Executive Summary

The construction industry is demonstrating a robust and growing interest in HR technologies, as evidenced by research trends over the past year. Key insights include:

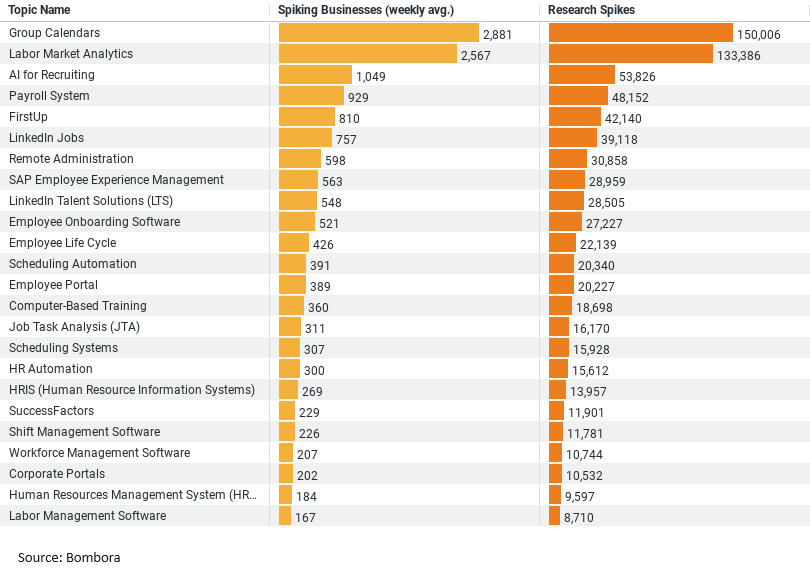

Group Calendars and Labor Market Analytics lead in interest, with weekly research spikes of approximately 2880 and 2567 businesses, respectively, underscoring the industry’s focus on improving scheduling coordination and understanding labor market dynamics.

AI for Recruiting and Payroll Systems follow, indicating an embrace of technology to streamline recruitment and manage payroll efficiently, with over 50,000 and 48,000 total research spikes in the past year, respectively.

FirstUp shows emerging interest, suggesting an inclination towards technologies that enhance initial employee engagement and onboarding processes.

Overall, the data reflects a significant shift towards integrating advanced HR technologies within the construction sector, aiming to optimize workforce management, recruitment, and employee engagement strategies.

Harnessing HR Technologies: A New Era for the Construction Industry

In the rapidly evolving landscape of the construction industry, the integration of HR technologies is no longer a trend—it’s a revolution. As construction firms navigate through the complexities of labor management, scheduling, and recruitment, the adoption of innovative HR solutions has become paramount. The latest data sheds light on this transformative journey, revealing how the construction sector is not just keeping pace but setting the pace in embracing HR technologies.

The Rise of HR Technologies in Construction

The construction industry, traditionally seen as a sector slow to digitalize, is now at the forefront of adopting HR technologies. This shift is driven by the pressing need to address unique challenges such as fluctuating workforce demands, complex project timelines, and the critical importance of attracting skilled labor in a competitive market.

Group Calendars and Labor Market Analytics Lead the Way

At the heart of this transformation are Group Calendars and Labor Market Analytics. The data reveals an impressive weekly average spike of approximately 2880 businesses researching Group Calendars, followed closely by Labor Market Analytics with about 2567 businesses. These numbers not only highlight the industry’s priority in improving scheduling coordination and gaining insights into labor market trends but also indicate a strategic approach to optimizing workforce allocation and project planning.

AI for Recruiting and Efficient Payroll Systems

Not far behind, AI for Recruiting and Payroll Systems are making significant inroads. With over 50,000 and 48,000 total research spikes in the past year, respectively, it’s evident that the construction sector is keen on leveraging artificial intelligence to streamline the recruitment process and ensure efficient payroll management. This trend underscores the industry’s commitment to adopting solutions that can reduce time-to-hire, enhance candidate selection, and manage payroll complexities with precision.

The Emerging Interest in FirstUp

FirstUp represents an emerging interest within the sector, with 42,140 research spikes over the last year. This trend suggests a growing recognition of the importance of engaging employees from day one, enhancing onboarding processes, and fostering a positive work environment. It’s a clear signal that the construction industry is not just focusing on the operational aspects of HR technologies but also on creating a more inclusive and supportive workplace culture.

The Impact of HR Technologies on the Construction Industry

The adoption of HR technologies is having a profound impact on the construction industry. These technologies are not only solving traditional challenges but also opening new avenues for growth and competitiveness.

Streamlining Operations and Enhancing Efficiency

By integrating HR technologies such as Group Calendars and Payroll Systems, construction firms are able to streamline their operations, improve project scheduling, and manage payroll more efficiently. This operational efficiency is crucial in a sector where timelines are tight and budgets are closely monitored.

Attracting and Retaining Talent

The use of AI for Recruiting and the focus on improving the employee onboarding experience through technologies like FirstUp are transforming the way construction firms attract and retain talent. In an industry where skilled labor is a valuable asset, these technologies are pivotal in building a more dynamic, skilled, and motivated workforce.

Shaping the Future of Work in Construction

As the construction industry embraces HR technologies, it is also shaping the future of work. These technologies are not just tools for managing the workforce; they are catalysts for creating more agile, responsive, and people-centric construction firms. They represent a shift towards a more modern, technologically advanced, and human-focused industry.

Conclusion

The construction industry’s research and interest in HR technologies are a testament to its resilience and forward-thinking approach. As firms continue to harness these technologies, they are setting new benchmarks for efficiency, innovation, and workplace culture. The data is clear: HR technologies are not just transforming the construction industry; they are paving the way for a new era of growth and competitiveness. In embracing these technologies, the construction sector is building more than just structures; it’s building a stronger, more sustainable future for its workforce and the communities it serves.

Company Sample Data

The company sample we are working with, provides a fascinating glimpse into the engagement levels of companies of various sizes with market research. This data categorizes companies based on the number of employees, ranging from micro-sized entities with 1-9 employees to medium-large organizations housing 500-999 employees. The structure of the data allows us to explore how businesses across this spectrum show interest in market insights, as evidenced by spikes in research activities.

Key insights from the data include:

- Diverse Company Sizes: The dataset categorizes companies into five distinct sizes, providing a broad view of the market’s research activities from the smallest to larger enterprises.

- Weekly Research Spikes: The average weekly spikes in market research interest are quantified, revealing which company sizes are most actively seeking market insights.

- Interest Distribution: The data also sheds light on the proportion of total market research interest attributable to each company size category, offering a clear picture of where the bulk of research activities originate

Notably, medium-small companies (50-199 employees) demonstrate the highest average weekly spike in research interest, indicating a keen engagement with market insights in this segment. This is closely followed by small (10-49 employees) and medium (200-499 employees) companies, suggesting a strong inclination towards understanding market dynamics across these categories.

The dataset provides a valuable foundation for analyzing how different sizes of companies prioritize and engage with market research. This can offer critical insights for businesses and market analysts aiming to understand market trends, tailor their strategies to target specific company segments, and gauge the overall landscape of market research interest within the business community.