Paper invoices, lost payments, and manual data entry—sound familiar? For field service businesses, invoicing isn’t just another admin task—it’s the backbone of cash flow. But relying on outdated processes slows everything down.

AI-powered automation tools speed up these day to day processes that used to take up a lot of time, and can do it without error. In fact, 80% of contractors we surveyed say AI field tools will be essential to stay competitive in the next 3 years.

Whether you’re running a commercial HVAC company or managing electrical service calls, automating your invoicing means no more chasing payments or sifting through stacks of invoices at the end of the month. In this guide, we’ll break down exactly what you need to know about invoice automation:

- How to choose the right invoice automation software

- 6 key features to look for in an automated invoice system

- 5 best invoice automation software & tools for contractors

- 7 benefits of using an automated invoicing software

- 4 important invoice automation software FAQs answered

Before you commit to an automation tool, you need to know what to look for. The right software should fit your workflow, integrate with your systems, and support the unique needs of the field service industry. Field service management software is built to help businesses like yours connect invoicing, scheduling, and dispatching into a seamless operation. Up next, let’s break down how to choose the right invoice automation software.

How to choose the right invoice automation software

Managing invoices manually slows everything down—payments get delayed, errors pile up, and your team spends more time on admin work instead of servicing customers. For field service businesses, choosing the right invoice automation software is about finding a tool that fits how you work. The goal is to speed up invoicing, reduce mistakes, and keep cash flow steady without adding extra headaches.

Before committing to a solution, here are key questions to ask:

- Scalability – Will this software grow with your business? Whether handling a handful of invoices or hundreds each month, it should keep up without slowing you down.

- Integration – Does it connect with your accounting system, job management tools, and field service management software? If not, you’ll waste time transferring data manually.

- Automation options – What tasks can be automated? Look for things like recurring invoices, payment reminders, and job-to-invoice syncing to reduce manual work.

- Invoice functionality – Can the system handle things like partial payments, taxes, line items, or multiple service locations? Strong invoicing tools should match how you actually do business.

- Mobile accessibility – Can your team create, send, and track invoices from the field? A mobile-friendly system speeds up approvals and payments.

- Security & compliance – Does it protect sensitive financial data? Check for encryption, role-based access, and compliance with industry regulations.

- Features – Does it include built-in reporting, multi-user access, or customer portals? Ask yourself what additional tools would make invoicing even easier.

With the right system, invoicing should feel effortless. From reducing admin work to keeping payments on track, automation ensures your business runs without interruptions. Next, let’s break down the six key features every field service business should look for in an invoice automation system.

6 key features to look for in an automated invoice system

Field service businesses rely on efficiency to keep operations running smoothly. The right invoice automation software ensures that payments are processed on time, errors are minimized, and techs can focus on the job instead of paperwork. Whether you manage a plumbing crew, an HVAC team, or an electrical contracting business, automating invoices keeps revenue flowing without delays.

1. Mobile accessibility for on-the-go invoicing

A field service tech finishing up a job shouldn’t have to return to the office just to send an invoice. Mobile-friendly invoicing lets them generate, review, and send invoices from their phone or tablet while still on-site. This speeds up the billing process and reduces the risk of delays.

Take, for instance, a plumbing contractor who just wrapped up a late-night emergency pipe repair. Instead of waiting until morning to handle paperwork, they can use a mobile field service solution to send a digital invoice on the spot. The customer gets it instantly, and payment can be processed before the tech even leaves the driveway.

2. Integration with scheduling and dispatch

Disconnected systems create bottlenecks. A seamless link between scheduling, dispatch, and invoicing ensures that job details automatically populate into invoices, reducing manual entry and human error. Think about an HVAC company handling multiple service calls daily. With integrated scheduling for invoice automation, invoice details pull directly from completed work orders, ensuring accuracy. No more back-and-forth between office staff and field techs—everything flows smoothly from job completion to billing.

3. Automated payment processing for faster transactions

Waiting on checks or manual payment follow-ups slows down cash flow. An automated system allows customers to pay instantly through digital invoices with secure online payment options. Now, consider an electrical contractor finishing a major rewiring project for an office building.

Without automation, they’d have to send an invoice manually and wait for the client to process it. With automated payments, the invoice goes out immediately with a built-in payment link, allowing the client to settle the bill on the spot. No delays, no chasing payments.

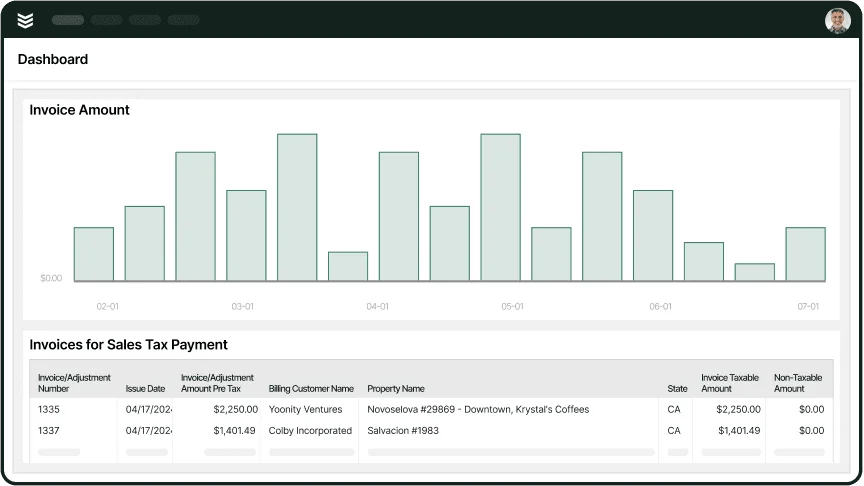

4. Real-time tracking and reporting

Without real-time visibility, tracking unpaid invoices becomes a guessing game. A reporting feature helps contractors see which invoices are paid, pending, or overdue—allowing them to take action quickly. Imagine a roofing company juggling multiple projects across town. Instead of calling the office to check on outstanding payments, they can rely on real-time reporting for invoice tracking to see which clients still owe money. With a live dashboard showing overdue invoices and trends, they can follow up strategically without sifting through spreadsheets.

5. Customer management for accurate billing

Messy customer records lead to duplicate invoices, missed payments, and billing errors. A built-in CRM keeps all client information—past work history, pricing agreements, and contact details—organized and up to date. Let’s say a refrigeration contractor services multiple restaurant chains with different locations.

They need customer management tools for invoice accuracy to ensure that each location is billed correctly with its own service history. Instead of manually adjusting every invoice, the system auto-fills contract pricing, reducing errors and saving hours of administrative work.

6. Automated service agreements and recurring billing

For businesses handling maintenance contracts, manually generating recurring invoices wastes time. A system that automates service agreements ensures clients receive timely invoices for ongoing work.

Think back to a fire safety company that provides quarterly inspections for commercial buildings. Instead of creating invoices from scratch every three months, they can use automated service agreements to generate invoices on a set schedule. The system sends invoices automatically based on contract terms, eliminating manual work and ensuring consistent cash flow.

Other valuable features to look for in an invoice automation software

While core invoicing features handle the heavy lifting, some additional tools can make a big difference in how smoothly payments and financial workflows run. These extra features help field service businesses operate more efficiently, cutting down on manual work and keeping cash flow predictable.

- Time tracking for accurate billing – When invoicing is tied directly to logged work hours, there’s no guesswork when billing customers. Hours tracked on-site should automatically sync with invoices to ensure accuracy. Think about a contractor managing multiple crews on different job sites. Instead of relying on manual timecards, a time tracking system records work hours digitally, preventing disputes and ensuring clients are billed correctly.

- Fleet management to optimize job costs – Vehicle usage impacts job expenses, and tracking fleet data can help businesses cut costs while improving dispatch efficiency. Suppose an HVAC company runs a fleet of service vans. If they aren’t tracking mileage and fuel usage, they’re likely missing opportunities to reduce expenses. With fleet management tools, businesses can monitor fuel costs, track maintenance needs, and automatically factor vehicle expenses into invoices.

- Pipeline visibility for forecasting revenue – Staying on top of current and future invoices helps business owners manage cash flow and plan ahead. A pipeline feature allows teams to see expected revenue and upcoming payments in real-time. For example, a plumbing company handling both service calls and large installation projects needs a way to predict income from different jobs. By using pipeline tracking for invoice automation software, they can see which invoices are pending, which are expected soon, and whether any late payments need follow-ups.

Expert Tip

The correct invoicing tools can do more than just track payments: they simplify job completion and ensure prompt payment. Discover how BuildOps field service invoicing software can streamline your administrative tasks, minimize missed payments, and maintain consistent cash flow.

Adding these features to an invoice automation system streamlines every part of the billing process, from job tracking to financial planning. Now that we've covered the essential and advanced features, let's take a look at the best invoice automation software available for field service businesses.

5 best invoice automation software & tools for contractors

Finding the right invoice automation software depends on your business type. Some tools work best for large commercial operations, while others cater to residential or independent contractors. Below are the top five options, each suited for a different type of field service professional.

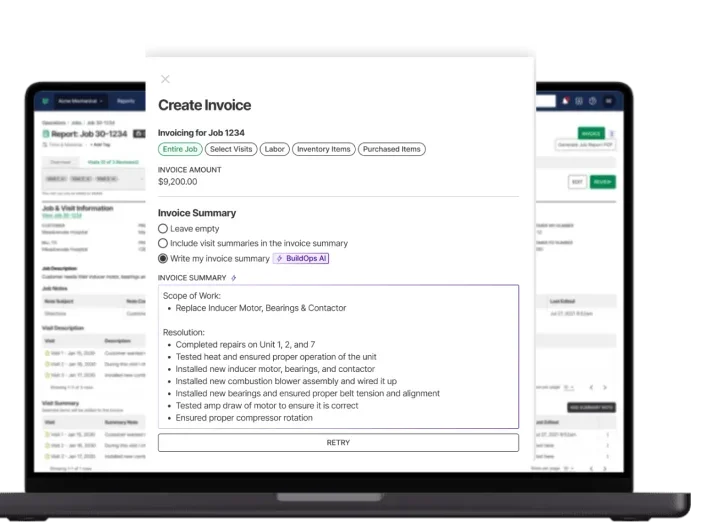

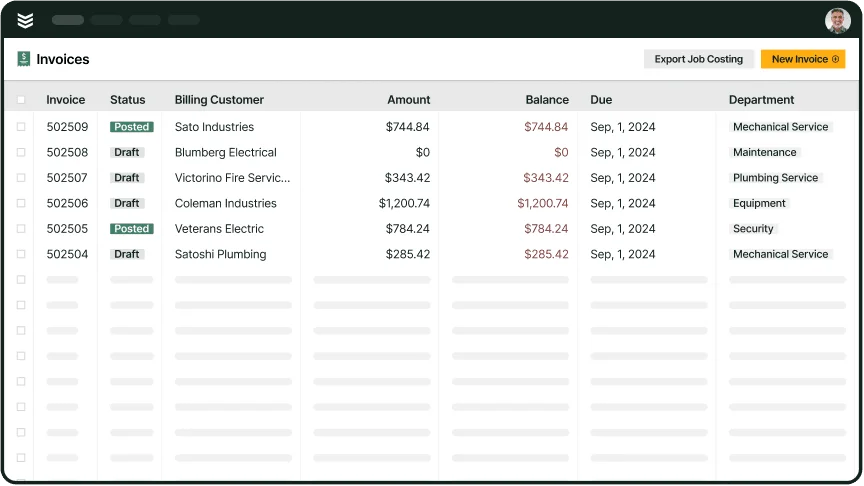

1. Best for commercial contractors: Buildops

BuildOps was designed specifically for commercial field service businesses, making it one of the most powerful invoice automation tools for large-scale operations. Unlike residential-focused platforms, BuildOps integrates seamlessly with job costing, project tracking, and service agreements—helping contractors manage complex invoicing without the hassle.

How Pricing Works: We offer live demos every week. You can also book a personal session to explore features and see which options make sense for your business.

Features Beyond Invoicing: Integrated job tracking, service agreement automation, and technician scheduling.

What Sets It Apart for Commercial: Built for high-volume service businesses, with enterprise-level automation that keeps invoices accurate and cash flow steady.

Get paid faster with BuildOps

Automate your entire field service operations to run your business smoother.

2. Best for residential: Housecall Pro

Image Source: Housecall Pro

Housecall Pro is a great option for residential service businesses looking for an all-in-one platform to manage scheduling, invoicing, and customer interactions. It allows contractors to generate and send invoices from a mobile device, making it easy to get paid right after a job is completed. The platform also includes automated follow-ups and online payment processing, which can help reduce late payments. However, businesses that handle larger commercial projects or need advanced job costing might find Housecall Pro too limited. It lacks the depth of automation and customization that larger operations require, making it a better fit for small-scale residential service providers.

How Pricing Works: Starts at $59/month, with higher-tier plans offering advanced automation and integrations.

Features Beyond Invoicing: Online booking, marketing automation, and payment processing.

What Sets It Apart for Residential: User-friendly interface designed for solo technicians and small service businesses.

3. Best for general contractors: Jobber

Image Source: Jobber

Jobber is built for general contractors who need a mix of job tracking, customer communication, and invoicing tools. It streamlines billing by pulling job details directly into invoices, reducing manual data entry and errors. Automated reminders help ensure payments don’t fall through the cracks, and the system integrates with popular accounting software. That said, Jobber may not be ideal for businesses handling large-scale commercial jobs with complex billing structures. While it excels in job scheduling and invoicing for general contractors, companies requiring advanced automation and deep financial reporting may find its features limiting.

How Pricing Works: Subscription plans start at $129/month for teams, with premium options offering enhanced automation, quoting, and reporting features.

Features Beyond Invoicing: Job tracking, client communication, and quoting tools.

What Sets It Apart for General Contractors: Jobber bridges the gap between job management and invoicing, making it easier for general contractors to keep track of multiple projects, send invoices, and ensure timely payments—all from one dashboard.

4. Best for small businesses: Workiz

Image Source: Workiz

Workiz is designed for small service businesses that need a straightforward invoicing system. It provides cloud-based invoicing, call tracking, and automated payment reminders, making it easy for small teams to manage their billing without extra admin work. The platform is intuitive and allows technicians to generate invoices on-site using a mobile app. While Workiz is excellent for small businesses, it may not be the best choice for contractors needing advanced financial reporting or integrations with enterprise-level accounting systems. Its automation capabilities are more limited compared to higher-end solutions, making it better suited for businesses with simpler invoicing needs.

How Pricing Works: Offers a free package for up to two users, then more advanced packages for teams start at $198/month, with add-ons available for automation and team collaboration.

Features Beyond Invoicing: Call tracking, job dispatching, and estimate approvals.

What Sets It Apart for Small Businesses: Designed for small service businesses, Workiz provides an easy-to-use invoicing and job management system that helps contractors send invoices quickly, collect payments, and keep track of outstanding balances.

Expert Tip

Interested in exploring automation for your entire field service business? Delve deeper with our comprehensive guide to the best field service management software for small businesses to discover more.

5. Best for independent contractors: Invoicera

Image Source: Invoicera

Invoicera is a lightweight invoicing tool built for independent contractors and freelancers who need a simple way to manage billing and expenses. It offers recurring invoices, multi-currency support, and client portals, making it easy to bill customers across different projects. The platform also includes expense tracking, which helps self-employed professionals stay on top of their financials. However, Invoicera lacks the field-service-specific features that businesses with multiple crews or recurring service contracts might need. It does not integrate deeply with job tracking or dispatching software, which may be a drawback for service professionals handling complex job scheduling.

How Pricing Works: Free for up to three clients, with paid plans starting at $15/month for unlimited invoicing.

Features Beyond Invoicing: Expense tracking, client portals, and multi-currency support.

What Sets It Apart for Independent Contractors: Invoicera is a straightforward and budget-friendly invoicing platform that helps solo contractors manage billing and payments without unnecessary complexity.

Download this handy guide

Perfect your invoicing process with our guide—complete with tips, tricks, and templates.

7 benefits of using an automated invoicing software

For field service businesses, invoicing is the final step before getting paid—but when done manually, it can be a roadblock that slows cash flow and piles on extra admin work. Automated invoicing software streamlines the process, ensuring technicians, contractors, and business owners spend less time on paperwork and more time on the job.

Here’s how invoice automation directly benefits field service professionals:

1. Faster payments and improved cash flow

Waiting on payments disrupts operations and makes it harder to cover expenses like payroll and materials. Automated invoicing speeds up the billing cycle by instantly generating invoices and sending payment reminders to customers. For example, an HVAC business completing dozens of service calls each week can set up automated invoicing tools that send digital invoices immediately after a job is finished. Customers receive payment links on the spot, reducing the chance of delayed payments.

Expert Tip

Your customers can’t pay you until they’ve gotten an invoice. Our research shows that the faster you invoice, the faster you get paid. Check out the Invoicing Sweet Spot to find out the best time to invoice to avoid late payments.

2. Reduced errors and invoice disputes

Manual invoicing opens the door to mistakes—wrong amounts, missing job details, or even duplicate invoices. Errors lead to disputes, which delay payments and create unnecessary back-and-forth with customers. With invoice automation, field service companies can eliminate these issues. The system pulls job details directly from completed work orders, ensuring invoices are accurate. A plumbing contractor, for instance, no longer has to worry about miscalculating labor hours or forgetting to add parts used during a repair.

3. More efficient job-to-invoice process

Technicians in the field shouldn’t have to wait until they’re back at the office to generate an invoice. Automation ensures the process flows smoothly from job completion to billing, reducing delays. Imagine how a fire protection company handling routine inspections can just integrate field service automation software to link job scheduling, service reports, and invoicing into one seamless workflow. The moment an inspection is signed off, an invoice is automatically created and sent, keeping operations moving without bottlenecks.

4. Less administrative work for office staff

Manually creating, tracking, and following up on invoices takes up valuable time that could be spent on higher-priority tasks. Automation cuts down on admin hours and allows office staff to focus on scheduling, dispatching, and customer service. For instance, a general contractor with a small back-office team can rely on automated invoicing to reduce manual data entry. Instead of chasing down paperwork, the office team can concentrate on coordinating crews and securing new projects.

5. Easier compliance and record-keeping

Keeping track of invoices for tax filing, audits, or customer disputes can be a nightmare when records are scattered across spreadsheets and paper files. Invoice automation ensures every invoice is logged, stored, and easily accessible. For example, an electrical contractor working with large commercial clients can quickly retrieve past invoices, job details, and payment statuses in just a few clicks. No more digging through old files or losing track of outstanding balances.

6. Automated follow-ups and payment reminders

Customers don’t always pay on time, and manually following up can be time-consuming. Automated invoicing software sends scheduled reminders, helping field service businesses collect payments without extra effort. In a real-world situation, a refrigeration company servicing restaurants can use field service business process automation to automate follow-ups. If a payment is overdue, the system sends a reminder email with a secure payment link, reducing the need for manual outreach.

7. Better financial insights and forecasting

Knowing which invoices are pending, paid, or overdue helps businesses stay on top of their finances and plan ahead. Automated systems provide real-time visibility into cash flow, making it easier to forecast revenue. For example, a commercial roofing company using invoicing automation can quickly pull up reports on outstanding balances and expected payments. This allows them to make smarter financial decisions, like when to invest in new equipment or hire additional staff.

Always get paid on time

We automate invoicing so you can focus on getting jobs done faster—without hiccups.

4 important invoice automation software FAQs answered

Field service professionals often have questions about how invoice automation software fits into their workflow. Below are clear, direct answers to some of the most common concerns.

1. What is invoice automation software?

Invoice automation software is a tool that improves the invoicing process by automatically generating, sending, and tracking invoices. For field service businesses, it reduces manual entry, minimizes errors, and boosts payments by integrating with scheduling, dispatch, and accounting systems.

Additionally, this means technicians can send invoices straight from the job site, office staff can track payments in real time, and contractors can eliminate the hassle of chasing down unpaid invoices.

2. How invoice automation software can improve your business operations

By automating the invoicing process, field service companies can eliminate paperwork, reduce human errors, and get paid faster. The software connects with scheduling tools, ensuring accurate billing for completed jobs. It also sends automatic reminders for overdue payments, cutting down on collection efforts. For contractors juggling multiple jobs, automation means invoices are no longer a bottleneck—billing happens instantly, and cash flow stays steady.

3. Is invoice automation software worth the cost for contractors?

Yes, because the time and money saved outweigh the investment. Manual invoicing takes hours each week and increases the risk of errors or missed payments. Automation reduces admin work, prevents revenue loss, and ensures faster payments—all of which directly impact a contractor’s bottom line.

For example, a plumbing company that automates invoicing can free up office staff to focus on customer service and scheduling rather than tracking down payments, making the software pay for itself over time.

4. How to integrate invoice automation tools into your existing tech stack

Most modern invoice automation software integrates with accounting platforms, field service management systems, and payment processors. Contractors should look for solutions that sync with their current tools to avoid manual data entry.

A seamless integration ensures that job details flow directly into invoices and that financial records update in real time, preventing duplicate work. Choosing a cloud-based system makes it easier for field techs, office staff, and business owners to access invoices from anywhere.

Invoice automation software isn’t just a convenience—it’s a necessity for field service businesses looking to eliminate billing delays, reduce administrative headaches, and improve cash flow. Whether you’re a contractor juggling multiple job sites or a technician handling service calls all day, the right system keeps invoices accurate and payments flowing without extra effort.

While many invoicing tools offer basic automation, most lack the deep integration that field service businesses need. Features like job-to-invoice syncing, automated payment reminders, and real-time financial tracking aren’t standard across all platforms. That’s where an all-in-one solution built for commercial contractors makes a difference. If you're looking for a system that connects invoicing with scheduling, dispatch, and job tracking, BuildOps brings everything into one seamless platform.

See BuildOps in action

Learn how we help your field service operations by automating invoicing.