Executive Summary: Messaging Research Trends in the Construction Industry

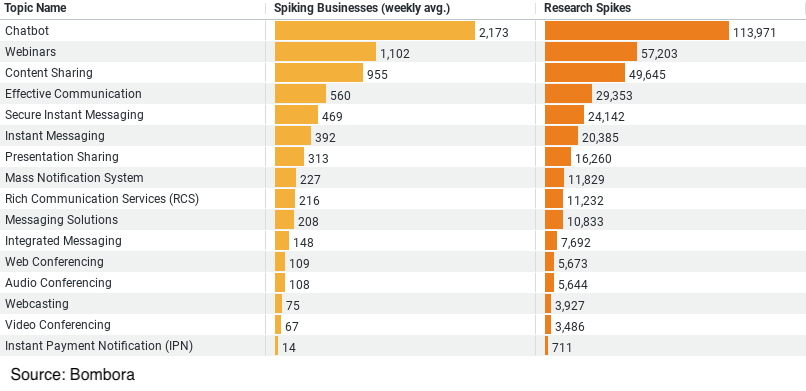

– Dominant Interest: The topic “Chatbot” dominates in terms of research interest with 113,971 spikes and an average weekly interest from approximately 2,173 businesses. This suggests a high value placed on automation and customer interaction solutions.

– Webinars and Sharing: “Webinars” and “Content Sharing” follow with 57,203 and 49,645 research spikes, respectively. Both topics highlight the industry’s emphasis on utilizing digital mediums for education and collaborative purposes.

– Communication Efficiency: The topics “Effective Communication” and “Secure Instant Messaging” are also significant, with 29,353 and 24,142 spikes, respectively. These reflect concerns over improving workflow communications and securing those communications.

– Trends: The overall trend indicates a strong investment in technologies that facilitate efficient and secure communication, underscoring the importance of staying connected and informed in a dynamic industry environment.

Construction Industry’s Messaging Revolution: Trends and Insights

In an era where communication technology is rapidly advancing, the construction industry has not remained on the sidelines. Instead, it’s actively participating, exploring, and adopting various messaging technologies to enhance operational efficiency and stakeholder engagement. This blog post delves into the most recent data revealing how the construction sector is engaging with different messaging-related topics and what these trends indicate about the industry’s future directions.

The Unmatched Dominance of Chatbots

At the forefront of this technological uptake is the industry’s interest in chatbots. Data shows a staggering 113,971 research spikes in this area, with an average weekly interest from approximately 2,173 businesses. This immense interest is indicative of the construction industry’s push towards automation. Chatbots are being increasingly deployed to handle everything from customer service inquiries to supplier and order management communications. By automating these processes, businesses can streamline operations and reduce the human resources needed for mundane tasks.

Webinars: A Tool for Collaboration and Learning

Following chatbots, webinars have garnered significant attention with 57,203 research spikes. In a field where ongoing education and training are crucial, webinars offer a practical solution for delivering timely and relevant information to dispersed teams. Moreover, with the rise of remote project management and virtual team meetings, webinars provide an essential platform for real-time collaboration and decision-making, bridging the gap between various stakeholders spread across different locations.

Content Sharing for Enhanced Accessibility

Content sharing has also seen substantial research interest, with 49,645 spikes, underscoring the construction industry’s focus on improving information dissemination. The ability to share project updates, blueprints, compliance documents, and safety protocols efficiently ensures that everyone on the ground and in the office is on the same page. It reduces errors and improves project outcomes by keeping all parties informed of the latest developments and changes.

Effective Communication and Secure Instant Messaging

The topics of effective communication and secure instant messaging, with 29,353 and 24,142 research spikes respectively, reflect the industry’s commitment to enhancing internal communication channels. Effective communication is pivotal in avoiding costly misunderstandings and delays in construction projects, while secure instant messaging is crucial in protecting sensitive information from cyber threats. Together, these interests highlight a dual focus on optimizing communication flows and safeguarding data—a necessary balance in today’s digital age.

Implications and Future Trends

The construction industry’s focused research on these messaging technologies indicates a broader trend towards digital transformation. By adopting these technologies, the industry can expect several improvements:

1. Increased Efficiency: Automation through chatbots and enhanced communication tools reduces time spent on routine tasks, allowing teams to focus on more strategic activities.

2. Enhanced Collaboration: Tools like webinars and content-sharing platforms streamline collaboration, making it easier to manage complex projects with multiple stakeholders.

3. Improved Compliance and Safety: Effective communication ensures that all team members are aware of and comply with safety protocols, reducing the risk of accidents on site.

4. Data Security: With the rise in cyber threats, the focus on secure messaging is more crucial than ever, ensuring that sensitive information remains protected.

As the construction industry continues to navigate its path towards digitalization, these messaging technologies play a pivotal role. Not only do they enhance operational efficiencies, but they also improve project outcomes and safety, paving the way for a more connected and efficient construction industry. Moving forward, we can expect to see even greater adoption of these technologies as the benefits become increasingly evident and as the solutions themselves become more sophisticated and tailored to the unique needs of the construction sector.

Company Sample Data: Analysis and Trends

1. Company Size: Categories of companies based on the number of employees, ranging from micro-sized (1-9 employees) to large (1000+ employees).

2. Spiking Businesses (weekly avg.): Represents the average number of businesses in each size category showing a significant interest in a particular activity or topic weekly.

3. **Percent of Total**: The proportion that each company size category represents of the total number of spiking businesses.

Trends and Implications Based on Company Sizes:

From the data:

– Micro (1-9 Employees: Shows the lowest number of spiking businesses, accounting for approximately 9.53% of the total. This indicates a lower but noticeable activity level in micro-sized companies, likely due to limited resources but a targeted focus.

– Small (10-49 Employees) and Medium-Small (50-199 Employees: These segments show a more substantial engagement, with 25.94% and 28.93% respectively. These businesses likely have more resources than micro companies to engage in new trends but are still nimble enough to adapt quickly.

– Medium (200-499 Employees) and Medium-Large (500-999 Employees): Representing 14.80% and 7.88% of the total, these groups show a declining trend as company size increases. This could be due to the complexities and slower decision-making processes typical in larger organizations.

– Large (1000+ Employees): Although not shown above, larger companies might exhibit specific trends that could either show a spike due to their substantial impact when they decide to engage or a lower relative percentage due to their typically cautious approach to adopting new practices.

Why This Trend Matters:

The trend observed in the data suggests a sweet spot in engagement among small to medium-small companies, possibly reflecting their ability to be more agile and responsive to market changes. This trend is crucial because it highlights how different sizes of companies prioritize and respond to market opportunities, which can be insightful for service providers, policymakers, and businesses themselves to understand their market position and strategic planning.