Executive Summary: Consumer Research Trends in the Construction Industry

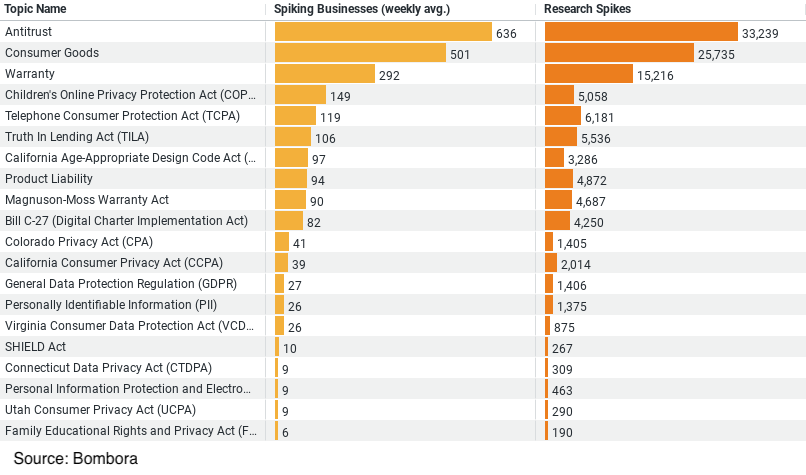

– Antitrust Concerns Predominate: The topic of Antitrust is the most researched, with a weekly average of 635 businesses showing interest and a total of 33,239 research spikes. This suggests heightened vigilance and concern around legal compliance with antitrust laws within the industry.

– Significant Interest in Consumer Goods and Warranty: Consumer Goods and Warranty are also highly researched topics, indicating a robust focus on product quality and consumer guarantees. These areas show weekly averages of 501 and 292 businesses engaging respectively, highlighting their importance in maintaining consumer trust and satisfaction.

– Attention to Consumer Privacy Regulations: Research on consumer privacy regulations like the Children’s Online Privacy Protection Act (COPPA) and the Telephone Consumer Protection Act (TCPA) shows substantial engagement, reflecting ongoing efforts to comply with evolving privacy standards.

– Varying Levels of Research Activity: The dataset reveals a wide range of research activity, from over 33,000 spikes for Antitrust to lower, yet significant, activity around other key topics, emphasizing the dynamic nature of research interests in the industry depending on regulatory and market developments.

Consumer Focus in Construction: Insights from Industry Research

The construction industry, often viewed through the lens of urban development and architectural innovation, is increasingly focusing its research on consumer-related topics. This shift highlights a proactive approach to not only abide by regulations but also to enhance consumer trust and satisfaction. By delving into the recent data on the industry’s research trends, we can gain a clearer picture of its priorities and challenges in addressing consumer needs.

Regulatory Compliance Takes Center Stage

Top of the research agenda is compliance with antitrust laws. The data reveals an impressive average of 635 construction businesses per week engaging in research related to antitrust topics, with a total of 33,239 research spikes. This indicates a robust industry-wide effort to understand and adhere to legal frameworks that promote fair competition. The high volume of research in this area reflects the industry’s awareness of the severe implications non-compliance can bring, including heavy fines and reputational damage.

Antitrust laws are crucial in ensuring that companies operate on a level playing field, and the construction industry’s keen interest in this area suggests a commitment to ethical practices and a competitive market structure. Such vigilance is essential not only for legal compliance but also for fostering a healthy market environment that benefits consumers directly.

Emphasis on Quality and Guarantees

Another significant area of focus is on consumer goods and warranties, as evidenced by the weekly average of 500 and 292 businesses researching these topics, respectively. This interest underscores the industry’s dedication to product quality and reliability—factors that are directly tied to consumer satisfaction. Research into warranties, in particular, highlights a promise of durability and service assurance that construction businesses are keen to communicate to their clients.

The industry’s focus on warranties also suggests an understanding of the long-term engagement with consumers, who expect not just initial quality but also ongoing support. By emphasizing warranties and the quality of consumer goods, construction companies are not just selling a product but also offering a commitment to their consumers’ sustained satisfaction and trust.

Protecting Consumer Privacy

Privacy regulations such as the Children’s Online Privacy Protection Act (COPPA) and the Telephone Consumer Protection Act (TCPA) are also areas of significant interest, with notable levels of research activity. This indicates the industry’s proactive stance on consumer privacy, an increasingly pertinent issue as digital interactions with consumers expand. With 5,058 and 6,181 research spikes for COPPA and TCPA respectively, it’s clear that construction firms are keenly aware of the need to safeguard consumer information, a critical aspect of consumer rights.

The focus on privacy laws also reflects the broader industry trend towards digitalization. As more consumer interactions shift online, from sales inquiries to customer service, the need to understand and implement robust privacy protections has become paramount. This not only helps in compliance with stringent laws but also builds consumer confidence in the industry’s digital platforms.

Dynamic Research Interests

The varying levels of research activity across different topics illustrate the dynamic nature of the construction industry’s interests. Regulatory issues such as antitrust laws often see spikes in research due to changes in legislation or high-profile legal cases. Similarly, shifts in consumer preferences or market trends can trigger increased research into product quality and warranties.

This responsiveness to external changes highlights the industry’s commitment to staying ahead of developments that impact their consumer relations. It also points to an adaptive research strategy that prioritizes areas of immediate relevance to their operations and consumer expectations.

Conclusion

The construction industry’s focused research on consumer-related topics is a testament to its evolving approach towards more consumer-centric operations. By prioritizing areas such as regulatory compliance, product quality, warranties, and consumer privacy, the industry is not only addressing its immediate compliance needs but is also building a foundation of trust and reliability with its consumers. As this trend continues, we can expect to see a more responsive and consumer-focused industry emerge, one that values transparency and quality as much as architectural and structural innovation.

Company Sample Data

1. Company Size: This categorizes companies based on the number of employees. Categories include Micro, Small, Medium-Small, Medium, and Medium-Large.

2. Spiking Businesses (weekly avg.): The average number of businesses in each category that showed a spike in research or interest in a given week.

3. Percent of Total: The percentage of the total businesses that each size category represents.

Analysis of Trends by Company Size:

– High Engagement in Medium-Sized Companies: Medium-Small companies (50 – 199 employees) show the highest weekly average of spiking businesses, suggesting that companies in this size range are particularly active in researching or pursuing new opportunities. This could be due to their capability to allocate more resources to research compared to smaller companies, while still being agile enough compared to larger companies.

– Significant Activity in Small and Medium Companies: Both Small and Medium categories also show substantial activity. This indicates a strong interest and capability in these segments to engage with market trends and possibly innovate or pivot more quickly than larger corporations.

– Micro and Medium-Large Companies Show Lower Engagement: Micro and Medium-Large companies have lower engagement levels. The smaller size might limit the micro companies’ ability to engage deeply due to resource constraints. On the other hand, Medium-Large companies might be facing the complexities associated with larger organizational structures, which can slow down rapid research and adaptive actions.

Medium-Small to Medium companies appear to be in a ‘sweet spot’, balancing agility and resource availability effectively, thereby showing higher levels of research activity and intent to adapt. This capability to actively engage with market dynamics is crucial in today’s fast-paced business environment.