Executive Summary: Education Research Trends in the Construction Industry

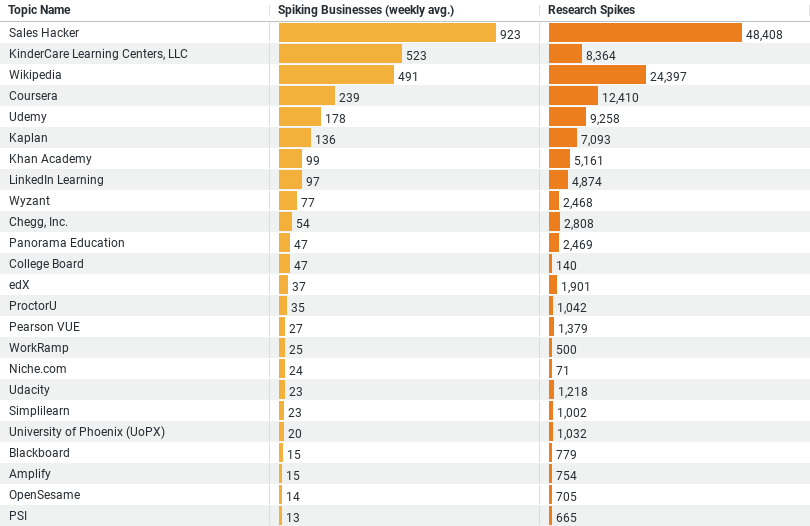

1. Popular Topics: “Sales Hacker” is the most popular topic with the highest weekly average of businesses showing interest (approximately 923 businesses per week), followed by “KinderCare Learning Centers, LLC” and “Wikipedia”.

2. Intensity of Interest: The topic “Sales Hacker” not only leads in the number of businesses interested but also in the total number of research spikes, reaching a total of 48,408 spikes. This suggests a significant and sustained interest in sales-related education within the construction industry.

3. Educational Platforms and Tools: Apart from specific educational topics, there is also notable interest in educational platforms like “Coursera” and “Udemy”, indicating a trend towards online learning and professional development.

4. Variability in Interest: While a few topics have high research spikes, there are also topics with moderate to low spikes, suggesting a diverse range of interests but with some clear leaders in attention.

Education in Construction: Exploring Industry Research Trends

The construction industry, traditionally viewed through the lens of physical labor and machinery, is increasingly showing a robust interest in education and professional development. This shift towards embracing learning and growth is not just about enhancing technical skills but also about integrating business acumen, sales strategies, and modern educational tools. A recent analysis of industry data reveals fascinating trends in how construction businesses are investing in education, with a particular emphasis on topics like sales, child care management, and online learning platforms.

Broadening Horizons with Sales Education

At the forefront of educational interest within the construction industry is the topic of “Sales Hacker,” a concept that has garnered the most significant attention, both in terms of businesses involved and research intensity. With an average of 923 businesses per week delving into this topic, it’s clear that the construction sector is keen on mastering the art of sales. The massive number of research spikes, totaling 48,408, underscores a strategic shift in the industry—construction firms are not only looking to build structures but also to enhance their sales strategies to better market their services and expand their customer base.

Emphasizing Early Education Management

Another interesting focus is on early education management, highlighted by the keen interest in “KinderCare Learning Centers, LLC.” This topic’s popularity with an average of 522 businesses per week exploring it, paired with 8,364 research spikes, suggests that construction companies are looking at child care not just as a societal necessity but potentially as a business venture. This trend could be driven by the growing understanding of the importance of early childhood education and the opportunities it presents for creating supportive environments for employees’ families.

Leveraging Online Learning Platforms

The construction industry’s engagement with online learning platforms such as Coursera and Udemy further illustrates its commitment to continuous learning and adaptability. With 238 and 178 businesses per week, respectively, delving into these platforms, it’s evident that the sector values flexible, accessible educational resources. These platforms offer courses ranging from project management to advanced construction techniques, enabling professionals in the industry to enhance their knowledge and skills conveniently.

The Role of Wikipedia in Industry Research

Interestingly, Wikipedia also emerges as a significant resource, with an average of 491 businesses per week turning to this vast repository of knowledge. This indicates that construction professionals are not just relying on formal educational platforms but are also seeking quick, accessible information that spans various topics, which can be crucial for making informed decisions on the fly.

Implications and Future Trends

This data-driven insight into the construction industry’s educational pursuits has several implications. First, it signals a growing recognition within the industry of the need for continuous professional development to remain competitive and innovative. Additionally, the interest in diverse educational topics and platforms suggests that the industry is becoming more multifaceted, with a workforce that values both foundational construction skills and broader business insights.

Looking forward, we can anticipate that the construction industry will continue to embrace educational advancements, potentially leading to collaborations with educational institutions and tech companies to develop tailored learning solutions that address specific industry needs. Moreover, this trend towards education and professional development is likely to enhance the industry’s appeal to a younger, more diverse workforce, ultimately contributing to its long-term sustainability and growth.

In conclusion, the construction industry’s evolving approach to education and professional development is a positive indicator of its readiness to adapt and thrive in a rapidly changing business environment. By investing in education, construction firms are not only enhancing their capabilities but are also paving the way for a more innovative and resilient future.

Company Sample Data Analysis

Trends by Company Size

1. Micro (1 – 9 Employees): Shows the least average weekly spiking businesses, but these companies still contribute a notable percentage (about 8.33%) of the total spikes. This could indicate that while the absolute number of businesses interested is lower, the relative interest within this group is strong.

2. Small (10 – 49 Employees): Represents a more significant chunk of the interest, with over 20% of the total spikes and a higher average of spiking businesses weekly. This suggests that small businesses are more actively seeking information and perhaps trying to leverage knowledge to grow or compete.

3. Medium-Small (50 – 199 Employees): Shows the highest engagement among all categories with the highest average weekly spiking businesses and nearly 25% of total research spikes. This indicates that companies in this range are possibly at a stage where they are ready to invest more heavily in research to support expansion or innovation.

4. Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees): These categories show a decreasing trend in the number of spiking businesses and percentage of total spikes as company size increases. It might reflect a transition point where companies have established systems and processes, requiring less frequent exploration of new topics compared to smaller companies.

Why This Is a Trend

The data trends suggest a strong inclination towards research and development in smaller to medium-small companies, likely driven by the need to innovate and grow. As companies increase in size, the proportionate interest in constant research diminishes, possibly due to established structures and less urgency for adaptive strategies. This trend underscores the dynamic nature of business operations where smaller entities might be more agile and responsive to new information, whereas larger ones might focus on optimizing and scaling existing knowledge and systems.

This analysis highlights how company size influences research behavior, with smaller companies showing higher relative activity in seeking new opportunities and information, suggesting a trend towards leveraging knowledge as a critical component for growth and competitiveness in the marketplace.