topic of affordable housing. With an average weekly spike of approximately 1,634 businesses engaging in research, and a total of 84,928 research spikes, affordable housing emerges as a pressing concern. This surge in interest underscores the industry’s recognition of the critical need for affordable living spaces in urban areas. As cities continue to grow and the demand for accessible housing increases, the construction sector is keenly focused on developing solutions that address this gap, ensuring that affordability doesn’t compromise quality.

The Pulse on Transportation Connectivity

Transportation connectivity claims the second spot, with around 979 businesses delving into this area on a weekly basis, accumulating a total of 51,279 research spikes. The emphasis on transportation reflects a broader understanding of its pivotal role in urban planning. Efficient and accessible transportation networks are fundamental to the functionality and livability of urban spaces, facilitating seamless movement and contributing to the economic vitality of cities. The construction industry’s interest in this area highlights a commitment to enhancing urban connectivity, recognizing it as a vital component of sustainable urban development.

Zoning Laws and Urban Development: The NYC Case Study

Zoning laws, particularly within New York City (NYC), occupy the third spot in the construction industry’s research priorities. With an average weekly engagement of 960 businesses and a total of 49,684 research spikes, the focus on NYC zoning offers valuable insights into how regulatory environments influence urban development. NYC’s complex zoning laws serve as a critical study for understanding the balance between regulation and development, offering lessons that can be applied to other urban contexts. This interest points to the industry’s efforts to navigate zoning regulations effectively, ensuring that development projects align with legal frameworks while fostering urban growth.

Rental Properties and Urban Housing Markets

The research into residential rental properties, with an average weekly engagement of 875 businesses and 45,723 research spikes, highlights the construction industry’s focus on the urban rental market. This interest likely stems from recognizing the rental sector’s role in urban housing markets, exploring ways to improve the sustainability and viability of rental properties. As urban populations evolve, the industry seeks to adapt, ensuring that rental properties meet the changing needs and preferences of city dwellers.

Building Resilient Cities In The Years To Come

Rounding out the top five topics is the concept of resilient cities, with around 698 businesses researching this area weekly, leading to a total of 36,403 research spikes. This interest in resilience underscores the industry’s awareness of the challenges posed by environmental, social, and economic factors. Developing cities that can withstand these challenges is crucial for sustainable urban planning. The construction industry is keen on incorporating resilience into development projects, aiming for cities that are not only livable but also adaptable to future changes.

Conclusion

The construction industry’s research into urban planning reveals a comprehensive and nuanced understanding of the multifaceted challenges facing urban development. From affordable housing and transportation connectivity to the intricacies of zoning laws, rental markets, and resilience, the sector is actively exploring diverse aspects of urban planning. These insights highlight the industry’s commitment to shaping cities that are sustainable, inclusive, and prepared for the future. As urban landscapes continue to evolve, the construction industry’s research efforts will undoubtedly play a pivotal role in guiding their development, ensuring that cities remain vibrant, dynamic spaces for generations to come.

Company Sample Data

Micro (1 – 9 Employees)

Starting with micro-sized companies, we see an average of approximately 539 businesses engaging on a weekly basis, representing about 9.1% of the total. This suggests that even the smallest firms are actively seeking information and potentially looking to innovate or adapt in the context of urban planning. Their involvement indicates a keen interest in staying competitive and relevant, despite limited resources.

Small (10 – 49 Employees)

Small-sized companies show a significant increase in engagement, with around 1,514 businesses spiking weekly, accounting for 25.5% of the total. This segment’s substantial participation highlights the critical role of urban planning in small business operations, perhaps due to their closer interaction with local markets and communities. This size category appears to be highly proactive in seeking out opportunities for growth and adaptation in changing urban landscapes.

Medium-Small (50 – 199 Employees)

The medium-small category represents the highest engagement, with approximately 1,726 businesses participating weekly, making up 29.1% of the total. This peak suggests that companies within this size range might have more resources to allocate towards research and development, thus showing a heightened interest in urban planning topics. It could reflect an understanding of the strategic importance of urban planning in scaling their operations and enhancing their market position.

Medium (200 – 499 Employees)

For medium-sized companies, there is a notable decrease in engagement, with around 874 businesses spiking weekly, representing 14.8% of the total. This decline might indicate a shift in focus towards internal optimization and scaling strategies, possibly relying on established practices rather than external research in urban planning. However, their involvement still points to a significant interest in urban planning, likely influenced by the need to manage more complex operations and logistics.

Medium-Large (500 – 999 Employees)

Finally, medium-large companies show the least engagement, with about 451 businesses participating weekly, accounting for 7.6% of the total. This trend might suggest that as companies grow, their focus on urban planning becomes more specialized and possibly integrated into specific departments rather than a widespread interest across the business. Alternatively, these companies might have established partnerships or in-house capabilities that reduce the need for external research spikes.

Trend Analysis

The data indicates a bell curve of engagement in urban planning topics, peaking with medium-small businesses and tapering off as companies grow larger. This trend could be attributed to the varying needs, resources, and strategic focuses at different stages of company growth. Smaller companies might be leveraging urban planning insights for agility and innovation, while medium-sized companies could be focusing on expansion and optimization that necessitates a deep dive into such topics. As companies become larger, their strategies might shift towards leveraging internal expertise or specific research channels, leading to lower visibility of engagement in broad-based research spikes.

In conclusion, engagement in urban planning and related topics across different company sizes highlights the pervasive importance of urban planning across the business spectrum. It reflects a collective recognition of the need to adapt and thrive in ever-changing urban environments, with each company size showing distinct patterns of engagement that mirror their operational priorities and strategic objectives.