Executive Summary: Place of Work Research Trends in the Construction Industry

Data Overview

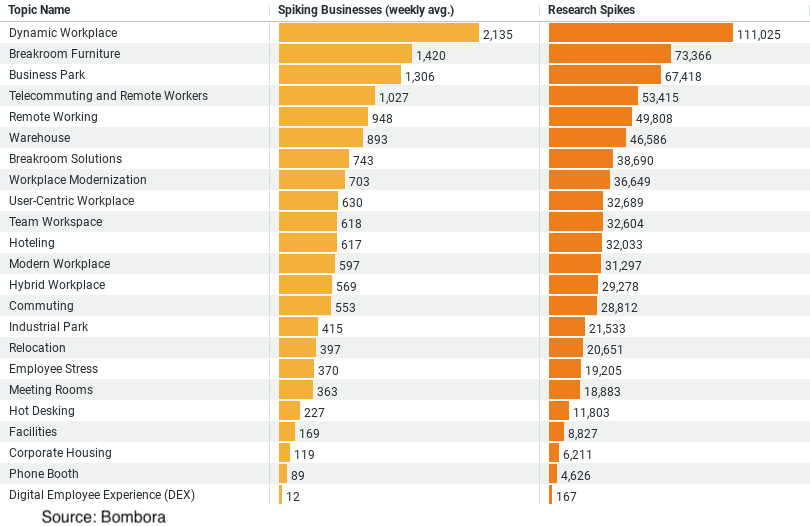

– The dataset contains information on various “Place of Work” topics researched within the construction industry, specifically tracking interest spikes and engagement from businesses.

Key Findings

1. Dynamic Workplace: Leads in both research spikes and weekly average spiking businesses, indicating high interest in adaptable work environments.

2. Breakroom Furniture: Shows significant research activity, reflecting a focus on improving physical spaces for employee comfort and productivity.

3. Business Park and Remote Work Trends: Also significant, aligning with industry movements toward decentralized office environments and telecommuting options.

Trends and Implications

– There is a clear trend towards investing in environments that support flexibility, comfort, and remote work capabilities.

– These preferences may influence future construction projects, emphasizing designs that accommodate changing work styles and technological integrations.

Construction Industry Focus: Insights into the ‘Place of Work’

The construction industry stands at the forefront of redefining modern workspaces, driven by evolving workplace needs and employee preferences. Recent data highlights an increasing focus on creating dynamic, comfortable, and efficient workplaces. This blog delves into how businesses in the construction sector are prioritizing and researching various aspects of the ‘Place of Work,’ reflecting broader trends and shifts in workplace design.

The Rise of Dynamic Workplaces

At the top of the research spikes is the concept of the ‘Dynamic Workplace.’ This topic leads both in terms of research intensity and the weekly average of businesses showing keen interest. A dynamic workplace refers to an adaptive setting that can quickly change based on the needs of the employees and the tasks at hand. The construction industry’s keen interest in dynamic workplaces is indicative of a shift from traditional static offices to more fluid and versatile environments. This could involve modular spaces, movable partitions, and multipurpose areas that can serve various functions throughout a workday.

Investing in Employee Comfort through Breakroom Furniture

Second in line in terms of research intensity is ‘Breakroom Furniture,’ which highlights a significant investment in the spaces where employees relax and rejuvenate. The data suggests a surge in researching the best practices and products for furnishing break rooms—a critical element in enhancing employee satisfaction and productivity. By focusing on comfortable, aesthetically pleasing, and functional furniture, construction businesses are looking to create more inviting spaces that encourage relaxation and social interaction among employees.

The Importance of Business Parks and Remote Work Facilities

The research interest in ‘Business Parks’ and trends towards ‘Telecommuting and Remote Workers’ showcases the industry’s response to changing work patterns, especially in the wake of global shifts towards remote work. Business parks are being viewed as hubs that can offer both connectivity and the benefits of a decentralized work environment. Simultaneously, the construction industry is also focusing on building or remodeling spaces to accommodate remote workers, including better home office spaces and community working hubs that support hybrid work models.

Insights from Spiking Businesses

The weekly averages of businesses that show spikes in interest in these topics provide additional layers of insight. The highest spikes in businesses researching these areas underscore a proactive approach towards adopting these trends. For instance, the continuous high interest in dynamic workplaces suggests that companies are not only interested in adapting to new trends but are actively seeking ways to implement these changes rapidly.

Implications for Future Construction Projects

The insights from this data are not just numbers—they are indicative of the future directions of workplace constructions. As businesses continue to emphasize flexibility, comfort, and remote work capabilities, construction designs are likely to evolve to meet these demands. This could mean an increase in projects focusing on adaptive designs that cater to hybrid working models and employee well-being.

Conclusion

The construction industry’s research into ‘Place of Work’ topics is shaping how work environments are designed and built. As businesses adapt to the demands of modern workforce needs, the industry is poised to respond with innovative solutions that prioritize flexibility, comfort, and efficiency. The ongoing interest in dynamic workplaces, comfortable break rooms, and adaptable business parks is not just a trend but a shift towards creating future-ready workplaces that enhance productivity and employee satisfaction.

Company Sample Data Overview

Data Description

1. Company Size: Categories defined by the number of employees, ranging from micro to large companies.

2. Spiking Businesses (weekly avg.): The average number of businesses per week within each size category showing increased interest or ‘spikes’ in specific topics.

3. Percent of Total: The percentage representation of each company size category’s interest spikes relative to the total observed across all sizes.

Insights and Trends

– Micro (1 – 9 Employees): Despite being the smallest in size, these companies show a notable level of activity, suggesting that even the smallest businesses are keen on keeping up-to-date with industry trends or needs.

– Small (10 – 49 Employees) and Medium-Small (50 – 199 Employees): These categories show the highest number of weekly spiking businesses, indicating a strong engagement with the topic. Their combined contributions make up over half of the total percentage, emphasizing the proactive nature of small to medium-sized enterprises (SMEs) in exploring and adapting new workplace trends.

– Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees): These larger businesses have fewer spikes in interest on a weekly average compared to smaller companies, which might suggest either a slower response rate to new trends or a more established system that requires less frequent updates.

Why This Is a Trend

– Agility of Smaller Companies: Smaller companies, such as micro and small businesses, might be more agile and quicker to explore or adopt new trends as they seek competitive advantages and efficiency improvements in workplace management.

– Resource Allocation in Larger Companies: Larger companies may have more established protocols and infrastructure, making them less nimble in adopting new trends quickly but possibly integrating them more deeply once adopted.

– Impact of Company Size on Interest and Adoption Rates: The data suggests that company size impacts how actively businesses engage with new industry trends. Smaller companies may have higher engagement rates due to their flexibility and need to adapt quickly to market changes, whereas larger companies might take a more measured approach, analyzing trends thoroughly before adoption.