Executive Summary: Chromatography Research Trends in the Construction Industry

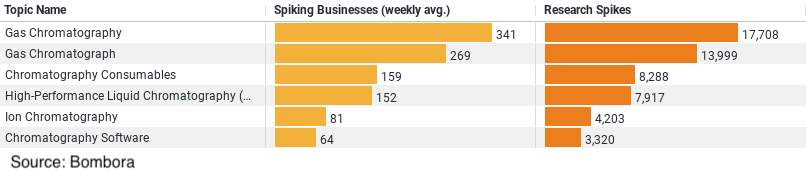

– Gas Chromatography: Dominates the field with 340.52 spiking businesses weekly and 17,708 research spikes.

– Gas Chromatograph: Closely follows with 269.19 spiking businesses and 13,999 research spikes.

– Chromatography Consumables: Significant interest with 159.46 spiking businesses and 8,288 research spikes.

– High-Performance Liquid Chromatography (HPLC): Maintains strong focus with 152.25 spiking businesses and 7,917 research spikes.

– Ion Chromatography: Emerging area with 80.87 spiking businesses and 4,203 research spikes.

The data reveals a substantial emphasis on gas chromatography and related equipment, underscoring their critical role in the construction industry. The continuous engagement with HPLC and chromatography consumables indicates active development and usage, while ion chromatography represents an emerging trend.

Exploring Chromatography: Insights from the Construction Industry

The construction industry is continually evolving, driven by advancements in technology and materials that enhance efficiency, safety, and sustainability. One of the lesser-known but increasingly important areas of research in this field is chromatography. This analytical technique, widely used in various scientific disciplines, is garnering significant attention in construction research. This blog post delves into the top trends and insights from recent data, showcasing how the construction industry is exploring and investing in chromatography.

Chromatography in Construction: An Overview

Chromatography is a powerful technique used to separate mixtures into their individual components. It is crucial for quality control, material testing, and environmental monitoring. In the construction industry, chromatography plays a pivotal role in analyzing materials, detecting contaminants, and ensuring compliance with environmental standards.

Top Trends in Chromatography Research

The latest data reveals several key areas of focus within chromatography research in the construction industry:

1. Gas Chromatography (GC)

– Weekly Avg. Spiking Businesses: 340.52

– Research Spikes: 17,708

Gas chromatography stands out as the most researched topic, with the highest number of businesses and research spikes. This indicates a strong industry focus on analyzing gaseous substances and volatile compounds, essential for ensuring air quality and safety in construction environments.

2. Gas Chromatograph

– Weekly Avg. Spiking Businesses: 269.19

– Research Spikes: 13,999

Closely following gas chromatography, gas chromatographs are critical instruments in the field. Their high research activity underscores their importance in accurately measuring and analyzing gases, which is crucial for various construction applications.

3. Chromatography Consumables

– Weekly Avg. Spiking Businesses: 159.46

– Research Spikes: 8,288

The significant interest in chromatography consumables highlights the ongoing need for high-quality materials and supplies used in chromatographic processes. These consumables are essential for maintaining the accuracy and efficiency of chromatographic analyses.

4. High-Performance Liquid Chromatography (HPLC)

– Weekly Avg. Spiking Businesses: 152.25

– Research Spikes: 7,917

HPLC is another major area of focus, reflecting its application in analyzing liquid samples. In construction, HPLC can be used for testing building materials, detecting pollutants in water, and ensuring the quality of adhesives and coatings.

5. Ion Chromatography

– Weekly Avg. Spiking Businesses: 80.87

– Research Spikes: 4,203

While not as heavily researched as gas chromatography, ion chromatography is an emerging trend. It is particularly useful for detecting and quantifying ions in various substances, which is vital for environmental monitoring and material testing in construction.

The Construction Industry’s Investment in Chromatography

The data clearly indicates that the construction industry is heavily investing in chromatography research. This investment is driven by the need to:

– Ensure Quality Control: Chromatography allows for precise analysis of building materials, ensuring they meet the required standards for strength, durability, and safety.

– Monitor Environmental Impact: As sustainability becomes a priority, chromatography helps detect and mitigate pollutants in construction sites, contributing to greener building practices.

– Enhance Safety: By analyzing air and water samples, chromatography helps identify hazardous substances, protecting workers and residents from potential health risks.

– Innovate with New Materials: The ability to analyze and understand the composition of new materials leads to innovation in construction techniques and products.

Conclusion

The construction industry’s growing interest in chromatography reflects a broader trend of integrating advanced scientific techniques into building practices. By leveraging chromatography, the industry can enhance quality control, ensure environmental compliance, and drive innovation. The significant research activity in gas chromatography, gas chromatographs, and other chromatographic techniques underscores their critical role in shaping the future of construction.

As the industry continues to evolve, we can expect chromatography to remain a key tool in addressing the challenges and opportunities of modern construction. Whether it’s through improving material performance or safeguarding environmental health, chromatography will undoubtedly contribute to a more efficient, safe, and sustainable construction industry.

Company Sample Data

1. Micro Companies (1 – 9 Employees)

– Weekly Avg. Spiking Businesses: 53.21

– Percent of Total Engagement: 7.03%

Despite being the smallest category in terms of employee count, micro companies exhibit a noticeable level of engagement in chromatography research, indicating a niche but significant interest.

2. Small Companies (10 – 49 Employees)

– Weekly Avg. Spiking Businesses: 140.31

– Percent of Total Engagement: 18.54%

Small companies show substantial interest in chromatography, which could be attributed to their flexibility and innovation-driven approach in adopting new technologies and research methodologies.

3. Medium-Small Companies (50 – 199 Employees)

– Weekly Avg. Spiking Businesses: 154.02

– Percent of Total Engagement: 20.35%

Medium-small companies lead in research engagement, suggesting that as companies grow, they invest more in sophisticated analytical techniques like chromatography to enhance quality control and operational efficiency.

4. Medium Companies (200 – 499 Employees)

– Weekly Avg. Spiking Businesses: 101.06

– Percent of Total Engagement: 13.35%

Medium-sized companies also demonstrate a significant level of interest, reflecting their need to maintain high standards in quality and compliance as they scale up operations.

5. Medium-Large Companies (500 – 999 Employees)

– Weekly Avg. Spiking Businesses: 75.23

– Percent of Total Engagement: 9.94%

Medium-large companies continue to invest in chromatography, albeit at a slightly lower level compared to smaller counterparts, possibly due to already established quality control systems and resources.

Insights and Trends

– Increasing Interest with Size: There is a trend where the interest in chromatography research increases with company size up to the medium-small category (50 – 199 employees). This suggests that as companies grow, their capacity and need for advanced research tools like chromatography expand.

– Engagement Peaks in Medium-Small Companies: Medium-small companies (50 – 199 employees) have the highest average weekly engagement. This peak indicates that companies in this size range are actively scaling their operations and leveraging advanced analytical techniques to support this growth.

– Sustained Engagement in Larger Companies: While larger companies (500 – 999 employees) show slightly lower engagement levels compared to medium-small companies, their continued investment indicates the importance of chromatography in maintaining established standards and innovation.

Why This Trend?

1. Resource Allocation: Smaller companies may have limited resources but often show innovation and flexibility in adopting new technologies. As companies grow, they can allocate more resources to research and development, leading to increased engagement in chromatography.

2. Operational Scale: Medium-small companies, experiencing rapid growth, are likely to invest heavily in quality control and analytical techniques to support their scaling operations. This is reflected in their higher engagement levels.

3. Established Systems: Larger companies may already have robust systems in place, which could explain the slight decline in engagement. However, their sustained interest highlights the ongoing need for advanced analytics to maintain high standards.

This analysis highlights the dynamic relationship between company size and research engagement in chromatography within the construction industry. The trend showcases how growing companies prioritize advanced analytical techniques to drive quality, innovation, and compliance in their operations.