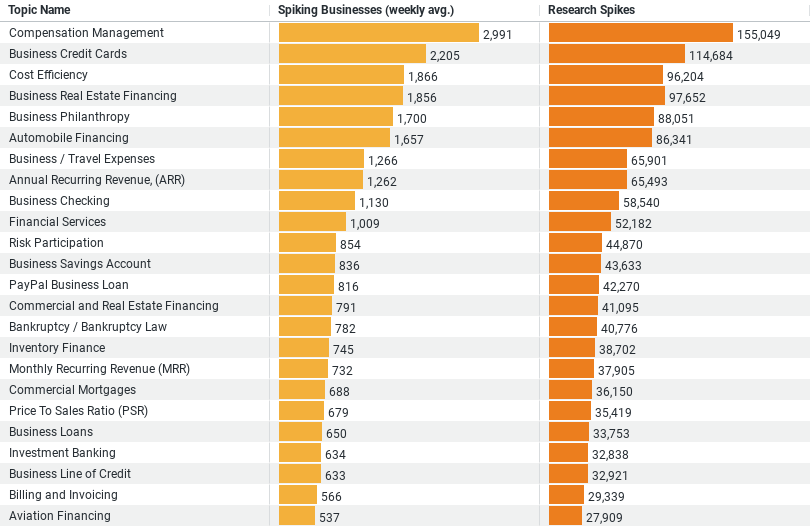

(Data visualized in the chart captures buying and research signals for the past 365 days)

Executive Summary: Business Finance Research Trends in the Construction Industry

Analyzing the data from the construction industry’s research activities in Business Finance reveals significant insights:

– Compensation Management is at the forefront, highlighting the industry’s priority in managing workforce expenses, with an impressive 155,049 research spikes.

– Business Credit Cards and Business Real Estate Financing show the sector’s active search for financial tools and solutions, with over 100,000 research spikes each, indicating a strong need for financial products and real estate financing options.

– Cost Efficiency emerges as a critical focus area, with businesses striving to enhance operational efficiencies, evidenced by 96,204 research spikes.

– Business Philanthropy indicates an increasing trend towards corporate social responsibility, with 88,051 research spikes, showcasing the industry’s commitment to giving back to the community.

Insights from the Construction Industry’s Focus on Business Finance

In today’s rapidly evolving economic environment, the construction industry stands out for its dynamic approach to managing financial complexities. A deep dive into recent data reveals intriguing insights into how businesses within this sector are prioritizing their research and interests in various aspects of Business Finance. This exploration uncovers the strategic areas that are capturing the industry’s attention, from compensation management to business philanthropy, highlighting a multifaceted approach to financial excellence.

The Pinnacle of Interest: Compensation Management

At the heart of the industry’s financial focus is Compensation Management, which has emerged as the leading topic of interest. With an astonishing 155,049 research spikes and a weekly average of approximately 2,991 spiking businesses, it’s clear that managing compensation effectively is a top priority. This surge in interest underscores the critical importance of designing and implementing robust compensation strategies that not only attract but also retain top talent in a highly competitive landscape. Moreover, as construction projects grow in complexity and scale, the ability to manage workforce costs efficiently becomes paramount, driving businesses to seek innovative solutions in this area.

Financial Tools at the Fore: Business Credit Cards and Real Estate Financing

Following closely are the topics of Business Credit Cards and Business Real Estate Financing, each drawing considerable attention with over 100,000 research spikes. These areas highlight the construction industry’s proactive search for financial tools and solutions that can support operations and facilitate growth. With approximately 2,205 businesses weekly delving into the nuances of business credit cards, the focus is on leveraging credit to manage cash flow, purchase materials, and sustain operations. Similarly, the interest in Business Real Estate Financing, reflected in 97,652 research spikes, points to the critical role of financing in acquiring, developing, and managing property—a fundamental aspect of construction projects.

The Quest for Efficiency: Cost Optimization

Cost Efficiency emerges as another critical area of focus, with 1,866 businesses on average exploring this topic weekly, accumulating 96,204 research spikes. In an industry where margins can be tight and competition fierce, the quest for operational efficiency is relentless. Businesses are actively seeking strategies and technologies that can help reduce costs, enhance productivity, and ultimately improve the bottom line. Additionally, this emphasis on cost efficiency reflects the industry’s acknowledgment that optimizing operations is key to maintaining competitiveness and achieving financial health.

A Commitment to Community: Business Philanthropy

Interestingly, Business Philanthropy also ranks among the top interests, with 1,700 businesses researching this topic weekly, leading to 88,051 research spikes. This trend indicates a growing recognition of the importance of corporate social responsibility and the desire to give back to the community. In the construction industry, where projects can significantly impact local communities and environments, engaging in philanthropic activities is becoming an integral part of business strategy. Moreover, this not only helps in building a positive brand image but also strengthens community relations and supports sustainable development.

Conclusion

The construction industry’s focused research and interest in Business Finance topics reveal a comprehensive approach to navigating financial challenges. From the strategic management of compensation and the utilization of financial tools to the optimization of costs and a commitment to philanthropy, businesses are exploring a broad spectrum of areas to enhance financial stability and foster growth. These insights not only highlight the industry’s adaptability and resilience but also its dedication to excellence and social responsibility. As the sector continues to evolve, its proactive engagement with financial management practices will undoubtedly play a critical role in shaping its future success.

Company Sample Data

The company sample data provides a structured overview of businesses’ research activities in Business Finance, segmented by company size. Here’s a brief description based on the initial data:

– Company Size Categories: The data is divided into distinct categories based on company size, ranging from “Micro (1 – 9 Employees)” to “Medium-Large (500 – 999 Employees).” This categorization helps in understanding the intensity and focus of Business Finance research activities across different scales of operation.

– Spiking Businesses (weekly avg.): This column shows the average weekly count of businesses within each size category that have shown a significant spike in researching Business Finance topics. For example, Small (10 – 49 Employees) businesses have the highest weekly average of spiking businesses at 5,200.8, indicating a keen interest in Business Finance within this segment.

– Percent of Total: This metric represents the proportion of businesses in each category that contribute to the total Business Finance research activity observed. Small businesses (10 – 49 Employees) account for the largest share at 31.7%, followed closely by Medium-Small (50 – 199 Employees) businesses at 31.5%.

Key Insights and Trends

1. Interest Across Sizes: The distribution of interest in Business Finance varies significantly across different company sizes. This variation likely reflects the differing needs and resources available to companies of various scales. Smaller businesses might focus on basic financial management and growth strategies, while larger entities might delve into more complex financial instruments and strategies.

2. High Activity in Small and Medium-Small Businesses: The high weekly average of spiking businesses and the substantial percent of total in the Small (10 – 49 Employees) and Medium-Small (50 – 199 Employees) segments suggest that businesses within these sizes are particularly active in researching Business Finance. This could be due to the critical growth phase these companies are in, where effective financial management can significantly impact their development and scaling efforts.

3. Micro Businesses’ Engagement: Despite being the smallest in scale, Micro (1 – 9 Employees) businesses also show a notable engagement in Business Finance research. This reflects the fundamental importance of financial knowledge and planning even at the earliest stages of business development.

4. Decreasing Engagement with Increasing Size: As companies grow larger (Medium to Medium-Large), there’s a noticeable decrease in the weekly average of spiking businesses and their percent of total contribution. This trend could be attributed to larger companies having more established financial practices and departments, reducing the need for external research or the frequency of significant spikes in such activities.

In summary, the data highlights the vibrant and varied landscape of Business Finance research within the construction industry, showcasing how companies of different sizes prioritize and engage with financial management and planning activities.