Executive Summary: Civil Research Trends in the Construction Industry

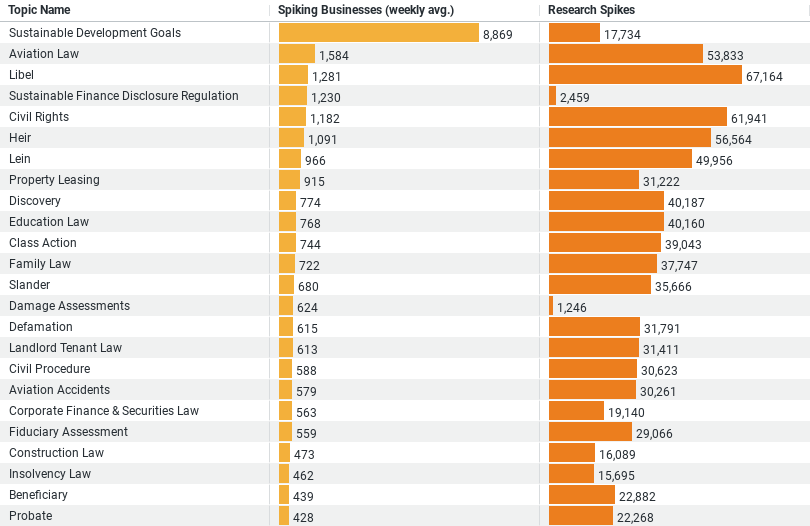

– Sustainable Development Goals lead in consistent weekly interest from businesses, with an average of 8,869 businesses engaging weekly, suggesting a broad and sustained relevance in the industry.

– Libel and Civil Rights are the top subjects for research spikes, indicating that these topics encounter significant peaks in interest, possibly due to regulatory changes or high-profile cases.

– Aviation Law is notable both for its high average weekly interest and significant spikes, reflecting its critical importance and possibly ongoing developments in regulations affecting the construction sector.

– The correlation between average weekly interest and total research spikes across topics is 0.299, indicating a weak relationship, which suggests that topics with steady weekly interest do not necessarily experience high peaks

in interest and vice versa.

Construction Industry Focus: Civil Topics and Emerging Trends

The construction industry is a dynamic field where research and development play a crucial role in shaping business practices and compliance with regulations. Recent data reveals fascinating insights into how businesses within this sector are focusing their research efforts, particularly on topics related to civil issues such as sustainability, legal regulations, and rights. By examining these trends, we can gain a deeper understanding of the industry’s current interests and predict future directions.

Sustainable Development Goals (SDGs) Lead the Way

At the forefront of research interest is the topic of Sustainable Development Goals (SDGs). An average of 8,869 businesses per week are delving into this area, making it the most researched topic in the dataset. The construction industry’s heightened interest in SDGs reflects a broader shift towards sustainability in business practices. This trend is likely driven by increasing regulatory requirements and a growing public demand for environmentally responsible construction practices. The focus on SDGs indicates that businesses are not only seeking to comply with regulations but are also aiming to enhance their corporate responsibility profiles.

Aviation Law and Civil Rights: High Interest with Significant Spikes

Other topics of significant interest include Aviation Law and Civil Rights, both of which see a high level of weekly research and notable spikes in interest. Aviation Law, with an average of 1,584 businesses researching this topic weekly and a total of 53,833 research spikes, highlights the complexities and ever-evolving nature of this field. These spikes may correlate with changes in legislation or high-profile cases affecting the construction industry’s operations in airspace and related infrastructure projects.

Civil Rights, researched by approximately 1,182 businesses weekly with a total of 61,941 spikes, underscores the industry’s focus on compliance with laws ensuring equal opportunity and non-discriminatory practices. This is particularly pertinent in an era where corporate governance and ethical operations are under greater scrutiny by the public and governments alike.

Libel: A Topic of Periodic Intensity

Libel stands out with the highest total research spikes at 67,164, despite a lower weekly research average of 1,281 businesses. The peaks in interest for Libel likely reflect the industry’s response to specific legal challenges or high-profile defamation cases that could impact company reputations and business operations. This topic’s pattern suggests that while it may not command constant attention, it becomes highly relevant when specific incidents arise, demonstrating the industry’s need to quickly adapt to legal challenges.

Analyzing Trends: Weak Correlation Between Consistency and Intensity

The analysis reveals a weak correlation (0.299) between the average number of businesses researching a topic weekly and the total research spikes. This suggests that topics with consistent research interest do not necessarily experience intense periods of research and vice versa. For instance, while Sustainable Development Goals maintain steady interest due to their ongoing relevance, topics like Libel experience bursts of intense research activity likely triggered by particular events.

Implications for the Construction Industry

These insights have several implications for the construction industry. Firstly, the focus on Sustainable Development Goals indicates a strategic alignment with global efforts to promote sustainability, which could enhance company reputations and operational efficiencies. Secondly, the periodic spikes in topics like Libel and Aviation Law highlight the need for businesses to remain agile and responsive to immediate challenges. Lastly, the weak correlation between consistent and intense research interests suggests that businesses must maintain a balance between steady, ongoing research activities and the ability to mobilize resources in response to specific events.

Conclusion

In summary, the construction industry’s research patterns reveal a complex landscape of interests and priorities, with a clear emphasis on civil-related topics. By understanding these trends, businesses can better position themselves to address both the steady demands of regulatory compliance and the acute challenges posed by specific legal and ethical issues. This dual focus will be crucial for sustaining growth and maintaining competitiveness in a rapidly evolving industry.

Company Sample Data Analysis

– Company Size: This column categorizes companies based on the number of employees. The categories include Micro (1-9 employees), Small (10-49 employees), Medium-Small (50-199 employees), Medium (200-499 employees), and Medium-Large (500-999 employees).

– Spiking Businesses (weekly avg.): Indicates the average weekly number of businesses within each size category that are researching specific topics.

– Percent of Total: Reflects the percentage that each company size category contributes to the total number of researching businesses.

Here’s a breakdown of the data and an analysis of why these trends might be observed:

Company Size Engagement in Research

– Micro (1 – 9 Employees): This segment, despite its smaller size, shows a substantial amount of research activity with 1,068.65 average weekly researching businesses, making up approximately 10.79% of the total. This indicates that even the smallest enterprises are keen on staying informed and competitive, possibly focusing on niche areas where they can compete effectively.

– Small (10 – 49 Employees): Small companies are more active, with 2,837.54 average weekly researching businesses, accounting for 28.65% of the total. This higher engagement might be due to these companies having slightly more resources compared to micro-sized businesses, allowing them to invest more in research to expand their operations or improve efficiency.

– Medium-Small (50 – 199 Employees): These businesses are the most active in research, with 3,036.5 average weekly researching businesses, contributing to 30.65% of the total. At this size, companies likely have established research and development departments and greater capital to invest in innovation and compliance, driving their higher engagement.

– Medium (200 – 499 Employees): There’s a notable drop in research activity in this category, with 1,382.04 average weekly researching businesses, making up 13.95% of the total. This decrease might suggest that companies of this size may be in a transitional phase, possibly optimizing their operations and focusing more on applying past research rather than seeking new information.

– Medium-Large (500 – 999 Employees): The smallest proportion of research is conducted by medium-large companies, with only 652.19 average weekly researching businesses, or 6.58% of the total. This could be due to these companies having well-established practices and lesser need for frequent research, relying instead on their existing frameworks and systems.

Implications and Trends

The trend indicates that the intensity of research activity peaks in the medium-small size category and then gradually decreases as companies grow larger. This might be due to several factors:

– Resource Allocation: Smaller companies might allocate a higher proportion of their resources to research to find niches or innovative methods to compete against larger firms.

– Operational Necessities: As companies grow, they might shift focus towards scaling their operations and integrating their existing knowledge rather than seeking new insights.

– Efficiency and Implementation: Larger companies might focus more on refining and implementing strategies developed from past research.

These insights suggest that as companies grow, the focus of their research activities shifts from high engagement to more strategic and possibly less frequent research undertakings. This could reflect a maturation process where the need for constant research diminishes as companies establish more stable and efficient operational models.