Running a small field service business means juggling a lot—tight schedules, multiple job sites, and customers expecting clear, timely invoices. But if you're still sending out PDFs manually or chasing down payments with scattered tools, it's probably time to rethink how you’re handling invoicing.

Today’s top invoicing software for small business helps you automate the paperwork, track payments faster, and get your books clean without the late nights. Whether you're a solo operator or managing a lean crew, invoice tools built for small field teams can keep your cash flow moving and your workday cleaner.

And here’s the real kicker—many of these tools pair seamlessly with job tracking and field service management platforms, making it easier to go from job completed to invoice sent in just a few clicks. This guide breaks down everything you need to know about choosing and using invoice software for small business—from key features to the best options out there right now. Here’s what we’ll cover:

- How to choose the right small business invoicing software

- Top invoicing software features for small businesses to look for

- 10 best invoicing tools for small business contractors

- 8 benefits of using invoicing software for small businesses

- 4 important FAQs about small business invoice software answered

Before we get into the specifics, let’s go over what to look for when picking out your small business invoicing software—especially if you’re working jobs in the field and need something that keeps up.

How to choose the right small business invoicing software

For small service business contractors, invoicing happens where the work does—right after a job’s done, not hours later back at the office. Whether you’re unclogging drains, tuning up HVAC systems, or handling electrical repairs, your invoicing tool needs to work in the truck, on the jobsite, and during the rush between calls.

That’s why choosing invoicing software for small business takes more than just price-checking. You need something your crew can use fast, trust in the field, and grow with—without getting bogged down by features that don’t serve you. The best invoicing software for small business should keep your billing clean, accurate, and out of your way so you can keep moving. Here’s what to think through as you compare your options:

- Pricing – What does the monthly cost actually cover? Are there limits on invoices, users, or mobile access? Can you try it before paying with a free plan or demo?

- Ease of use – Can techs send an invoice in under a minute without a learning curve? Does it take too many clicks to do basic tasks? Is the dashboard clear enough to use in a work truck?

- Mobile capability – Can it run smoothly on mobile without losing features? Does it support offline invoicing in areas with spotty service? Will it work on both Android and iOS devices your team already uses?

- Support and updates – Is live support available when something breaks? Do they update regularly with real improvements? Is there onboarding help that speaks to field service teams, not just office admins

- Features – Does it handle line-item estimates, tax calculations, signatures, and deposits? Can it send recurring invoices or reminders? Is it built to sync with payment tools or job scheduling platforms?

Next, let’s dig into the key features that actually make a difference in invoicing software for small businesses—especially when your crew’s in the field and time matters.

Top invoicing software features for small businesses to look for

For small HVAC contractors, invoicing begins the second the job hits the schedule. Whether it’s a rooftop unit replacement or a simple residential tune-up, every task needs to move quickly from scheduled call to finished work to invoice sent. Your technicians are on the go, your office is juggling multiple calls, and customers expect fast, clear billing. That’s why invoicing software for small business needs to fit how HVAC companies actually operate in the field.

We’ll break down the features into three simple groups HVAC service businesses should focus on when evaluating invoice software for small business:

- Field service management & project management software features

- CRM & sales software features

- Invoicing management and payment features

Let’s start with the field service and project management side that sets up every job for fast invoicing.

Field service management & project management software features

In HVAC service work, staying on schedule keeps invoices flowing. When your techs miss appointments or get stuck in the wrong location, it delays everything—including your billing. These features help HVAC contractors keep jobs running smoothly so invoices can be created and sent as soon as work wraps up.

- Mobile accessibility - HVAC techs are always on the move. A strong technician mobile app gives your team access to schedules, work orders, customer histories, and invoicing tools directly from the field. Techs can complete jobs and generate invoices on-site without needing to call the office or wait until the end of the day.

- Real-time scheduling & dispatch - When HVAC units break down in peak season, response time is critical. With HVAC field service scheduling software and dispatch software, your office staff can assign jobs based on real-time availability, location, and technician skill sets—ensuring work gets completed quickly and invoices go out without delay.

- Fleet management integration - Every HVAC service van is a rolling warehouse. With fleet management software, you can monitor your vehicles’ locations, fuel efficiency, and maintenance status, helping your crews stay on time and on-site—keeping jobs on schedule and billing on track.

- Time tracking - HVAC repairs don’t always fit a flat-rate model. With time tracking software, your team’s billable hours are automatically logged and transferred into the invoicing system, ensuring every minute spent troubleshooting or installing gets billed correctly.

- Job quoting and estimating - Nearly every HVAC job starts with an estimate. With quoting software, you can create detailed estimates for installs, repairs, and maintenance work that seamlessly convert into invoices once the job is completed.

- Reporting and analytics - Staying on top of your invoicing performance helps you get paid faster. Reporting software gives you full visibility into outstanding invoices, late payments, and job profitability—letting you adjust operations before cash flow becomes a problem.

CRM & sales software features

For HVAC contractors, invoicing doesn’t start when the job’s done—it starts with the customer relationship. From the first service request to follow-up calls, your CRM and sales tools play a major role in how jobs move through your pipeline and eventually get invoiced. Good CRM features help you organize customer information, track sales opportunities, and keep your invoicing clean and accurate as jobs progress.

- Customer management - Every HVAC customer has a service history, equipment list, and past invoices that your techs need quick access to. A dedicated CRM software allows you to store customer details, track equipment across multiple properties, and ensure your techs have the full service history on-site when quoting new work or invoicing completed jobs.

- Sales pipeline tracking - Keeping your sales process organized directly affects your invoicing pipeline. With a strong sales pipeline tool, you can manage incoming leads, track open proposals, and see which jobs are close to closing. Once approved, these proposals flow directly into scheduling and invoicing without manual data entry.

- Service history visibility - For recurring HVAC customers, knowing what work was done on each unit helps you quote repairs, schedule follow-ups, and invoice accurately. A CRM tied into your service data ensures every piece of equipment has a full maintenance history your techs can reference before billing.

- Quote-to-invoice conversion - When HVAC projects require initial proposals or inspections, being able to convert a signed quote directly into an invoice saves time and eliminates errors. CRM platforms that integrate with quoting tools simplify this process so billing happens as soon as work wraps up.

- Customer segmentation and upselling - CRM software helps you identify customers due for seasonal maintenance, system upgrades, or indoor air quality add-ons. These upselling opportunities directly feed into new quotes and invoices, helping boost revenue with every job.

Now that CRM features are locked in, the final category will cover the invoicing management and payment features — the core of what makes small business invoicing software effective for HVAC teams.

Invoicing management and payment features

This is where everything comes together. After the job is scheduled, dispatched, completed, and documented, your invoicing and payment system takes over. For small HVAC businesses, this part needs to be simple, fast, and fully connected to the work that just got done. Clean invoicing means better cash flow, fewer disputes, and less time chasing down payments.

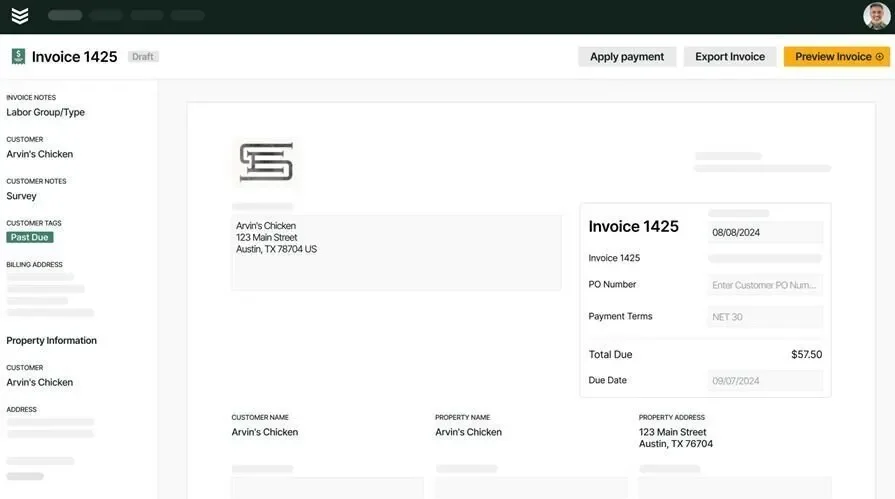

- Invoice generation - Once the HVAC job is complete, generating an invoice should be automatic. With HVAC invoicing software, your system pulls in completed job data, time logs, parts used, and service notes to create professional, itemized invoices ready to send to customers immediately.

- Payment processing - The faster you get paid, the stronger your cash flow stays. Payment processing tools allow customers to pay invoices online, by card, or even through automated recurring payments for service agreements—cutting down on billing cycles and improving collections.

- Service agreements - Preventive maintenance contracts are standard in HVAC. Service agreement tools allow you to schedule recurring service visits and automatically generate invoices tied to your long-term customer agreements.

- Automated reminders - Late payments slow down HVAC businesses fast. Invoicing software that sends automated reminders helps reduce overdue balances by nudging customers at set intervals after the invoice is sent.

Want to tighten up invoicing for every job?

BuildOps helps small service teams keep cash flowing without the extra paperwork.

10 best invoicing tools for small business contractors

With all the features in place, let’s get into the actual tools small HVAC businesses can use. Like before, we’ll break these invoicing software options into three categories based on where they fit into your workflow. Some of these platforms handle just one piece of the puzzle, while others offer complete solutions that cover everything from scheduling to invoicing.

Best field service management & project management invoicing software

These tools help HVAC contractors manage daily service operations — scheduling, dispatching, quoting, documenting work, and turning completed jobs into invoices ready to send.

1. Best for small commercial: BuildOps

BuildOps is designed specifically for commercial field service businesses, including HVAC contractors who handle multiple job sites and assets. With its advanced search, field reporting, and invoicing features, it helps techs document work, track labor, and generate invoices without delays.

Industry Specialization: Commercial field service (HVAC, mechanical, and facility maintenance)

How Pricing Works: Per user, per month; annual contract

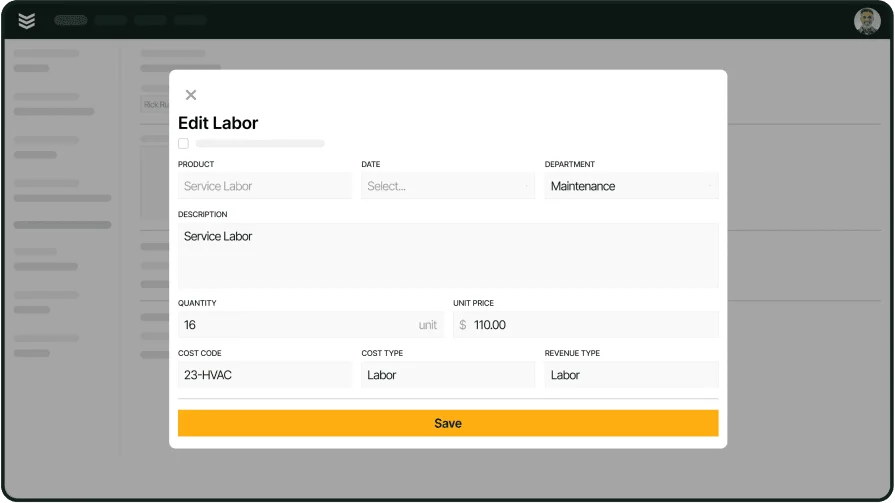

What Sets It Apart: Built-in invoicing that pulls directly from job reports, service agreements, time tracking, and completed work orders — keeping billing accurate and tied to real field activity.

Key Features:

- Real-time dispatch board makes scheduling service calls simple and efficient

- AI-powered notetaking automatically converts technician job reports into invoice-ready data

- Fully integrated invoicing software for commercial service work that keeps your billing and operations fully connected

See how BuildOps can help

Turn finished jobs into fast, accurate payments — all from one connected platform.

2. Best for small residential: Housecall Pro

Image Source: Housecall Pro

Housecall Pro is built for residential field service companies, including HVAC, plumbing, and electrical contractors. It’s built with simplicity in mind, helping smaller teams handle everything from job scheduling to instant invoicing while out in the field. However, it may not be the best fit for HVAC contractors managing commercial properties or complex multi-site service agreements.

Industry Specialization: Residential field service (HVAC, plumbing, electrical)

How Pricing Works: Monthly subscription based on feature tiers

What Sets It Apart: Mobile-first platform that allows techs to send invoices right from the customer’s driveway before leaving the job site.

Key Features:

- Create invoices directly from completed jobs

- Collect digital signatures and instant customer payments on-site

- Automated payment reminders and late-fee tracking

3. Best for general contractors: Jobber

Image Source: Jobber

Jobber supports general field service contractors managing various trades, including HVAC. It simplifies job tracking, quoting, invoicing, and customer communication all from one central platform. That said, it may not offer the advanced asset tracking or commercial client management many HVAC service businesses need for larger multi-property clients.

Industry Specialization: Field service businesses across HVAC, landscaping, electrical, plumbing, and more

How Pricing Works: Subscription pricing per user

What Sets It Apart: Smooth quote-to-invoice process that lets your HVAC team move quickly from approved estimate to final billing.

Key Features:

- Field invoicing lets technicians bill directly from the job site

- Automated quote approval converts jobs into invoices instantly

- Full field service invoicing software integration with payments and client communication

4. Best for growing teams: Workiz

Image Source: Workiz

Workiz helps growing HVAC businesses manage job schedules, dispatching, invoicing, and payment collection all from one platform — built to scale with your business as you add more techs and vehicles. But for HVAC contractors handling larger commercial contracts or highly specialized reporting, Workiz may feel limited in customization and depth.

Industry Specialization: HVAC, locksmiths, junk removal, cleaning, and other field service businesses

How Pricing Works: Per user, monthly subscription

What Sets It Apart: Designed for small but expanding teams needing an all-in-one solution that supports growth.

Key Features:

- Customizable invoicing templates for recurring HVAC services

- Mobile access allows techs to send invoices as soon as work is complete

- Full job management and invoicing are built into the software

Best CRM & sales invoicing software

For HVAC contractors, strong customer management directly affects how well invoices move through the system. Whether you’re tracking service histories, quoting new installs, or managing long-term maintenance customers, CRM and sales invoicing tools help organize every detail that leads to faster, more accurate billing. These platforms handle customer data, sales pipelines, and invoice creation—so nothing slips through the cracks.

5. Best for full-service invoicing CRM: Invoice Ninja

Image Source: Invoice Ninja

Invoice Ninja offers a CRM-style invoicing platform built to help small service businesses like HVAC track clients, quotes, projects, and payments all in one place. Its simple dashboard makes it easy for smaller teams to handle invoicing while managing customer details. However, it may not provide the field service scheduling or technician dispatch features HVAC businesses typically need for daily job coordination.

Industry Specialization: Small businesses and service contractors

How Pricing Works: Free plan available; paid subscriptions unlock advanced features

What Sets It Apart: Open-source flexibility with full CRM and invoicing built into a simple, customizable interface.

Key Features:

- Manage clients, quotes, and invoices from one central platform

- Track payments and recurring billing cycles

- Full invoicing & CRM system through the software

6. Best for simple customer invoicing: Zoho Invoice

Image Source: Zoho

Zoho Invoice offers a lightweight CRM-integrated invoicing solution that allows small HVAC companies to generate professional invoices, track customer payments, and automate reminders with minimal setup or tech knowledge required. That said, Zoho Invoice may lack deeper field service functionality like fleet management, time tracking, or integrated dispatching HVAC teams often rely on.

Industry Specialization: Small businesses across multiple industries

How Pricing Works: Free plan available for small teams

What Sets It Apart: Clean interface that simplifies invoice creation, customer payment tracking, and automated follow-ups.

Key Features:

- Create branded HVAC invoices quickly

- Automate recurring invoices for maintenance agreements

7. Best for advanced CRM integration: Salesforce Invoicing

Image Source: Salesforce

Salesforce offers small business invoicing through its CRM platform, allowing HVAC businesses to combine customer data, service history, and sales pipeline management into one complete invoicing solution. However, Salesforce may feel overwhelming and costly for many small HVAC contractors who don’t need the advanced CRM depth designed for larger teams.

Industry Specialization: Small to mid-sized businesses scaling customer and service management

How Pricing Works: Custom pricing based on feature bundle and user count

What Sets It Apart: Full customer lifecycle management that connects sales, service calls, and invoicing under one CRM platform.

Key Features:

- Integrated CRM with invoice creation tools

- Track service history alongside open invoices

- Enterprise-grade CRM and invoicing through

Invoicing management and payment software tools

For small HVAC businesses, this is the heart of the operation—turning completed jobs into invoices, getting payments processed quickly, and keeping cash flowing. These tools focus on the invoicing and payment cycle itself, giving small service contractors the ability to generate clean invoices, collect payments, and stay on top of their receivables without complicated setups or heavy CRM systems.

8. Best for simple invoicing with payment flexibility: FreshBooks

Image Source: FreshBooks

FreshBooks offers small service businesses a clean, easy-to-use invoicing platform that allows HVAC contractors to create professional invoices, accept online payments, and automate follow-up reminders. However, FreshBooks may feel limited for HVAC businesses that also need integrated scheduling, dispatch, or service agreement management.

Industry Specialization: Small businesses and self-employed service contractors

How Pricing Works: Tiered monthly subscription plans

What Sets It Apart: Extremely simple interface that helps small teams get invoices out fast and collect payments online.

Key Features:

- Create and send invoices from desktop or mobile

- Accept credit cards, bank transfers, or online payments

- Track overdue invoices and send automated reminders

9. Best for free invoicing with basic features: Wave

Image Source: Wave

Wave offers completely free invoicing and payment tools built for small businesses trying to manage their billing without the cost of subscription fees. HVAC contractors looking for a starter option may find Wave useful for basic invoicing and simple payment processing. That said, Wave may not meet the needs of HVAC businesses as they grow or require advanced features like field service management or job costing.

Industry Specialization: Solo operators and small business owners

How Pricing Works: Core invoicing is free; fees apply for payment processing

What Sets It Apart: Free invoicing platform that covers the essentials for smaller teams or startups.

Key Features:

- Professional invoice templates

- Online credit card and bank payment acceptance

- Basic reports for income, expenses, and payments

10. Best for mobile-friendly invoicing and payments: Square Invoices

Image Source: Square

Square Invoices offers small HVAC contractors an easy way to send invoices, accept payments, and manage billing directly from the jobsite. Its mobile-first design makes it especially useful for technicians who want to generate invoices on the spot and collect payments before leaving the property. However, Square Invoices may not provide full service management or dispatch capabilities that HVAC businesses often need to manage daily operations.

Industry Specialization: Small businesses, trades, and service contractors

How Pricing Works: Free invoicing; transaction fees apply for payments processed

What Sets It Apart: Mobile invoicing and built-in payment processing that lets field techs send invoices and collect payments in real time.

Key Features:

- Create invoices directly from smartphones or tablets

- Accept card, ACH, or contactless payments on-site

- Track paid, unpaid, and overdue invoices automatically

Eliminate late payments entirely

Speed up payment times and increase cashflow with BuildOps invoicing.

8 benefits of using invoicing software for small businesses

For small HVAC contractors, invoicing is one of the easiest parts of the job to fall behind on—but one of the most important to get right. When you’re running a lean team, balancing service calls, scheduling, and customer demands, billing delays or mistakes directly impact your cash flow. That’s where invoicing software for small business becomes a game-changer. It keeps your invoicing organized, accurate, and fully connected to the jobs your team is finishing in the field.Here’s how the best invoicing software for small business helps small HVAC shops work faster, get paid quicker, and keep things running smoothly.

1. Faster payments right after every job

When your HVAC tech wraps up a job—whether it's a quick repair or a system install—there’s no reason to wait days to send an invoice. With invoicing software, your tech can generate and send the invoice immediately while still at the customer’s location. Faster invoices mean customers pay sooner, and you avoid the cash flow gaps that can crush small businesses running on tighter margins.

2. Fewer billing mistakes that cost you money

Manual invoicing leaves plenty of room for error. Forgetting to charge for parts, missing labor hours, or adding the wrong rate hurts your bottom line. Invoicing software automatically pulls real-time data from each job—materials used, technician time, services performed—so every invoice is complete, accurate, and ready to go. This kind of automation helps small shops avoid profit leaks from simple mistakes.

3. Your entire team stays connected between field and office

For small HVAC companies, it’s common for one or two people to handle both dispatch and billing. When those two systems aren’t connected, invoices get delayed or missed completely. Small business scheduling and invoicing software links job scheduling directly to invoicing, so when a tech closes out a job, the office knows instantly that billing is ready. No more guessing which jobs are done or tracking paperwork that never makes it back to the office.

4. Less time wasted chasing down unpaid invoices

For many small HVAC contractors, the owner or office manager often becomes the collections department too. Instead of spending hours calling or emailing overdue accounts, invoicing software automatically sends reminders at set intervals. Customers stay informed, payments come in sooner, and your small team gets to focus on booking more work instead of chasing checks.

5. Easier billing for maintenance contracts and repeat customers

Maintenance contracts are a steady revenue stream for many small HVAC companies. But manually billing after each seasonal service adds extra steps. Invoicing software automatically generates invoices after each scheduled visit. When paired with dispatch invoicing software, your recurring service calls automatically trigger invoices, cutting down your admin time and ensuring nothing gets missed as your contract base grows.

6. Clear job records tied directly to invoices

When customers question their bill, small businesses can’t afford long disputes. Invoicing software connects each invoice to the exact job report—photos, parts lists, labor hours, and customer sign-offs—giving you easy proof of work. This helps protect your business, keeps customers confident, and cuts down on back-and-forth when questions come up.

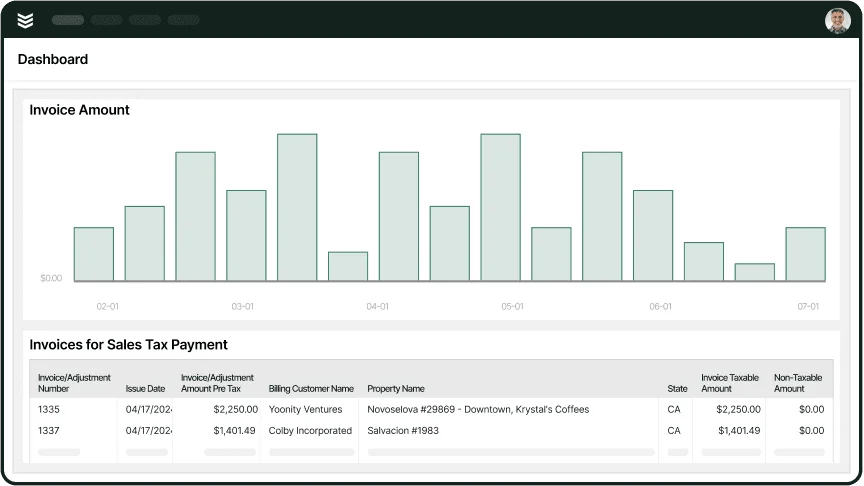

7. A full view of your invoicing health at any moment

Without invoicing software, many small HVAC companies rely on spreadsheets or paper files to track who’s paid and who hasn’t. That leaves room for missed payments and accounting headaches. With invoice automation software, you get a live dashboard showing paid, unpaid, and overdue invoices—so you know exactly where your receivables stand, without sorting through piles of paperwork.

8. Easy to scale as your business grows

For small businesses adding more techs, trucks, and service calls, invoicing software grows with you. You can handle more jobs and customers without needing to hire more office staff just to keep up with billing. Platforms like best field service management software for small business combine job management and invoicing, letting your back office stay lean even as your schedule fills up.

4 important FAQs about small business invoice software answered

Small business contractors depend on accurate, fast billing to keep cash flow healthy. Whether it’s work happening in the field or invoices processed back at the office, the best invoicing software for small business helps service companies stay organized and get paid without delays. Here are a few key questions small HVAC, plumbing, and electrical contractors often ask when evaluating their invoicing software for small businesses.

1. What is invoicing software for small business?

Invoicing software helps small business contractors create, send, and track invoices tied directly to their field service work. It connects your scheduling, job completion, and payment collection into one system. Having this type of software allows your team to generate invoices right after a job is finished.

It helps small businesses, their contractors and field service techs avoid billing delays, reduce errors, and keep payments flowing consistently.

2. How does invoice software for small business work in the field?

The best invoice software for small business allows technicians to generate invoices immediately after completing jobs. Techs log their labor hours, parts used, and service details while still on-site. Once submitted, the system automatically creates a professional invoice, ready to send to the customer for payment. This eliminates the need to return paperwork to the office or rely on manual entry after the fact.

3. Who should use invoice software small business platforms?

Any small business contractor who manages service calls, installations, or maintenance agreements can benefit from invoices software small business platforms. HVAC companies, plumbers, electricians, and field service teams that need to send accurate invoices tied to daily jobs will find it especially valuable. It keeps both office staff and field techs working off the same system, reducing confusion and speeding up the entire payment cycle.

4. What are some best practices for using small business invoice software?

Using small business invoice software correctly helps HVAC contractors avoid delays, eliminate billing errors, and improve cash flow without creating extra work for techs or office staff. Here are proven best practices small businesses should follow:

- Link invoicing directly to your scheduling and job management system

- Allow field technicians to generate invoices immediately after completing jobs

- Use mobile-friendly invoicing apps so billing can happen from any job site

- Automatically pull labor hours and parts directly into each invoice to reduce errors

- Set up recurring invoices for service agreements and maintenance contracts

- Enable automated payment reminders to reduce overdue accounts

- Include job documentation, photos, and customer sign-offs on each invoice for added transparency

- Track unpaid and partially paid invoices in real-time with clear dashboard views

- Offer customers multiple online payment options to simplify collections

- Regularly review invoicing reports to monitor payment trends and spot issues early

For small HVAC contractors and field service businesses, invoicing isn’t just paperwork—it’s how you stay alive. When every job, every hour, and every part used needs to show up on an invoice fast, having invoicing software for small business built for real field work makes all the difference. The right platform keeps your office organized, your techs focused, and your payments coming in without adding layers of complicated processes.

While plenty of invoicing tools handle one piece of the puzzle, most small contractors don’t have the time or staff to juggle multiple disconnected systems. That’s where all-in-one platforms like BuildOps can make the process smoother. By connecting scheduling, dispatch, job tracking, invoicing, and payments into one system, commercial field service teams can handle billing without missing a beat—whether it’s one truck or twenty in the field.

See BuildOps in action

See how our fully connected invoicing system improves efficiency and productivity.