Executive Summary: Manufacturing Research Trends in the Construction Industry

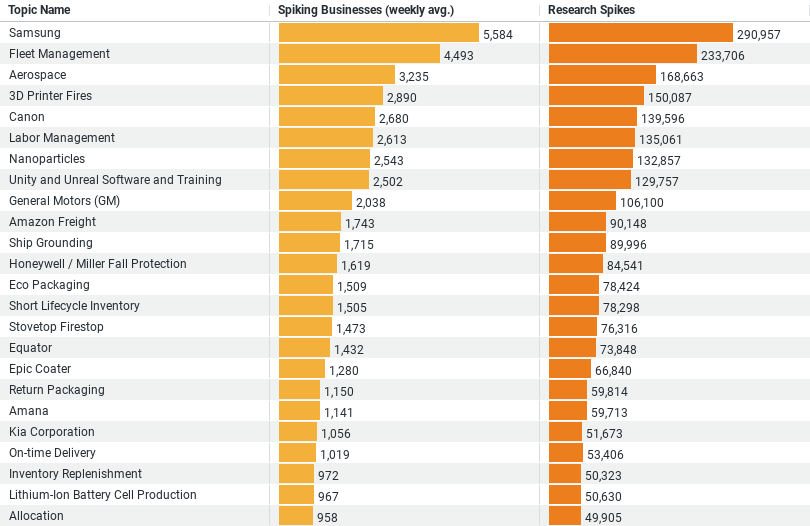

1. High Engagement Topics: The dataset reveals that Samsung is the most researched topic, with a substantial weekly average of 5,583.9 businesses showing interest and a total of 290,957 research spikes. This indicates a strong industry focus on technologies or collaborations related to Samsung.

2. Important Technologies: Fleet management and aerospace are also significant, with 4,492.8 and 3,235.1 businesses researching these topics weekly, respectively. These high numbers suggest a keen interest in integrating advanced fleet management solutions and aerospace technologies within construction processes.

3. Safety and Technology Integration: The topic of “3D Printer Fires” indicates a focus on safety concerns associated with using advanced manufacturing technologies like 3D printing, involving 2,890.25 businesses weekly. This highlights a proactive approach towards managing and mitigating risks.

4. Specialized Equipment Research: Canon, commonly associated with imaging and printing technologies, is also notably researched by 2,680.23 businesses weekly. This suggests an interest in adopting specialized imaging solutions in construction activities.

5. Industry Trends: The dataset illustrates a trend towards adopting and integrating diverse technologies from different sectors such as electronics, aerospace, and imaging within the construction industry, highlighting a cross-industry synergy aimed at enhancing efficiency, safety, and innovation.

Exploring Manufacturing Trends in Construction: Key Insights from Recent Data

The construction industry is increasingly integrating advanced manufacturing technologies to enhance efficiency, ensure safety, and innovate at a rapid pace. A recent analysis of industry data has revealed significant insights into the construction sector’s research interests in manufacturing, highlighting key trends that could define the future of both industries. This blog post delves into these insights, providing a clearer understanding of the current focus areas and technological intersections that are shaping construction today.

1. Dominant Interest in Samsung Technologies

Leading the chart is the high interest in technologies and solutions provided by Samsung. The data shows a staggering weekly average of 5,583.9 businesses exploring Samsung-related topics, accumulating a total of 290,957 research spikes. This indicates a strong industry focus, potentially in areas such as smart construction technologies, IoT integration, and robust communication tools that Samsung offers. The construction industry’s keen interest in Samsung may stem from the company’s advancements in smart devices and integrated systems that promise to streamline construction operations and enhance project management capabilities.

2. Fleet Management Innovations

Another significant area of interest is fleet management, which saw 4,492.8 businesses researching weekly, with a total of 233,706 research spikes. Fleet management technology is crucial in construction as it helps in tracking and managing the various vehicles and mobile equipment essential for construction projects. Innovations in this area can lead to better logistics management, reduced operational costs, and improved maintenance schedules, all of which are vital for the timely and budget-friendly completion of construction projects.

3. Aerospace Technology Applications

The intersection of aerospace and construction might not be the first link one might think of, yet the data suggests a robust connection with 3,235.1 businesses focusing on this area weekly. This crossover likely explores the use of aerospace technology in construction materials, engineering methods, and even the utilization of drones for site surveying and monitoring. With 168,663 research spikes noted, it’s clear that the construction sector is keen on adopting cutting-edge aerospace technologies to possibly enhance structural integrity and explore new building techniques.

4. Focus on Safety in 3D Printing

3D printing is revolutionizing construction by enabling more precise and cost-effective building methods. However, the interest in “3D Printer Fires” shows a concerted effort to address and mitigate the risks associated with this technology. With 2,890.25 businesses researching this topic weekly, safety standards and fire prevention methods are a major focus area, underlining the industry’s commitment to safe and sustainable innovation.

5. Canon’s Specialized Solutions

Canon is another key player, with 2,680.23 businesses weekly delving into research related to their technologies, summing up to 139,596 spikes. In construction, Canon’s high-resolution imaging and printing solutions can be vital for detailed architectural drawings, precise documentation, and efficient project planning.

These trends illustrate how the construction industry is not just limited to traditional building methods but is eagerly adopting varied technologies to improve various facets of construction management. The integration of diverse technological solutions from sectors like electronics, aerospace, and imaging is part of a broader trend towards a more interconnected industrial landscape. This synergy is not only enhancing operational efficiencies but is also paving the way for innovative approaches to construction challenges.

The implications of these trends are vast. As construction firms continue to explore and integrate these technologies, we can expect to see significant improvements in project timelines, cost management, safety protocols, and overall construction quality. For industry professionals, staying abreast of these trends is essential. It not only informs strategic decisions but also ensures that they remain competitive in a rapidly evolving industry landscape.

In conclusion, the construction industry’s active research into manufacturing technologies is a clear indicator of its direction towards greater integration and technological adoption. This ongoing evolution promises to bring about more robust, efficient, and innovative construction practices that could redefine the standards and expectations of the industry worldwide.

Company Sample Data Overview

1. Company Size: Classification of companies based on the number of employees, ranging from micro-sized firms (1-9 employees) to large companies (1000+ employees).

2. Spiking Businesses (weekly avg.): The average weekly number of businesses within each size category showing a spike in research activity.

3. Percent of Total: The proportion of each company size category’s research activity relative to the total observed across all sizes.

Insights and Trends

– Micro (1 – 9 Employees): These smallest business entities show an average of 4,559.65 businesses spiking in research weekly, making up about 14.56% of total activity. This suggests that even with limited resources, micro businesses are actively seeking new information and technologies, possibly to find niche advantages or cost-effective solutions.

– Small (10 – 49 Employees): This category shows the highest activity with an average of 11,645.21 businesses spiking weekly, accounting for 37.20% of the total. Small businesses, often in growth phases, might be researching to expand capabilities, enter new markets, or innovate within their industry sectors.

– Medium-Small (50 – 199 Employees): With 9,387.52 businesses spiking on average each week and making up about 29.98% of the total, medium-small businesses are also significantly active. This could be driven by the need to compete with larger players and the necessity to optimize and improve operational efficiencies.

– Medium (200 – 499 Employees) and Medium-Large (500 – 999 Employees): These groups show lower activity relative to smaller companies, with 2,983 and 1,187.69 spiking businesses respectively. As companies grow larger, they might consolidate their research activities or focus on fewer, more substantial innovations.

– Large (1000+ Employees): Not shown in the snippet but likely included, would typically have a different set of strategic focuses possibly related to scaling, global expansion, and leveraging big data and AI.

Why This Is a Trend

The trend seen here, where smaller companies display proportionally higher research activity, could be indicative of the dynamic and competitive nature of smaller businesses. These businesses often need to stay agile, adapt quickly to market changes, and continuously innovate to survive against larger corporations. In contrast, larger companies might focus their research more strategically and have dedicated teams or departments, leading to less volatility in their research activities.