Every project brings in work orders, time sheets, expenses, and materials that pile up fast. If your crew’s wiring up floors while the back office is buried in spreadsheets, things slip. Invoices get missed. Hours go untracked. Payments get delayed. Electrical contractors need tools built around the way field service actually works—tools that tie job costs to billing without clogging up your day.

Accounting software for electrical contractors should do more than store numbers. It should connect what’s happening onsite with what gets logged behind the scenes. When your techs are out in the field, you need clear job costs, clean invoicing, and tight control over every dollar that moves.

For teams in the electrical industry, that means choosing software designed to handle field-driven work—software that links real job activity to clean financial data that holds up when it counts.

- Choosing the right accounting software for electrical contractors

- 5 key features to look for in electrical accounting software

- 10 best accounting software for electrical contractors

- 7 benefits of using accounting software for electrical

- 5 important electrical contractor accounting software FAQs answered

Getting this choice right means fewer mistakes, better margins, and a smoother flow between jobs and books. Let’s break down what electrical contractors should focus on first.

Choosing the right accounting software for electrical contractors

Out in the field, your crew is pulling wire, installing panels, and juggling tight schedules. But back at the office—or in the truck between jobs—someone still has to track labor, submit invoices, and make sure the budget holds up. That’s why accounting software for electrical contractors matters. It shapes how jobs get tracked, how fast you get paid, and how clearly you see the costs tied to every project.

Electricians can’t afford tools that add confusion or slow things down. The best accounting software for electrical contractors works in real-time, ties directly to what your techs are doing onsite, and helps your back office keep a clean paper trail without chasing down missing info later. Before settling on anything, ask these questions to make sure your software holds up where it counts—out in the field and inside your books.

- Job tracking – How well does this software connect jobsite activity to actual costs? Can you link time logs, materials, and labor directly to each project? Does it support the kind of multi-phase or service-heavy work that electrical contractors handle every week?

- Field usability – Can techs update job details, expenses, or time from the field without needing a laptop? Does it sync cleanly across mobile devices and keep everyone on the same page? Will it still work when your crew is deep in a site with limited signal?

- Billing and cash flow – How fast can your team get invoices out once the job wraps? Does it support partial billing for longer installs or change orders? Can it flag unpaid balances or overdue accounts without digging through spreadsheets?

- Job costing accuracy – Does the system break down labor, materials, and equipment clearly? Can you track costs by task, crew, or location? Will it help you spot margin gaps before they hit the bottom line?

- Features – Does the platform include payroll integration, automated tax prep, and real-time reporting? Will it sync with scheduling or dispatch tools? Does it reduce the double entry between accounting and job tracking?

Having the answers to these questions helps electrical contractors avoid messy handoffs between field and office. Next, we’ll cover the features that matter most when evaluating electrical accounting software for field-ready teams.

5 key features to look for in electrical accounting software

For electrical contractors, every work order starts with gear in the truck and ends with paperwork back at the office. Without the right electrical accounting software, tracking that flow gets messy. Estimates fall apart, invoices lag, and nobody’s sure if the numbers line up. That’s where software built around electrical field work makes the difference. From job costing to payment collection, these features keep your books aligned with what’s happening in the field.

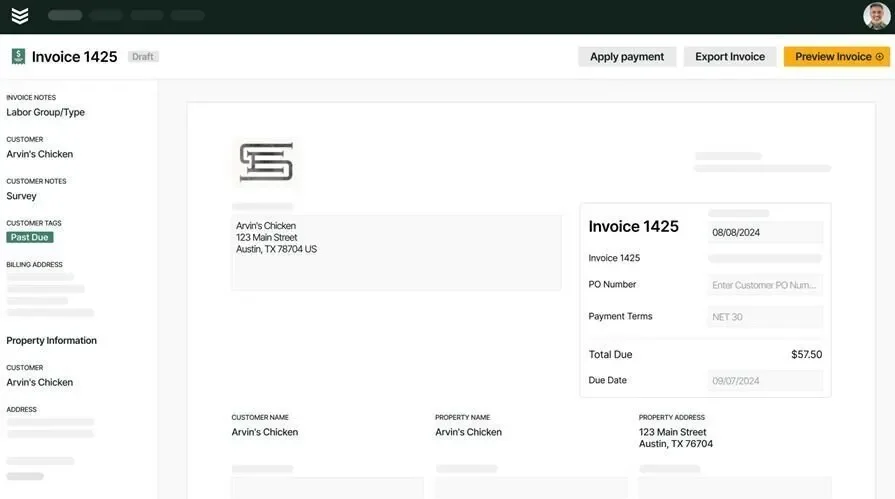

1. Fast, field-ready invoicing and payments

Invoicing tools that sync directly with job status help crews send bills as soon as the work wraps up. No waiting on office staff. No missed paperwork. The best platforms pair field service invoicing with integrated payment tools to keep cash flowing and close the loop faster. Say you’ve just finished an emergency panel replacement at a commercial facility. Instead of waiting to get back to the office, your tech logs the work and generates the invoice on-site. The customer pays on the spot. That speed keeps revenue moving and reduces time chasing down unpaid balances.

2. Built-in quoting that connects to job costing

Creating quick, clear quotes right from the field helps crews close jobs faster—and track profitability from the start. With field-ready quoting tools, electricians can build estimates that sync to real-time job data and feed directly into accounting. Think of a service call where the customer adds unexpected work. A foreman uses the quoting tool to adjust the scope while still onsite. That revised quote flows straight into the job cost breakdown, keeping your books clean and your margin intact.

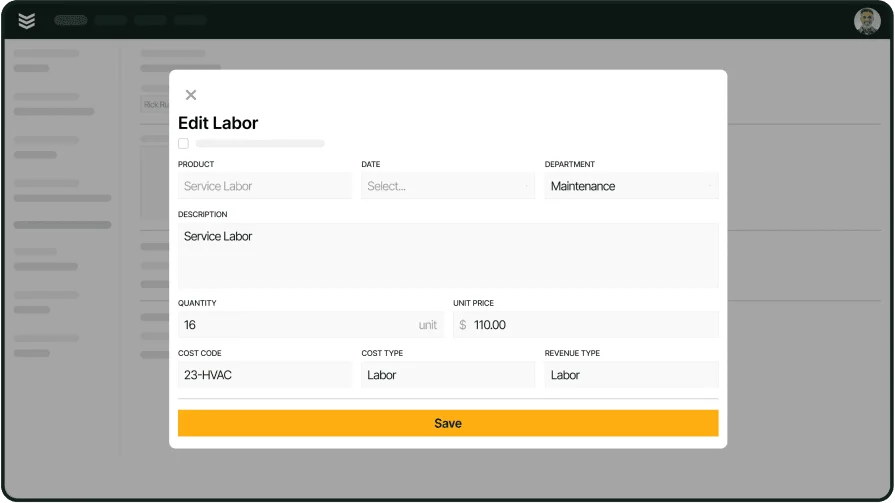

3. Real-time time tracking that feeds your books

Your crew logs hours as the work happens. With integrated time tracking, labor hours flow straight into payroll and job costing—no extra steps or delays. You get visibility into who worked when and where, tied to each job. Let’s say a two-person team handles a lighting retrofit at a school. One logs hours for the install, the other handles cleanup and inspection. Their entries show up immediately in your accounting software for electrical contractors, keeping cost data accurate without back-and-forth.

4. Job data synced through CRM visibility

Every work order has a customer behind it. With CRM tools for contractors, you track service history, billing records, and past quotes—all from one place. It creates clean handoffs between your field techs and office staff. Imagine that during a warehouse fit-out, a customer calls to confirm if grounding was included. Your tech pulls up the CRM, checks the original quote and invoice history, and answers on the spot—no call-backs, no guesswork.

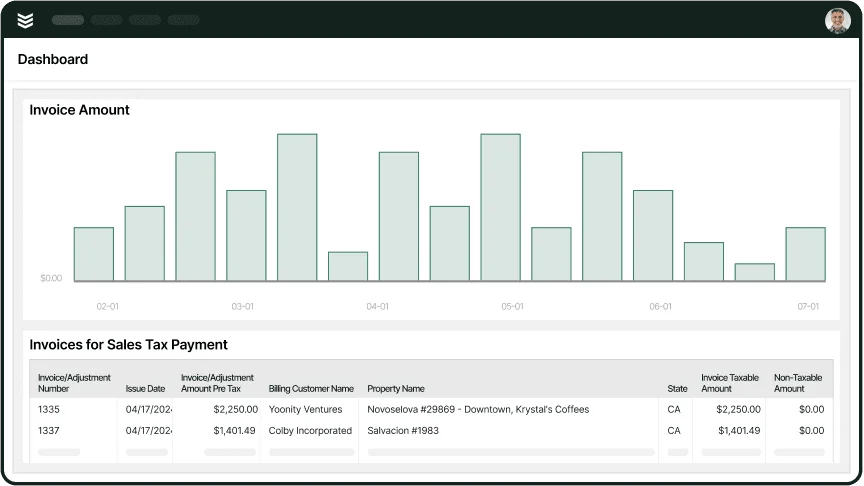

5. Reporting that highlights true job profitability

Electrical contractor accounting software should surface the numbers that matter. Reporting tools built for field contractors show project-level profit, unpaid invoices, labor efficiency, and cost breakdowns—fast. Say after completing a multi-phase hospital upgrade, your reporting dashboard shows material costs spiked mid-project. With that insight, you tweak how you source gear next time—saving thousands on the next big job.

Other notable features electricians need in accounting software

Once the core tools are covered—like invoicing, time tracking, quoting, and reporting—there are still a few features that make life easier for electricians in the field. These functions help tighten operations, reduce back-and-forth, and support the full job lifecycle from start to finish. While not as critical as the main six, they add serious value when integrated into your accounting software for electrical contractors.

- Service agreement automation: Managing recurring service contracts is easier when billing, scheduling, and renewals are tied together. Withservice agreement tools, your team can generate recurring invoices, schedule follow-ups, and track work tied to long-term clients—all without manual reminders.

- Fleet tracking integration: Electricians need to know where trucks are, how long jobs take, and when vehicles need service.Fleet tracking featureshelp coordinate dispatch, monitor asset usage, and sync job activity with mobile crews.

- Dispatch board visibility: Having a real-time view of technician availability supports faster response times and tighter job turnarounds.Contractor dispatch softwaregives office teams a live view of current jobs, active locations, and incoming requests—while linking directly to time logs and job cost data.

Reduce late payments with BuildOps

Find out how to nail invoice timing so your customers always pay on time.

These added features give electrical contractors tighter control over scheduling, customer relationships, and field performance. But at the core of it all is the software itself. Up next, we’ll break down the 10 best accounting software for electrical contractors—what they offer, where they fit best, and how they stack up when your team’s in the field

9 best accounting software for electrical contractors

Choosing the best accounting software for electrical contractors depends on how well the tool supports actual field work. Some platforms focus strictly on financials, while others bring in scheduling, mobile reporting, and job tracking—all of which help electricians stay on top of projects. Below, we break down the top options, what they offer, and where each one fits best.

1. Best for commercial electrical contractors: BuildOps

BuildOps gives electrical contractors a full platform that combines accounting, dispatch, quoting, job costing, and reporting—all in one. It’s built specifically for commercial field service teams, offering seamless workflows between what happens in the field and what needs to be tracked behind the scenes.

How pricing works: Pricing is based on users and feature access, typically under an annual agreement.

Features beyond accounting: BuildOps includes project scheduling, technician tracking, real-time reporting, CRM, and built-in service agreements. All tools work together, cutting out manual entry and syncing financials with active job data.

What sets it apart for specialization: Unlike general software, BuildOps was designed for commercial electrical contractors. That means workflows are tailored to longer job timelines, multi-crew work, and back-office coordination—without bolting on outside systems.

Want to equip your team for the field?

Keep electrical projects on track and invoice on-site to reduce late payments.

2. Best for residential: ServiceTitan

Image Source: ServiceTitan

ServiceTitan caters to residential electrical contractors who need help with estimating, scheduling, and invoicing from the field. Its mobile-first tools simplify customer management and field data collection, making it ideal for high-volume residential calls. However, it may lack the customization and depth commercial crews need for complex buildouts.

How pricing works: Subscription pricing is tiered and typically quoted based on team size and features.

Features beyond accounting: ServiceTitan includes mobile estimates, recurring service scheduling, call tracking, and customer communication tools.

What sets it apart for specialization: It’s built around fast-response, residential field service. Ideal for electrical contractors focused on homes and small business accounts that need quick turnarounds and mobile field tools.

Check out our head-to-head comparison of ServiceTitan and BuildOps, showing how their features compare.

3. Best for general contractors: Jobber

Image Source: Jobber

Jobber supports general field service teams with basic accounting features, quotes, and scheduling. It's easy to set up and well-suited for multi-trade firms offering electrical services alongside plumbing, HVAC, or landscaping. However, it may lack the depth in job costing and reporting needed by specialty electrical teams handling larger commercial work.

How pricing works: Tiered monthly subscription with user-based pricing.

Features beyond accounting: Jobber includes quoting, scheduling, CRM, and customer notifications—plus a mobile app for field techs.

What sets it apart for specialization: Its simplicity makes it a good fit for teams offering mixed trade work with short-duration jobs and light reporting needs.

4. Best for small to mid-sized businesses: FreshBooks

Image Source: FreshBooks

FreshBooks helps smaller electrical contractors keep tabs on invoices, payments, and expenses through an easy-to-use interface. It’s designed for speed and simplicity, helping contractors send bills and track payments without heavy setup. That said, it may fall short for teams who need full dispatch, field operations, or deeper job-cost controls.

How pricing works: Monthly plans are based on number of clients billed, with upgrades unlocking advanced features.

Features beyond accounting: FreshBooks offers project time tracking, estimates, expense logging, and client communication tools.

What sets it apart for specialization: FreshBooks is ideal for solo electricians or small shops that need a clean, straightforward way to bill clients and track payments—without getting bogged down in complex field management features.

5. Best for independent contractors: QuickBooks

Image Source: QuickBooks

QuickBooks has long been a go-to for basic accounting across industries, offering general ledger tools, expense tracking, and tax reporting. It suits independent electricians who manage their own books and need a tool to stay compliant. However, it lacks integration with field service workflows like dispatch, time logs, or multi-crew scheduling.

How pricing works: Monthly subscription with different plans based on features; lower tiers focus on essentials, higher ones add inventory and payroll.

Features beyond accounting: QuickBooks includes bank syncing, invoice templates, recurring billing, and contractor tax tools.

What sets it apart for specialization: For solo electricians handling residential service, QuickBooks provides a familiar platform to manage cash flow, payments, and receipts—without much overhead.

6. Best for low-voltage electrical contractors: Werx

Image Source: Werx

Werx focuses on small specialty trades like low-voltage wiring, AV, and access control. It includes project tracking, invoicing, and timesheet tools in a simple interface. That said, it may feel too limited for commercial electricians needing broader job costing and reporting capabilities.

How pricing works: Monthly user-based subscription, typically aimed at small crews.

Features beyond accounting: Werx supports job timelines, team communication, project photos, and inspection tracking.

What sets it apart for specialization: Best for niche trades within electrical work—like low-voltage installers who want simple job tracking tied to invoice generation.

7. Best for residential service electricians: Housecall Pro

Image Source: Housecall Pro

Housecall Pro offers a mobile-first approach to job scheduling, estimates, and invoicing. It helps residential electricians respond quickly to service requests and get paid on-site. However, it lacks advanced reporting and may struggle with larger commercial projects that involve long timelines or permitting.

How pricing works: Tiered subscription based on features; base plans support invoicing and job scheduling, premium tiers add automation tools.

Features beyond accounting: Includes dispatching, mobile estimates, customer text reminders, and built-in payment options.

What sets it apart for specialization: Perfect for fast-paced residential electricians doing quick service calls, upgrades, and repairs where speed and mobility matter most.

Check out our breakdown of how Housecall Pro compares to BuildOps right here.

8. Best for job costing: ZenElectrical

Image Source: ZenElectrical

ZenElectrical is built for electrical job costing. It allows you to break down estimates, materials, labor, and phases on a per-project basis. Still, it may fall short in terms of CRM, scheduling, or broader financial features needed for full back-office integration.

How pricing works: Tiered pricing based on feature set and user access.

Features beyond accounting: Estimate breakdowns, vendor quote comparisons, phase tracking, and historical job analysis.

What sets it apart for specialization: Designed for contractors who live and breathe job costing—ideal for commercial teams needing visibility into project-specific margins.

9. Best for multi-trade contractors: Workiz

Image Source: Workiz

Workiz serves field service businesses that manage multiple trades—electrical, HVAC, locksmithing, and plumbing. Its all-in-one dashboard simplifies dispatch, scheduling, and invoicing across departments. However, it lacks deep accounting integrations and may need add-ons for advanced job costing.

How pricing works: Monthly subscription priced per user, with additional modules available.

Features beyond accounting: Real-time scheduling, phone system integration, and multi-user permissions for dispatch and field teams.

What sets it apart for specialization: Suits multi-trade service firms with electrical divisions that need shared tools across departments—not built specifically for specialized electrical workflows.

7 benefits of using accounting software for electrical

Electrical contractors deal with a constant stream of service calls, quotes, labor hours, and invoices. Without a system that keeps up, things pile up fast. That’s where accounting software for electrical comes in. It connects your field work with your financials—giving you a clear, real-time picture of how every job impacts your bottom line. Here are seven ways this kind of software makes life easier for electricians and field service businesses.

1. Better visibility into cash flow

With field invoicing synced to job activity, you know exactly when payments are coming in and where money is held up. This helps you keep the business stable even during project slowdowns or material delays. Seeing how money moves in real-time gives contractors a tighter grip on budget planning and decisions.

2. Faster, cleaner client billing

Invoices tied to completed work cut out double entry and reduce errors. Electricians can send bills right from the jobsite, with accurate labor and materials already plugged in. If you need examples of what clean, professional billing should look like in this trade, this collection of electrical contractor invoice examples shows exactly how accounting software helps teams bill with confidence.

3. Clearer understanding of job costs

Accounting software helps electricians track labor, gear, and install time across every project. You can see exactly where profit leaks out—and where costs can be trimmed on future bids. The breakdowns you’ll find in this electrical cost estimating guide line up with how strong accounting tools calculate true project cost.

4. Less back-and-forth between office and field

A shared system cuts down on handoffs between field techs and admin staff. Time entries, job notes, and expenses are logged as they happen, which means less clean-up later. When tools like electrical dispatch software sync with accounting, your crews and your books stay aligned without constant check-ins.

5. More accurate bids with financial data to back them

When your estimates are built on actual job history, your bids stop being guesswork. You can review costs from similar installs, plug in updated pricing, and create tighter proposals. Tools like this electrical bidding app help contractors pull historical data into the bid process—creating quotes that hold up once boots hit the ground.

6. Smarter client management through financial history

Seeing a customer’s billing history, payment habits, and past service volume helps teams prioritize work and avoid problem accounts. When your CRM connects directly with your accounting software, you can spot trends and protect your margin. This CRM resource for electrical contractors highlights how smart software bridges client records with revenue tracking.

7. Quicker financial reporting for better decision-making

Instead of waiting for reports to be built manually, accounting software gives you real-time dashboards that show job profitability, unpaid invoices, and team performance. That speed helps contractors react to challenges before they impact the next job. It’s how successful teams steer with data, not gut feeling.

Benefit from your accounting software

Learn how BuildOps invoicing software streamlines electrical payments.

5 important electrical contractor accounting software FAQs answered

Sorting through accounting tools as an electrical contractor can get overwhelming fast. Most software sounds the same until you're the one trying to tie job costs to labor, billing, and parts from the field. This section clears up the most common questions electricians ask when weighing whether accounting software is the right fit—and how it helps real field service teams.

1. What is electrical accounting software?

Electrical accounting software is a specialized platform that helps electricians and electrical contractors manage job-related financials—covering invoicing, payroll, labor tracking, material costs, and project profitability—while syncing that data with what’s actually happening in the field.

Instead of using disconnected tools for estimating, billing, and reporting, electrical contractors use this software to tie every cost directly to a work order or job. Whether your crew is wiring new construction or handling a panel upgrade, every logged hour and material charge flows into one system. This not only improves accuracy but gives field and office teams a shared view of the numbers—making it easier to get paid on time, track margins, and keep jobs on budget without manual entry.

2. How does accounting software for electrical contractors work?

Most electrical contractor accounting systems follow this flow:

- Job data is entered from the field — techs log time, materials, or notes via mobile tools

- Invoicing and cost tracking update automatically — the system ties expenses, time, and job scope to each work order

- Reporting dashboards sync in real time — owners and admins see margins, open invoices, and team performance without extra steps

- Payroll and compliance are built in — labor hours flow into payroll runs, and records stay clean for tax or audit needs

- Quotes and estimates link directly to job costing — once approved, estimates convert into active jobs with budget tracking already in place

- Service agreements and recurring work sync with billing — scheduled maintenance or contract jobs generate automated invoices and cost reports over time

Some platforms include dispatch, quoting, or CRM features alongside accounting. Others focus just on the financials. Either way, the software helps electrical contractors move away from scattered spreadsheets and toward a centralized system that reflects the actual job flow.

3. Is accounting software worth the cost for electrical contractors & electricians?

Yes—especially for growing teams or commercial contractors handling multiple jobs at once. The upfront cost pays for itself in time saved, fewer billing mistakes, and stronger insight into which projects are profitable. Manual tracking often leads to underbilled hours, forgotten expenses, or missed invoices—errors that compound fast.

Even small teams benefit. For solo electricians, the automation in job costing and invoicing means less time spent in the office and faster payment turnaround. For larger shops, accounting software gives leadership real visibility into field performance, payroll accuracy, and open balances across dozens of jobs.

4. Who needs automated electrician accounting software?

Any electrical contractor juggling service calls, installs, or multi-day jobs benefits from automation. If your techs track time by hand or your invoices are delayed until end-of-week—or later—then automation helps clean that up. It removes repeat data entry, reduces missed charges, and keeps job costs accurate without daily micromanagement.

Smaller teams use automation to cut back-office hours. Mid-sized and commercial contractors rely on it to scale without adding admin staff. The more moving parts in your day—from scheduling and quoting to final billing—the more value automated accounting software brings to your operation.

5. Should I get a stand-alone electrical accounting software, or a field service software with built-in accounting features?

For most electrical contractors, field service software with built-in accounting features is the better long-term choice. It connects your job flow—dispatch, quoting, time tracking, and invoicing—into one system, so every charge is backed by real job activity. You’re not switching between platforms or re-entering data just to send a bill or check your margins.

Stand-alone tools may handle financials, but they fall short once you’re managing techs, change orders, and job timelines. Software built for the full operation reflects how your team actually works—on job sites, not in spreadsheets. It keeps your numbers clean, synced, and ready to support the next job without missing a step.

Accounting software only solves part of the problem. Electrical contractors need tools that do more than manage invoices—they need systems that match the pace of field work, track labor in real time, tie costs to specific jobs, and flag what’s making or breaking margins. While many tools try to piece this together with plugins or workarounds, most fall short when it comes to full job visibility and crew coordination.

BuildOps was built to handle all of it. From quoting to dispatch to billing, it brings your field and office together on one platform—specifically built for commercial service contractors. The features covered throughout this guide? Most software doesn’t offer them all in one place. BuildOps does, and they’re already working for crews out in the field today.

Curious to see it in action?

Find out how our all-in-one platform helps electricians get jobs done faster.