Executive Summary: Website Publishing Research Trends in the Construction Industry

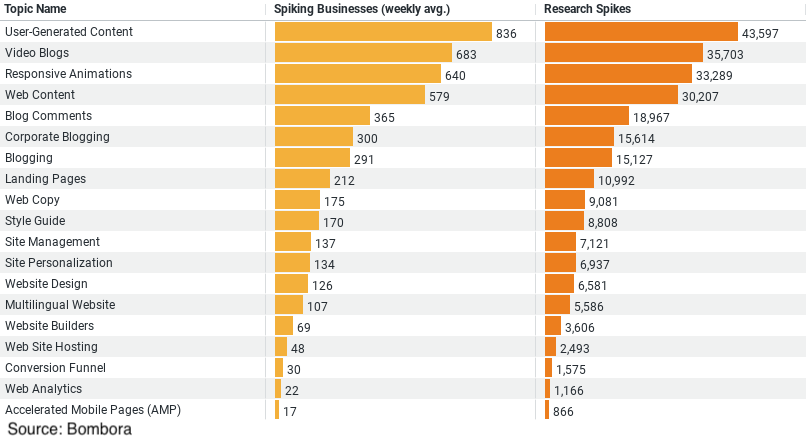

– User-Generated Content is the leading topic, attracting an average of 836 businesses weekly with a total of 43,597 research interactions.

– Video Blogs follow closely, with 683 businesses engaged weekly, accumulating 35,703 interactions.

– Responsive Animations are also popular, with 640 businesses exploring this area weekly and 33,289 interactions recorded.

– Web Content sees around 579 businesses researching it weekly, with a total of 30,207 interactions.

– Blog Comments, while less researched, still draw attention from 365 businesses weekly and have 18,967 interactions.

Website Publishing Trends in Construction: Engaging with Digital Content

In today’s digital age, the construction industry is increasingly leveraging online platforms to enhance visibility, engage with stakeholders, and drive business outcomes. An analysis of recent data reveals significant trends in how construction businesses are researching and utilizing website publishing to achieve these goals. This blog post delves into these trends, offering a clear picture of the industry’s shift towards more dynamic and interactive web content.

The Rise of User-Generated Content

Leading the charge in website publishing within the construction sector is the focus on User-Generated Content (UGC). Data shows that an impressive average of 836 construction businesses per week are exploring UGC. This trend is underpinned by a whopping 43,597 research interactions, indicating a robust interest in harnessing content created by users such as reviews, comments, and customer-generated photos and videos. UGC not only enhances authenticity but also boosts engagement and trust among potential clients and partners, providing real-life testimonials and proof of a company’s capabilities and reliability.

Video Blogs: A Visual Approach to Storytelling

Video blogs are another significant area of interest, with around 683 businesses delving into this format weekly. The appeal of video blogs is evident from the 35,703 interactions recorded, highlighting the construction industry’s recognition of the power of video to capture complex projects and achievements in an engaging way. Through video blogs, companies can offer virtual tours of sites, detailed explanations of services, and more personal introductions to key team members, thereby forging a stronger connection with their audience.

Interactive Elements: Responsive Animations

Responsive animations have garnered attention from approximately 640 businesses each week, with a total of 33,289 interactions. These animations make websites not just visually appealing but also interactive and user-friendly. In an industry like construction, where visual representation of projects can significantly impact client decisions, responsive animations provide an effective tool for illustrating processes, outcomes, and plans in a digestible and engaging format.

The Essential Role of Web Content

General web content remains a critical focus, drawing research from about 579 businesses weekly. This results in 30,207 interactions that reflect the ongoing need for high-quality, informative content that addresses customer concerns, showcases expertise, and provides valuable insights into the construction processes. Effective web content can help construction companies set themselves apart from competitors and serve as a key resource for clients looking for solutions.

Engagement Through Blog Comments

Lastly, blog comments might seem a smaller niche compared to other topics, but with 365 businesses exploring this avenue weekly and 18,967 interactions, it’s clear that fostering community through engagement is still valued. Comments sections in blogs provide a platform for interaction, allowing businesses to gather feedback, answer queries, and directly engage with their audience, thus building a community around their brand.

Conclusion

The construction industry’s increasing investment in website publishing underscores a broader digital transformation within the sector. As companies strive to stand out in a competitive market, engaging online content strategies like UGC, video blogs, and interactive animations are becoming fundamental tools. These strategies not only enhance the user experience but also play a crucial role in building trust and credibility.

Businesses in the construction industry are evidently prioritizing digital engagement and are keen on adopting innovative web solutions to attract, inform, and connect with their clients. The data clearly shows a move towards more dynamic and community-focused online presences, signaling a promising direction for industry growth and customer relations in the digital era.

Company Sample Data

Overview of the Data

1. Micro (1 – 9 Employees):

– Weekly Average Spiking Businesses: 264.3

– Percent of Total: 8.37%

2. Small (10 – 49 Employees):

– Weekly Average Spiking Businesses: 694.0

– Percent of Total: 21.98%

3. Medium-Small (50 – 199 Employees):

– Weekly Average Spiking Businesses: 820.0

– Percent of Total**: 25.97%

4. Medium (200 – 499 Employees):

– Weekly Average Spiking Businesses: 496.1

– Percent of Total: 15.71%

5. Medium-Large (500 – 999 Employees):

– Weekly Average Spiking Businesses: 309.1

– Percent of Total: 9.79%

Analysis and Trends

The data shows a clear trend where the intensity of research activity correlates with the size of the company, up to a certain point. Medium-small businesses (50-199 employees) lead in research activity, demonstrating the highest engagement with a weekly average of 820 businesses spiking. This could suggest that companies of this size have sufficient resources to invest in research and development but are still agile enough to rapidly implement new ideas and technologies.

Small companies (10-49 employees) also show significant activity, likely because they are at a stage where strategic investments in emerging trends can catalyze growth and competitive advantage. Micro companies, despite their smaller size, still maintain a notable level of activity, indicating an entrepreneurial drive to explore and possibly a need to leverage research for survival and growth.

Medium and medium-large companies show a decrease in the percentage of total interactions compared to smaller sizes. This might reflect the challenges larger organizations face in maintaining the same level of nimbleness in exploring new trends or the fact that their established processes and priorities may not require frequent shifts in strategic direction based on emerging research trends.

Why This Is a Trend

The trend highlighted in the data reflects the dynamic nature of business scaling. Smaller and mid-sized companies, which typically seek to expand their market reach or optimize their operations, are more active in researching new trends to find scalable solutions or innovative technologies. Larger companies may be more focused on leveraging existing strategies that have proven successful, or they may engage in research in more targeted, specific areas not captured in this dataset.

This segmentation of research activity by company size helps us understand how businesses prioritize their resources and focus areas, which can be critical for service providers, B2B businesses, and policymakers who aim to cater to these different segments effectively.