Executive Summary: Tools & Electronics Research Trends in the Construction Industry

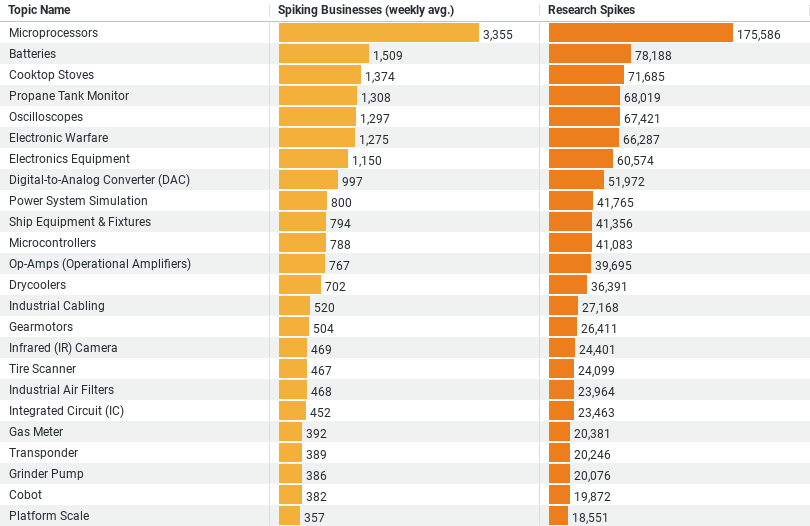

1. Microprocessors are the most researched topic, with an average of 3,354.63 businesses researching weekly and a total of 175,586 research spikes. This indicates a high interest in advanced technology and automation within the construction industry.

2. Batteries rank second, with 1,509.27 businesses researching them weekly and a total of 78,188 research spikes. This suggests a significant interest in power solutions and energy storage, which are critical for tools and electronics in construction.

3. Cooktop Stoves are also a popular research topic, with an average of 1,373.96 businesses researching weekly and a total of 71,685 research spikes. This might highlight a growing interest in integrating advanced kitchen technologies in construction projects.

4. Propane Tank Monitors have attracted attention, with 1,307.92 businesses researching them weekly and a total of 68,019 research spikes. This indicates an interest in safety and efficiency in fuel usage, important for both construction sites and the end-users of constructed spaces.

5. Oscilloscopes are researched by an average of 1,297.06 businesses weekly, with a total of 67,421 research spikes. This points to a demand for precise measurement and testing equipment, essential for quality assurance in electronic installations and maintenance.

These trends suggest a strong focus on technology integration, energy efficiency, safety, and quality assurance in the construction industry’s approach to tools and electronics.

Microprocessors: Leading the Charge

Topping the list of research interests are microprocessors, with an impressive average of 3,354.63 businesses delving into this topic weekly, accumulating a total of 175,586 research spikes. This overwhelming interest underscores the construction industry’s shift towards digitization and automation. Microprocessors, the brains behind computing devices, are now seen as vital components in modern construction equipment. Their integration promises not only to enhance operational efficiency but also to introduce a new level of precision and control in construction projects. The data suggests that businesses are keen on harnessing these advanced technologies to gain a competitive edge.

Batteries: Powering Innovations in 2024

The research on batteries, with 1,509.27 businesses exploring this area weekly and marking 78,188 research spikes, highlights the industry’s focus on sustainable and reliable energy solutions. Batteries are crucial for powering a wide array of tools and machinery on construction sites, from handheld devices to heavy equipment. The interest in this area reflects the industry’s move towards more sustainable practices, seeking out energy storage solutions that can support the demanding environments of construction sites while minimizing environmental impact.

Cooktop Stoves: An Unexpected Contender

Interestingly, cooktop stoves have also captured the industry’s attention, with 1,373.96 businesses researching them weekly, leading to 71,685 research spikes. This unexpected trend might signal a broader interest in incorporating modern amenities and technologies into construction projects, particularly in residential and commercial kitchens. It suggests that the construction industry is not just about the bricks and mortar but also about enhancing the end-user experience with innovative technologies.

Propane Tank Monitors: Ensuring Safety and Efficiency

Propane tank monitors are another area of keen interest, with 1,307.92 businesses exploring them weekly and a total of 68,019 research spikes. This trend underscores the industry’s commitment to safety and efficiency, particularly in managing fuel sources. Propane tank monitors can help prevent accidents, ensure an uninterrupted supply, and optimize fuel usage — critical factors in maintaining safety and efficiency on construction sites.

Oscilloscopes: Precision in Construction

Finally, oscilloscopes are being researched by an average of 1,297.06 businesses weekly, with 67,421 research spikes noted. This interest in oscilloscopes, instruments that visualize varying signal voltages, highlights the construction industry’s focus on precision and quality assurance. Such tools are essential for diagnosing issues, ensuring that electrical installations meet stringent standards, and maintaining the overall integrity of construction projects.

Conclusion: A Tech-Driven Future

The data provides a compelling narrative of a construction industry at the cusp of a technological revolution. The research trends in Tools & Electronics signal a move towards integrating cutting-edge technologies to enhance efficiency, safety, and sustainability. From microprocessors that promise smarter construction machinery to batteries that offer greener energy solutions, the industry’s research priorities reflect a commitment to innovation and quality.

As the construction sector continues to evolve, these insights into its research interests offer a glimpse into the future of construction — a future where technology and tradition merge to create safer, more efficient, and more sustainable building practices. The data not only highlights the current state of research and development within the industry but also points to a tech-driven trajectory that could redefine construction in the years to come.

Company Sample Data

– Micro (1 – 9 Employees): This category sees an average of 1,521.56 businesses engaging in research weekly, constituting about 11.15% of the total activity. The significant engagement from micro-enterprises indicates a robust interest in leveraging Tools & Electronics to enhance operational efficiency and competitive edge, despite their limited resources.

– Small (10 – 49 Employees): Small businesses lead in research intensity, with 4,178.75 businesses actively researching weekly, making up 30.62% of the total activity. This trend underscores the strategic focus of small enterprises on adopting technological innovations to scale operations and improve productivity.

– Medium-Small (50 – 199 Employees): With 4,229.73 businesses researching weekly, medium-small companies slightly outpace small businesses in research activity, accounting for 30.99% of the total. This group’s leading position highlights a keen interest in exploring advanced tools and technologies to drive growth and efficiency.

– Medium (200 – 499 Employees): Medium-sized businesses show a moderate level of research activity, with 1,748.69 businesses engaging in research weekly, representing 12.82% of the total. This indicates a consistent but more measured approach to integrating new technologies, possibly due to more complex operational structures and decision-making processes.

– Medium-Large (500 – 999 Employees): This group sees 813.38 businesses researching weekly, contributing to 5.96% of the total activity. The lower percentage may reflect the challenges larger organizations face in rapidly adopting new technologies, including longer approval times and higher coordination costs.

Analyzing the Trend

The data reveals a fascinating trend: the highest research activity in Tools & Electronics is not dominated by the largest companies, but rather by small to medium-small businesses. This trend can be attributed to several factors:

1. Agility and Innovation: Smaller companies often exhibit more agility, allowing them to explore and adopt new technologies more swiftly than their larger counterparts. This agility is crucial in sectors like construction, where the integration of innovative tools and electronics can significantly impact efficiency and cost-effectiveness.

2. Competitive Pressure: Smaller companies face intense competition, driving them to invest in research as a means to differentiate themselves and offer superior services. Tools and electronics represent a key area where strategic investments can yield substantial returns in productivity and service quality.

3. Growth Ambitions: For small and medium-sized enterprises, leveraging the latest technologies in tools and electronics is often seen as a pathway to scaling operations and entering new markets. These companies are more likely to invest in research to identify and adopt innovations that can support their growth ambitions.

4. Resource Constraints: Interestingly, micro-enterprises, despite their resource constraints, show significant research activity. This indicates a strategic focus on maximizing efficiency and effectiveness through targeted investments in technology, crucial for survival and growth in a competitive landscape.

In summary, the sample data highlights a trend where smaller to medium-sized companies are leading in the research and adoption of Tools & Electronics within the construction industry. This reflects broader themes of agility, competitive differentiation, and growth strategy, underscoring the importance of technological innovation across all segments of the industry.