Executive Summary: Intellectual Property Research Trends in the Construction Industry

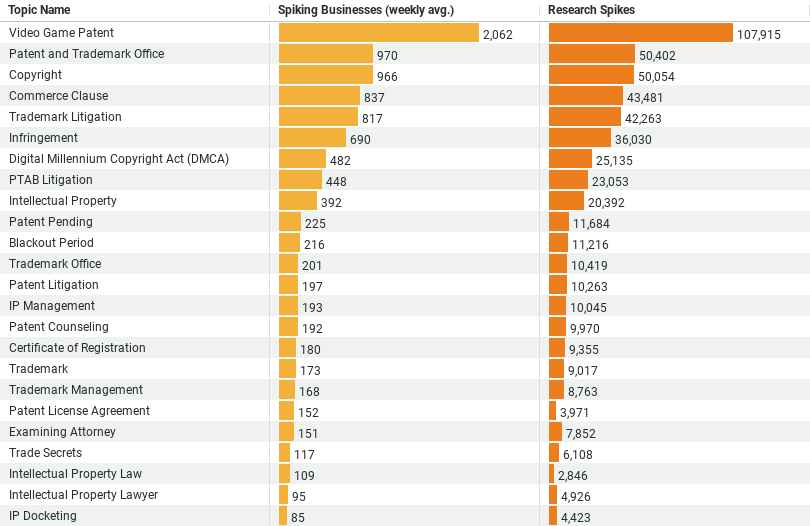

1. Video Game Patent is the most researched topic, with an average of 2061.5 businesses researching it weekly and a total of 107,915 research spikes. This suggests a significant interest in protecting innovations in gaming technology, possibly indicating a trend towards gamification or virtual simulations in construction projects.

2. Patent and Trademark Office research comes next, with about 969.85 businesses focusing on it weekly and a total of 50,402 research spikes. This highlights the importance of official registrations and legal protections for innovations and brands within the industry.

3. Copyright follows closely, with an average of 965.56 businesses per week and 50,054 research spikes, indicating a keen interest in protecting original works of authorship, including architectural designs and software.

4. Commerce Clause research is also notable, with 836.9 businesses researching it weekly on average and 43,481 research spikes, suggesting concerns or strategies related to interstate commerce and its implications on construction operations.

5. Trademark Litigation has an average weekly research interest from 816.98 businesses, with a total of 42,263 research spikes. This points to the importance of brand protection and the potential for disputes over trademarks in the industry.

These insights reveal a strong emphasis on protecting intellectual property in the construction industry, ranging from patents and copyrights to trademarks. The high level of interest in these topics suggests that businesses in this sector are increasingly focused on innovation, legal protections, and the competitive advantage that intellectual property rights can provide.

The Intellectual Property Frontier in Construction

Our analysis draws on data indicating the average weekly number of businesses researching specific IP-related topics and the total research spikes observed. The top topics reveal a diverse range of interests, from video game patents to copyright concerns, reflecting the industry’s multifaceted approach to IP.

Video Game Patent Leads the Way

Surprisingly, the most researched topic is “Video Game Patent,” with an average of 2,061.5 businesses focusing on it weekly and a whopping 107,915 research spikes. This trend might seem out of place at first glance. However, it underscores the construction industry’s move towards digitalization, including the use of gamification, virtual reality (VR), and augmented reality (AR) for training, simulation, and project visualization. Securing patents in these areas signifies the industry’s investment in cutting-edge technologies to enhance efficiency, safety, and client engagement.

The Role of the Patent and Trademark Office

The “Patent and Trademark Office” emerges as the second most researched topic, with around 969.85 businesses exploring it weekly. This interest highlights the critical importance of navigating the legal landscape of patents and trademarks. By understanding and leveraging the services of the Patent and Trademark Office, construction firms aim to protect their innovations, from construction methods to building materials, ensuring a competitive edge in the market.

Copyright Concerns in Construction

Closely following is the topic of “Copyright,” with 965.56 businesses researching it weekly. The construction industry produces a wealth of original works, including architectural designs, software, and even marketing materials. Protecting these assets through copyright is essential for maintaining exclusivity and preventing unauthorized use, thus safeguarding the intellectual and creative investments of businesses.

Understanding the Commerce Clause

The research on the “Commerce Clause” by an average of 836.9 businesses weekly signals the industry’s attention to interstate commerce laws. These laws can significantly impact construction projects, especially those that span multiple states. Understanding the Commerce Clause helps firms navigate regulatory requirements, ensuring smooth operation and compliance across state lines.

Trademark Litigation: A Cautionary Tale

Lastly, “Trademark Litigation” sees an average weekly research interest from 816.98 businesses. This topic’s prominence highlights the challenges and disputes that can arise over trademarks within the industry. From company logos to proprietary construction techniques, trademarks are vital for brand identity and protection. The focus on litigation indicates the potential conflicts in this area and the importance of robust legal strategies to defend trademarks.

The Broader Implications

These insights into the construction industry’s IP research interests reveal a sector that is increasingly leaning towards innovation, digitalization, and legal protection. By securing patents, copyrights, and trademarks, firms not only protect their assets but also pave the way for groundbreaking developments in construction technology and practices. The focus on topics like the Commerce Clause and trademark litigation further illustrates the industry’s commitment to navigating the complex legal landscape of IP, ensuring both compliance and competitive advantage.

The construction industry’s research into IP underscores a strategic shift towards embracing technology and innovation while safeguarding these advances through legal means. As businesses continue to explore and invest in these areas, the future of construction looks poised for a revolution, marked by a fusion of traditional building techniques with the digital age’s cutting-edge innovations. This evolution promises not only enhanced efficiency and safety on construction sites but also a new era of creativity and competitiveness in the sector.

Company Sample Data

1. Micro (1 – 9 Employees): Represents the smallest companies, with a weekly average of 590.06 businesses researching IP, accounting for approximately 9.78% of the total.

2. Small (10 – 49 Employees): Shows a significant increase, with 1,589.17 businesses on average per week, representing about 26.34% of the total.

3. Medium-Small (50 – 199 Employees): This category has the highest weekly average of IP research, with 1,765.23 businesses, making up 29.26% of the total.

4. Medium (200 – 499 Employees): Sees a decrease to 885.15 businesses researching IP weekly, accounting for 14.67% of the total.

5. Medium-Large (500 – 999 Employees): Further reduction, with an average of 456.29 businesses per week, comprising 7.56% of the total.

Analysis and Trends

This data reveals a fascinating trend regarding IP research intensity across different company sizes:

– High Engagement Among Medium-Small Businesses: The peak of IP research activity occurs within the Medium-Small (50 – 199 Employees) category. This could indicate that businesses at this scale have reached a level of operational maturity and resource availability that allows them to actively engage in and prioritize IP research. They might be seeking to protect their innovations as a strategy for competitive differentiation and growth.

– Declining Activity with Increasing Company Size: After reaching the peak in the Medium-Small category, there’s a noticeable decline in the weekly average of businesses engaging in IP research as company size increases. This trend could suggest that larger companies, despite having more resources, may rely more on established IPs or have dedicated teams focusing on IP, leading to fewer spikes in research activity. Alternatively, it could reflect a shift in focus towards other strategic priorities at scale.

– Significant Activity in Small Companies: Small companies (10 – 49 Employees) also show substantial engagement in IP research. This suggests an awareness of the importance of IP in securing a competitive edge and possibly the intention to grow or diversify their business.

– Micro Businesses: Even the smallest companies are active in IP research, though to a lesser extent. This engagement underscores the universal relevance of IP across all business sizes, possibly driven by the digital economy’s democratization of innovation.

Implications

The data underscores the strategic importance of IP research across the business spectrum, highlighting distinct patterns of engagement correlated with company size. Medium-Small businesses appear to be the most active, potentially indicating a strategic sweet spot where the ambition to innovate meets the practical ability to invest in IP research and protection. In contrast, larger entities show a relative decline in research activity, possibly due to different strategic focuses or methodologies in handling IP.

This trend reflects broader economic and industry dynamics, where IP is a critical lever for competitive advantage, innovation, and growth. Understanding these patterns can inform policymakers, business leaders, and IP professionals about where to focus educational and support efforts to maximize IP’s impact across the economic landscape.